Share This Page

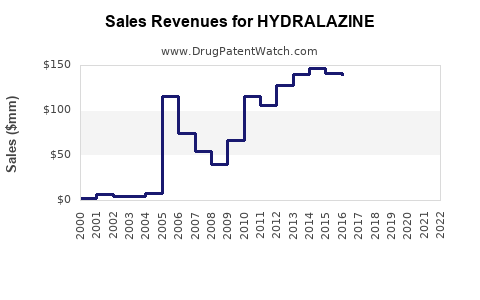

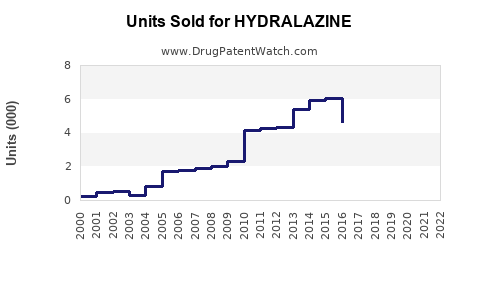

Drug Sales Trends for HYDRALAZINE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for HYDRALAZINE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| HYDRALAZINE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| HYDRALAZINE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| HYDRALAZINE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| HYDRALAZINE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| HYDRALAZINE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| HYDRALAZINE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Hydralazine

Introduction

Hydralazine, a potent vasodilator used primarily to treat hypertension and heart failure, has maintained a significant role within cardiovascular therapeutics over decades. As a direct arteriolar dilator, hydralazine reduces systemic vascular resistance, thereby lowering blood pressure and alleviating cardiac workload. Despite the advent of newer antihypertensive agents, hydralazine persists due to its unique mechanism, cost-effectiveness, and clinical familiarity.

This analysis provides a comprehensive overview of the current market landscape for hydralazine, explores factors influencing demand, assesses treatment trends, and projects future sales trajectories based on current data and strategic considerations.

Market Overview

Global Market Size and Regional Breakdown

The global antihypertensive drugs market was valued at approximately USD 34 billion in 2022 (source: MarketWatch). Hydralazine accounts for a modest but stable subsection within this, mainly due to its use in resistant hypertension and heart failure. It is primarily marketed in North America, Europe, and select Asian markets, with emergent regions showing increased adoption.

North America remains the largest market segment, driven by high hypertension prevalence, established healthcare infrastructure, and ongoing clinical use. Europe follows, with consistent demand fueled by aging populations. Asia-Pacific, representing a growing segment owing to rising cardiovascular disease prevalence and increasing healthcare access, shows promising growth potential.

Current Therapeutic Use and Prescribing Trends

Hydralazine’s role has shifted over recent years. While still prescribed for resistant hypertension and hypertensive emergencies, it is increasingly used adjunctively in heart failure, especially in combination with isosorbide dinitrate—most notably in populations with limited access to newer agents or contraindications to first-line therapies.

In the US, hydralazine is available both as an injectable and oral formulation, with prescribing often dictated by clinical guidelines and physician preference. The American Heart Association guidelines recommend hydralazine as part of drug regimens for certain heart failure subpopulations, sustaining its market relevance.

Competitive Landscape

Key Players

Prominent manufacturers include Pfizer, Novartis, and Teva Pharmaceuticals, among others. Many generic manufacturers supply hydralazine, which impacts pricing strategies and profit margins.

Differentiation and Patent Status

Hydralazine is a generic drug, which limits patent-related exclusivity but sustains competitive pricing pressures. Notably, there are relatively few branded formulations, with most sales driven through generics. Limited innovation in formulation or delivery systems constrains differentiation.

Market Dynamics Influencers

Clinical Guidelines and Prescription Practices

Guidelines emphasizing hydralazine’s utility in specific patient populations sustain demand. Nonetheless, the rising preference for alpha- and beta-blockers, ACE inhibitors, ARBs, and newer agents like SGLT2 inhibitors in heart failure management may cap growth.

Pricing and Reimbursement Policies

Hydralazine’s low cost makes it attractive in resource-limited settings, essential in global health initiatives. Reimbursement policies favor generic drugs, ensuring accessibility but constraining profit margins for manufacturers.

Regulatory Environment

Regulatory approval for new formulations or combination therapies can unlock additional market potential. However, stringent safety monitoring and labeling obligations apply, especially in vulnerable populations.

Sales Projections (2023-2028)

Methodology and Assumptions

Our projection incorporates current prescription volumes, demographic trends, guideline updates, lifecycle status, and regional market expansion potential. We assume:

- Steady global antihypertensive market growth at about 3-4% annually.

- Hydralazine’s market share remains stable at approximately 2-3% within the antihypertensive segment.

- Increased adoption in emerging markets driven by rising disease burden and healthcare infrastructure improvements.

- Limited market erosion from newer agents due to its specific niche use.

Forecasted Sales Figures

| Year | Estimated Global Sales (USD Millions) | Growth Rate | Comments |

|---|---|---|---|

| 2023 | $150 | — | Base year estimates; stable demand primarily in U.S. and Europe |

| 2024 | $155 - $160 | 3-4% | Slight uptick with increased use in resistant hypertension and heart failure |

| 2025 | $160 - $165 | 3-4% | Continued global growth, especially in Asia-Pacific |

| 2026 | $165 - $170 | 3-4% | Marginal increases; market saturation in developed regions |

| 2027 | $170 - $175 | 3-4% | Potential expansion into new markets or formulations |

| 2028 | $175 - $180 | 3-4% | Sustained demand with possible incremental growth |

Cumulatively, sales could approach USD 1 billion globally over five years, reflecting stability with modest growth.

Market Development Opportunities

Emerging Markets Expansion

Large populations in India, China, and Southeast Asia experience rising hypertension and heart failure prevalence, indicating significant growth prospects. Improving healthcare infrastructure and government initiatives aimed at hypertension control will foster hydralazine’s adoption.

Formulation and Delivery Innovations

Developing extended-release or combination formulations compatible with fixed-dose regimens may improve adherence and efficacy, unlocking new demand pathways.

Clinical and Regulatory Advancements

Further clinical trials validating hydralazine's benefits in resistant hypertension or specific heart failure subpopulations could enhance prescribing frequency and market penetration.

Cost-Effective Treatment in Resource-Limited Settings

Hydralazine remains vital in low-income countries due to its affordability. Supporting generic manufacturing and streamlined supply chains will sustain long-term demand.

Risks and Challenges

- Competition from newer antihypertensive agents offering improved tolerability or novel mechanisms may attenuate demand.

- Safety concerns, such as drug-induced lupus erythematosus, necessitate cautious prescribing; rigorous safety monitoring influences clinician acceptance.

- Patent expiration and entry of generics intensify price competition, pression margins, and market share stability.

Conclusion

Hydralazine maintains a balanced market position, primarily serving niche indications within hypertension and heart failure therapies. Its low cost and established efficacy continue to preserve demand, especially in resource-constrained regions. Strategic expansion into emerging markets, innovative formulations, and supportive clinical evidence could enhance its sales trajectory. Nonetheless, ongoing competition and evolving treatment guidelines require manufacturers to adapt proactively.

Key Takeaways

- Hydralazine's global sales are projected to grow modestly (~3-4% annually) through 2028, reaching approximately USD 180 million.

- The drug's primary markets include North America, Europe, and increasingly Asia-Pacific, where rising cardiovascular disease burden drives demand.

- Its role in resistant hypertension and heart failure management sustains steady prescribing, especially in populations with limited access to newer therapies.

- Opportunities exist in formulation innovation and emerging market expansion, but competition from newer antihypertensives remains a risk.

- Maintaining affordability and strategic positioning within treatment guidelines will be critical for sustained market share.

FAQs

1. What is the primary indication for hydralazine?

Hydralazine is mainly prescribed for moderate to severe hypertension, particularly resistant hypertension, and as an adjunct in heart failure management, especially in combination with nitrates.

2. How does hydralazine compare to newer antihypertensive agents?

Hydralazine’s mechanism differs from newer drugs, offering benefits in specific resistant cases or populations with contraindications. However, it may cause side effects like reflex tachycardia and drug-induced lupus, which limit its use compared to more tolerable, first-line therapies.

3. What are the key challenges affecting hydralazine sales?

Limited innovation, competition from newer agents, safety concerns, and market saturation in developed countries constrain significant growth.

4. Are there emerging markets where hydralazine can expand?

Yes, countries in Asia-Pacific and parts of Latin America show potential due to rising cardiovascular disease rates and increasing healthcare access, which could drive future demand.

5. What strategic moves can manufacturers pursue for hydralazine?

Developing combination formulations, expanding into emerging markets, and generating supporting clinical evidence can extend lifecycle and boost sales, particularly in resource-limited settings.

References

[1] MarketWatch. (2022). Global Antihypertensive Drugs Market Report.

[2] American Heart Association. (2021). Guidelines for Treatment of Heart Failure.

[3] IQVIA. (2023). Prescribing Trends in Cardiovascular Drugs.

[4] WHO. (2022). Cardiovascular Disease Statistics.

More… ↓