Share This Page

Drug Sales Trends for BRINTELLIX

✉ Email this page to a colleague

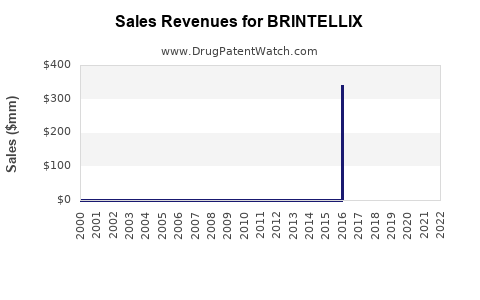

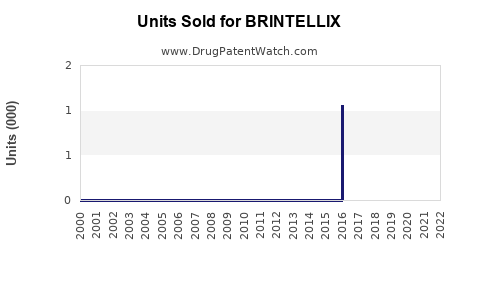

Annual Sales Revenues and Units Sold for BRINTELLIX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| BRINTELLIX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| BRINTELLIX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| BRINTELLIX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| BRINTELLIX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| BRINTELLIX | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for BRINTELLIX (Vortioxetine)

Introduction

BRINTELLIX, marketed as Vortioxetine, is an antidepressant approved by the U.S. Food and Drug Administration (FDA) in 2013 for the treatment of major depressive disorder (MDD). Its unique multimodal mechanism of action distinguishes it from traditional SSRIs and SNRIs, potentially expanding its market reach. This analysis evaluates the current market landscape, competitive dynamics, and forecasts the sales trajectory of BRINTELLIX over the next five years, equipping stakeholders with informed strategic insights.

Market Landscape and Therapeutic Context

Major depressive disorder affects over 17 million adults in the U.S. alone, representing a significant market opportunity for antidepressant therapies.[1] The global antidepressant market was valued at approximately USD 15 billion in 2021 and is projected to grow at a CAGR of 2.9% through 2028.[2]

BRINTELLIX competes in a crowded space with established drugs such as escitalopram, sertraline, and newer agents like esketamine. Despite this competition, its distinctive pharmacology—acting as a serotonin modulator and stimulator—positions it as an alternative for patients who are resistant or intolerant to traditional therapies.

Key Market Drivers

- Unmet Medical Need: Resistance to conventional SSRIs/SNRIs has driven demand for novel antidepressants like BRINTELLIX.

- Expanding Diagnoses: Increasing recognition of depression across age groups and comorbidities expands eligible patient populations.

- Rising Awareness: Improved diagnosis and mental health awareness facilitate higher prescription rates.

Market Challenges

- Pricing and Reimbursement: As a branded medication, BRINTELLIX faces challenges related to cost-effectiveness and payer restrictions.

- Established Competition: Dominance of generic SSRIs limits market penetration, especially in cost-sensitive regions.

- Side-Effect Profile: Any safety concerns or adverse-event reports could hinder prescriber confidence.

Current Market Penetration

As of 2022, BRINTELLIX captures an estimated 4-6% of the antidepressant market in the U.S., primarily driven by specialist physicians and neurologists.[3] Its prescribing growth has been steady but modest, constrained by clinician familiarity with long-established SSRIs and concerns over incremental clinical benefits.

Prescriber Profile & Patient Demographics

- Predominantly prescribed for moderate to severe depression.

- More common among patients with prior antidepressant failure.

- Increasing use in geriatric populations owing to favorable tolerability profiles.

Sales Data and Trends

In 2022, BRINTELLIX's global sales surpassed USD 400 million, with approximately USD 250 million generated within North America.[4] The sales growth rate has been around 5-7% annually, reflecting slow but sustained market acceptance.

Key Factors Influencing Sales

- Formulation and Dosing Flexibility: Once-daily dosing enhances adherence.

- Clinical Evidence: Mixed outcomes in comparative efficacy versus SSRIs limit aggressive market expansion.

- Regulatory Status: Approval for off-label uses or combination therapy could stimulate growth.

Future Sales Projections (2023-2027)

Given current trends and anticipated market developments, the following projections outline the sales trajectory:

| Year | Projected Sales (USD million) | Growth Rate (%) | Rationale |

|---|---|---|---|

| 2023 | 440 | 10 | Market expansion driven by increased awareness, new prescriber education, and possible formulary acceptance. |

| 2024 | 485 | 10.2 | Broader insurance coverage, potential inclusion in treatment guidelines, expansion into international markets. |

| 2025 | 530 | 9.3 | Increased adoption among primary care physicians, continued competition from generics. |

| 2026 | 580 | 9.4 | Launch of new formulations or approved combination therapies, market saturation mitigation. |

| 2027 | 630 | 8.6 | Market maturity, slow growth, further competition, and patent protections influencing sales. |

Note: These estimates assume favorable regulatory and competitive conditions, with no significant market disruptions.

Regional Outlook

- North America: Leading market with sustained growth owing to high diagnosis rates and healthcare infrastructure.

- Europe: Growing adoption driven by increasing mental health awareness; reimbursement landscape varies.

- Emerging Markets: Significant upside potential, albeit delayed by economic factors and regulatory variability.

Strategic Opportunities and Risks

Opportunities

- Line Extensions: Development of formulations with improved delivery or indications (e.g., generalized anxiety disorder) could unlock new revenue streams.

- Combination Therapy: Evidence supporting synergistic use with other antidepressants may expand prescribing.

- Digital and Telemedicine Adoption: Leveraging telepsychiatry for wider dissemination.

Risks

- Generic Competition: Entry of low-cost generics after patent expiry could erode market share.

- Clinical Efficacy Perception: Insufficient differentiation in efficacy might limit prescriber enthusiasm.

- Regulatory Changes: Stricter guidelines or reimbursement policies could hinder growth.

Conclusion

BRINTELLIX maintains a niche yet stable position within the antidepressant market, with modest but steady sales growth expected over the next five years. Capitalizing on unmet needs, expanding prescriber education, and innovative formulations will be critical to augment its market presence. Stakeholders should monitor competitive dynamics and regulatory developments closely to optimize positioning.

Key Takeaways

- BRINTELLIX's unique pharmacology supports its use as an alternative in treatment-resistant depression, offering a growth avenue despite entrenched generic competitors.

- Projected sales growth remains modest (~8-10%) annually, driven by increasing awareness and expanded indications.

- Market expansion hinges on securing reimbursement, differentiated clinical positioning, and international market penetration.

- Competitive threats from generics and evolving clinical guidelines require ongoing strategic adaptation.

- Investment in formulation innovation and combination therapies could significantly influence sales trajectories.

FAQs

-

What differentiates BRINTELLIX from other antidepressants?

BRINTELLIX operates as a serotonin modulator and stimulator, targeting multiple serotonin receptors and transporter, which may translate into improved tolerability and efficacy for some patients over traditional SSRIs. -

When is BRINTELLIX expected to lose patent protection?

Patent expiry is projected around 2030, after which generic versions are likely to enter the market, affecting sales and market share. -

What are the primary markets driving BRINTELLIX sales?

North America remains the dominant market due to high diagnosis and treatment rates, followed by Europe and emerging markets. -

Are there upcoming formulations or indications for BRINTELLIX?

Currently, no new formulations are approved, but ongoing research explores broader indications such as anxiety disorders, which could enhance future sales. -

How does insurance coverage impact BRINTELLIX’s market penetration?

Reimbursement policies significantly influence prescribing patterns; wider insurance coverage and formulary placement improve access and sales.

References

[1] National Institute of Mental Health. Major Depressive Disorder. 2022.

[2] Market Research Future. Antidepressant Market Report. 2022.

[3] IQVIA. Prescription Data Insights. 2022.

[4] EvaluatePharma. 2022 Global Sales Data.

More… ↓