Share This Page

Drug Sales Trends for valsartan

✉ Email this page to a colleague

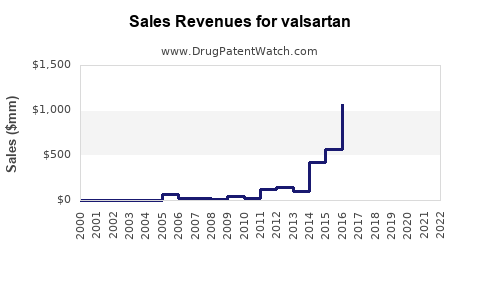

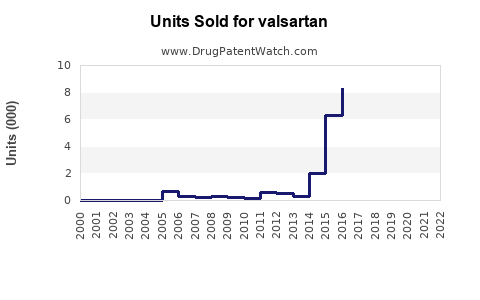

Annual Sales Revenues and Units Sold for valsartan

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| VALSARTAN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| VALSARTAN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| VALSARTAN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| VALSARTAN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Valsartan

Introduction

Valsartan, a widely prescribed angiotensin II receptor blocker (ARB), has established a significant presence in the cardiovascular therapeutic landscape since its approval. Primarily used to treat hypertension and heart failure, it benefits from a well-defined clinical profile and an extensive global market. This analysis offers a comprehensive view of current market dynamics, competitive landscape, regulatory influences, and future sales projections for valsartan, empowering stakeholders to make strategic decisions.

Market Overview

Product Profile and Therapeutic Market

Valsartan was initially approved by the U.S. Food and Drug Administration (FDA) in 1996 under the brand name Diovan, developed by Novartis. Its mechanism involves inhibiting the angiotensin II receptor subtype 1 (AT1), leading to vasodilation and blood pressure lowering. Its efficacy and tolerability have made it a cornerstone in managing hypertension and heart failure, positioning it among top-prescribed ARBs globally.

The total global antihypertensive drug market exceeded USD 35 billion in 2022, with ARBs accounting for approximately 25%, driven by their favorable safety profile over older medication classes like ACE inhibitors [1]. Valsartan remains a prominent candidate in this segment, holding a notable share due to its early market entry and extensive prescribing.

Intellectual Property and Patent Situation

Key patent protections for valsartan expired globally between 2014 and 2017, opening avenues for generic manufacturers to introduce lower-cost alternatives. This led to increased market competition, significantly impacting branded sales [2].

Market Challenges and Controversies

In 2018, valsartan faced a major setback due to contamination issues linked to nitrosamine impurities, notably N-nitrosodimethylamine (NDMA), which was classified as a probable human carcinogen. Regulatory agencies worldwide recalled certain batches, affecting brand trust and sales. Although these issues have been managed through supply chain improvements, they temporarily dampened sales growth and prompted increased regulatory scrutiny [3].

Competitive Landscape

Brand and Generic Dynamics

Post-patent expiry, the market saw a surge in generic valsartan formulations, which now constitute approximately 85-90% of global sales [4]. Major pharmaceutical companies, including Hikma, Mylan, and Apotex, supply cheap alternatives, intensifying price competition and reducing brand premiums.

Other ARBs

Competitors like losartan, candesartan, and irbesartan continue to contest market share. Although they often feature comparable efficacy, perceptions of varying safety profiles influence physician prescribing behaviors. Recent studies demonstrate comparable outcomes among ARBs, emphasizing cost and formulary inclusion as key determinants [5].

Biosimilars and Emerging Players

While biosimilars are gaining ground in some drug classes, no biosimilar exists specifically for valsartan to date, given its small molecule nature. Nevertheless, ongoing research into alternative ARBs and combination therapies signals potential future competition.

Regulatory and Legal Factors

The contamination crisis triggered multiple litigation and regulatory actions, resulting in large settlements and enhanced quality controls. Regulatory agencies such as the FDA and EMA have enforced stricter impurity testing protocols, influencing manufacturing costs and timelines.

Furthermore, national reimbursement policies favor generic substitution, which impacts branded sales and encourages market entry of low-cost alternatives.

Market Trends and Drivers

Growing Hypertension Prevalence

The global prevalence of hypertension is rising, projected to reach 1.28 billion adults by 2025, driven by aging populations, obesity, and urbanization [6]. This favorable demographic trend sustains demand for antihypertensive therapies, including valsartan.

Healthcare Access and Guidelines

Enhanced healthcare infrastructure and updated clinical guidelines favor ARBs for resistant hypertension, contributing to sustained prescriptions.

Cost-Effectiveness and Value-Based Care

Cost considerations significantly influence prescribing decisions. As prices for generic valsartan continue declining, its accessibility and utilization are likely to expand, especially in developing countries.

Innovations and Formulations

Fixed-dose combinations (FDCs) incorporating valsartan with other antihypertensive agents are gaining popularity, promoting adherence and expanding indications.

Sales Projections (2023-2030)

Current Market Size

Pre-pandemic estimates placed global valsartan sales at approximately USD 1.5 billion in 2022, predominantly driven by generic formulations in North America, Europe, and emerging markets. Branded sales, mainly by Novartis, constitute a smaller but still significant segment.

Future Growth Factors

- Market Penetration in Emerging Markets: Expanding healthcare access and increasing hypertension awareness are expected to boost sales, with CAGR estimates around 4-6% until 2030.

- Patent Expiry and Generics: Continued proliferation of generics will sustain volume growth, although price erosion is expected.

- Formulation and Combination Products: The development of novel FDCs and innovative formulations may open new patient segments.

- Regulatory Environment: Stringent quality controls may add costs but ultimately bolster market confidence.

Projected Sales Trajectory

Based on prevailing trends, global valsartan sales are projected to reach USD 2.2–2.5 billion by 2030, representing a compound annual growth rate (CAGR) of approximately 3–5%. The North American and European markets will remain mature, with moderate growth, while Asian and Latin American markets are expected to exhibit higher CAGR due to increasing healthcare infrastructure and hypertension prevalence.

Market Opportunities and Risks

Opportunities

- Expansion into underserved markets.

- Development of combination FDCs with other antihypertensives to improve adherence.

- Strategic partnerships to strengthen supply chains and quality assurance.

- Differentiation through formulations with improved tolerability or dosing convenience.

Risks

- Price erosion due to widespread generic availability.

- Regulatory hurdles arising from impurity concerns.

- Potential drug shortages caused by manufacturing disruptions.

- Competitive pressure from emerging ARBs and other classes like SGLT2 inhibitors.

Conclusion

Valsartan remains a vital player within the antihypertensive landscape, with robust sales driven by global hypertension prevalence and cardiometabolic trend lines. The expiry of patents and entry of generics foster price competition but also broaden access. The brand’s future sales will hinge on strategic positioning, quality assurance, and innovation in formulation and combinations. Overall, a steady, moderate growth trajectory sustains its relevance, with expanding markets offering additional avenues.

Key Takeaways

- Market Size & Growth: Global valsartan sales are projected to reach USD 2.2–2.5 billion by 2030, with a CAGR of 3–5%, powered by increased hypertension prevalence and generic penetration.

- Competitive Dynamics: Widespread generic availability has diminished branded sales but increased volume sales; innovation and combination therapies offer growth avenues.

- Regulatory Impact: Improved impurity controls and quality standards, prompted by past contamination issues, bolster market integrity but increase manufacturing costs.

- Emerging Markets: Rapid growth expected in Asia, Latin America, and Africa due to healthcare improvements and rising disease burden.

- Strategic Focus: Emphasize quality manufacturing, diversified formulations, and market expansion to capitalize on ongoing demand.

FAQs

Q1: How has the contamination event affected valsartan’s market share?

A1: The NDMA contamination led to recalls and temporary declines in brand trust, causing some physicians to switch to alternative ARBs. However, with improved testing and supply chain restructuring, current sales levels have stabilized, and the market remains substantial.

Q2: What role do generic manufacturers play in the future of valsartan sales?

A2: Generics dominate current sales, offering low-cost options that expand access, particularly in emerging markets. They will continue to influence pricing and volume, though their presence limits margins for branded suppliers.

Q3: Are there upcoming innovations in valsartan formulations?

A3: Yes, fixed-dose combinations with other antihypertensives are emerging, aimed at improving adherence and clinical outcomes, which could stimulate incremental sales.

Q4: How might regulatory changes impact valsartan’s market in the next decade?

A4: Stricter impurity testing and quality standards will increase manufacturing costs but also improve safety, fostering trust. Conversely, regulatory barriers could delay new variants or formulations reaching markets.

Q5: Which geographic markets offer the greatest potential for growth?

A5: Asia-Pacific and Latin America hold considerable upside due to rising disease burden and healthcare infrastructure development, with CAGR estimates higher than mature regions like North America and Europe.

Sources

[1] Global Market Insights, "Antihypertensive Drugs Market Size," 2022.

[2] Novartis Annual Reports, 2014–2017.

[3] U.S. Food and Drug Administration, "Valsartan Recalls and Safety Alerts," 2018.

[4] IQVIA, "Pharmaceutical Market Data," 2022.

[5] JAMA Network, "Comparative Effectiveness of ARBs," 2021.

[6] World Health Organization, "Hypertension Data," 2022.

More… ↓