Share This Page

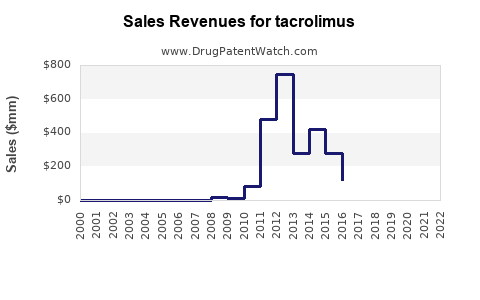

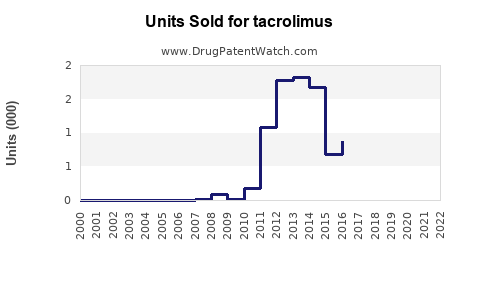

Drug Sales Trends for tacrolimus

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for tacrolimus

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TACROLIMUS | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TACROLIMUS | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TACROLIMUS | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TACROLIMUS | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| TACROLIMUS | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| TACROLIMUS | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Tacrolimus (FK506)

Introduction

Tacrolimus, a potent immunosuppressant, remains a cornerstone therapy in preventing organ rejection post-transplantation. Developed by Fujisawa Pharmaceutical Co. (now Astellas Pharma), tacrolimus's clinical success has propelled it into a significant position within the global immunosuppressive drug market. This analysis explores current market dynamics, competitive landscape, regulatory factors, and future sales forecasts, providing a comprehensive outlook for stakeholders.

Market Overview

Global Therapeutic Context

Tacrolimus's primary application in solid organ transplantation—liver, kidney, heart—drives steady demand, owing to its superior efficacy in reducing rejection episodes compared to older agents like cyclosporine. The broader immunosuppressant segment also includes cyclosporine, sirolimus, and newer biologics, with tacrolimus occupying a leading position. As of 2022, the global immunosuppressive drugs market was valued at approximately USD 15 billion, with tacrolimus constituting a significant share due to its clinical efficacy.

Market Drivers

- Growing Organ Transplantation Rates: Increasing transplantation procedures worldwide expand the need for effective immunosuppressants. According to the International Registry in Organ Donation and Transplantation, transplant volumes continue rising annually, particularly in Asia-Pacific regions.

- Life Expectancy Increases: Improved post-transplant management prolongs patient survival, sustaining demand.

- Expanding Indications: Emerging evidence supports tacrolimus use in autoimmune diseases and inflammatory conditions, potentially broadening its application scope.

- Patient Compliance and Formulation Innovations: Once-daily formulations and generic versions improve adherence and market penetration.

Market Constraints

- Toxicity and Side Effects: Tacrolimus's risks—nephrotoxicity, neurotoxicity, hypertension—necessitate careful monitoring, influencing clinician prescribing behaviors.

- Generic Competition: Patent expirations and subsequent generics have lowered prices, pressuring branded sales.

- Stringent Regulatory Environment: Post-market surveillance regulations vary across jurisdictions, impacting distribution and pricing strategies.

Competitive Landscape

Key Players

- Astellas Pharma: Original innovator, with branded Advagraf and Astagraf formulations.

- Generic Manufacturers: Tides of generics have flooded various markets post-patent expiry, including companies in India, China, and Europe.

- Innovative Formulations: Development of extended-release and microemulsion formulations aims to enhance patient compliance and safety.

Market Share Dynamics

While Astellas remains dominant in developed markets, generics account for an increasing share, especially in price-sensitive regions. Notably, the Asian-Pacific market exhibits fierce competition among local manufacturers offering lower-cost options, affecting global pricing and sales.

Regulatory and Patent Landscape

Patent protection for tacrolimus expired in major markets between 2014 and 2018, facilitating rapid generic entry. Regulatory agencies like the FDA and EMA impose rigorous bioequivalence and safety requirements, influencing formulation approvals. Ongoing patent litigations and litigation settlements impact market stability and pricing trajectories.

Sales Projections (2023-2030)

Methodology

Forecast derives from analyzing historic sales data, transplantation volumes, formulation innovations, and competitive dynamics. Adjustments account for regional growth disparities and regulatory changes.

Short-term (2023–2025)

- Market Growth Rate: Estimated at 3-5% annually, driven by incremental demand in emerging markets and the gradual adoption of generic versions.

- Brand vs. Generic: The branded segment is likely to stabilize or decline marginally due to price pressures, while generics expand rapidly, capturing up to 70% of the global market share.

Medium to Long-term (2026–2030)

- Market Stabilization: The overall market is projected to grow at 2-4% annually, reaching approximately USD 20–22 billion by 2030.

- Emerging Markets Contribution: Regions like India, Southeast Asia, and Latin America will account for significant growth due to increasing transplant activities and healthcare infrastructure development.

- Innovative Formulations: Extended-release and drug delivery innovations are anticipated to competitive advantage and stimulate additional sales.

- New Indications: Potential expansion into autoimmune and inflammatory conditions could contribute new revenue streams.

Regional Breakdown

- North America: Mature but stable, with ongoing influence of generics.

- Europe: Similar dynamics with heightened emphasis on biosimilars and biosimilar-like tacrolimus formulations.

- Asia-Pacific: Fastest growth owing to rising transplantation procedures, expand market share, and affordability factors.

Future Opportunities and Challenges

Opportunities

- Biosimilar Development: Entry of biosimilar tacrolimus products can lower costs and expand access.

- Personalized Medicine: Pharmacogenomic-guided dosing reduces toxicity, enhances outcomes, and may elevate demand.

- New Indications: Emerging research into autoimmune conditions can diversify revenue streams.

Challenges

- Toxicity Management: Addressing adverse effects remains critical; innovations in formulations may mitigate these concerns.

- Competitive Pricing: Price sensitivity, especially in developing economies, constrains profit margins.

- Regulatory Barriers: Variability across jurisdictions complicates market access and compliance.

Key Takeaways

- The global tacrolimus market is projected to reach USD 20–22 billion by 2030, driven by transplant volume increases, expanded indications, and formulation innovations.

- Generics will dominate market share in the coming years, intensifying price competition but also broadening access.

- Asia-Pacific and emerging markets present significant growth opportunities owing to increasing transplantation rates and healthcare expansion.

- Patent expirations catalyze market entry of biosimilar and generic products, influencing pricing and revenue strategies.

- Innovations in drug delivery and personalized dosing will be pivotal for future growth.

FAQs

1. How is the introduction of generic tacrolimus affecting the market?

Generic versions have significantly lowered prices, increased market penetration, and expanded access to immunosuppressants. Major companies are competing on price, which compresses margins but also broadens the market scope.

2. What are the key factors influencing tacrolimus sales in emerging markets?

Growing transplantation procedures, healthcare infrastructure development, increased healthcare spending, and a shift toward generic utilization are primary drivers.

3. How might regulatory changes impact tacrolimus sales in the future?

Tighter safety monitoring, quality standards, and approval pathways for biosimilars and generics could delay product launches or alter pricing strategies, impacting sales volumes.

4. Are there new formulations or delivery systems expected to boost tacrolimus sales?

Yes, extended-release formulations and innovative delivery mechanisms aim to improve compliance and reduce toxicity, potentially increasing demand, especially in non-transplant autoimmune indications.

5. What are the main risks to future sales projections?

Toxicity concerns, aggressive price competition, regulatory hurdles, and the emergence of newer immunosuppressants or biologics could challenge growth forecasts.

Sources

[1] Grand View Research, "Immunosuppressive Drugs Market Size, Share & Trends Analysis," 2022.

[2] International Registry in Organ Donation and Transplantation, 2022 Report.

[3] Astellas Pharma Annual Reports (2022).

[4] FDA and EMA regulatory updates on tacrolimus biosimilars, 2022.

More… ↓