Share This Page

Drug Sales Trends for simvastatin

✉ Email this page to a colleague

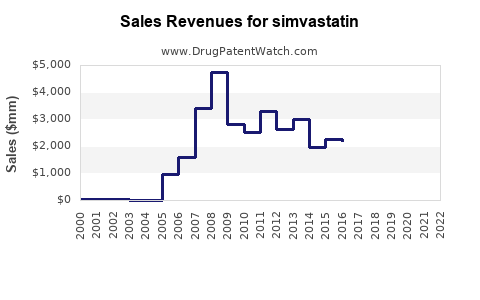

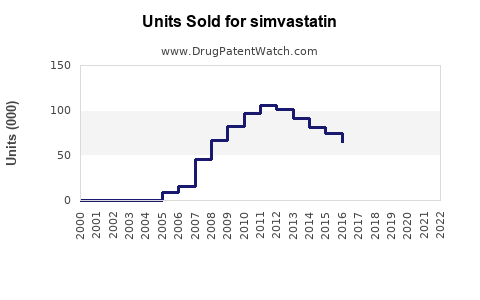

Annual Sales Revenues and Units Sold for simvastatin

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| SIMVASTATIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| SIMVASTATIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| SIMVASTATIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| SIMVASTATIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Simvastatin

Introduction

Simvastatin, a widely prescribed statin, is a lipid-lowering agent used primarily to reduce cardiovascular risk associated with hypercholesterolemia and dyslipidemia. Since its approval in the late 20th century, Simvastatin has cemented its position as a cornerstone of lipid management therapy. This analysis evaluates its current market landscape, key drivers, competitive environment, regulatory considerations, and future sales potential, providing actionable insights for stakeholders.

Current Market Landscape

Global Market Size and Growth Trends

The global statin market was valued at approximately USD 12 billion in 2022, with Simvastatin constituting a significant share due to its early availability and cost-effectiveness. Market growth is driven by increasing prevalence of cardiovascular diseases (CVD), the primary indication for Simvastatin, which afflicts over 600 million individuals worldwide, with rising trends in emerging markets[1].

Forecasts predict a Compound Annual Growth Rate (CAGR) of 3-4% over the next five years, propelled by escalating awareness of cholesterol management, aging populations, and expanding healthcare coverage in developing regions[2].

Market Dynamics

- Prevalence of CVD and Hyperlipidemia: The global surge in obesity, sedentary lifestyles, and poor dietary habits has heightened demand for lipid-lowering therapies. As a first-line treatment, Simvastatin benefits from its long-standing efficacy and affordability.

- Generic Drug Market Penetration: Patents for many statins, including Simvastatin, have expired, leading to high generic availability, which has significantly reduced treatment costs and expanded access.

- Clinical Guidelines: Major guidelines, including those from the American College of Cardiology (ACC) and American Heart Association (AHA), recommend statin therapy for primary and secondary prevention, bolstering market demand[3].

Competitive Landscape

Key Players

The market features several dominant players, including Merck (original developer), Teva, Mylan, and Sandoz, offering generic versions. Although newer, more potent statins like Rosuvastatin and Atorvastatin have increased competition, Simvastatin retains a strong position due to its established safety profile and cost advantage.

Patent Status and Generics

Simvastatin's patent expiration in 2006 in the U.S. and other regions facilitated the proliferation of generics, capturing over 80% of the market share among statins[4]. This commoditization limits pricing power but ensures widespread accessibility.

Regulatory and Reimbursement Environment

Regulatory Considerations

- FDA and EMA Approvals: Optional for generics if bioequivalence is demonstrated. No recent restrictions impact Simvastatin's market access.

- New Formulations: Limited development of novel formulations; focus remains on existing generics.

Reimbursement Policies

Most health systems favor generic statins due to cost savings, further encouraging prescription. In some regions, insurance plans favor Simvastatin as a first-line therapy, influencing prescribing patterns.

Sales Projections

Historical Performance

Between 2018-2022, the global sales of Simvastatin experienced modest growth, primarily driven by increased usage in rapidly urbanizing countries.

Forecasted Growth Factors

- Market Penetration: Continued use in primary prevention, especially in underserved markets.

- Emerging Markets: Population growth and increasing healthcare infrastructure will expand access.

- Pricing Dynamics: Generic competition has kept prices low, but potential manufacturing cost reductions could improve margins.

- Potential Generic Alternatives: Entry of biosimilar or differentiated formulations may influence market shares.

Projected Sales Volume and Revenue

Based on current trends, global sales of Simvastatin are projected to reach USD 4.5–5 billion annually by 2028, representing a CAGR of nearly 3.5%. The United States, Europe, and Asia-Pacific will remain key markets, accounting for approximately 70% of revenue share.

Strategic Opportunities and Challenges

Opportunities

- Expansion into Preventive Care: Increasing utilization in high-risk populations.

- Differentiated Formulations: Developing sustained-release or combination products (e.g., Simvastatin with ezetimibe) can capture additional market segments.

- Digital Health Integration: Implementation of adherence-promotion tools may improve patient outcomes and market retention.

Challenges

- Competition from Newer Statins: Drugs like Rosuvastatin exhibit higher potency and may replace Simvastatin in certain indications.

- Regulatory Changes: New safety warnings or guidelines emphasizing high-dose statin risks could temper demand.

- Market Saturation: High generic penetration reduces margins.

Conclusion

Simvastatin remains a foundational agent for lipid management, supported by longstanding clinical evidence, broad acceptance, and cost-effectiveness. While generic competition suppresses premium pricing, expanding indications, increasing global demand, and emerging markets sustain steady growth. Strategic focus on innovative formulations and integrated healthcare solutions can unlock future growth opportunities.

Key Takeaways

-

Market Size & Growth: Simvastatin capitalizes on a robust and expanding market driven by CVD prevalence, with projected sales approaching USD 5 billion globally by 2028.

-

Competitive Environment: Dominated by generics; price competition remains fierce but facilitates widespread access.

-

Regulatory & Reimbursement: Favorable policies support generic use, especially in developed and emerging markets.

-

Forecasts & Opportunities: Continued use in primary prevention and emerging markets offers growth; product differentiation via new formulations presents upside potential.

-

Challenges: Competition from higher potency statins, regulatory shifts, and market saturation require strategic agility.

FAQs

1. How has patent expiration affected Simvastatin’s market?

Patent expiration in 2006 led to an influx of generics, drastically reducing prices and increasing accessibility, but also intensifying competition and limiting margins for branded manufacturers.

2. What are the primary drivers of demand for Simvastatin?

Rising prevalence of cardiovascular diseases, aging populations, and clinical guidelines endorsing statin therapy sustain steady demand, especially in cost-sensitive markets.

3. How does Simvastatin compare to newer statins like Rosuvastatin?

While newer statins offer higher potency and favorable lipid profiles at higher doses, Simvastatin remains preferred due to established safety, lower cost, and broad prescribing familiarity.

4. Are there new formulations or combination therapies involving Simvastatin?

Limited innovation exists; however, combination formulations with ezetimibe or sustained-release versions are under development, potentially expanding therapeutic options.

5. What regulatory changes might impact Simvastatin's market?

Safety advisories regarding high-dose statin-related adverse effects and evolving guidelines emphasizing individualized therapy could influence prescribing patterns and market dynamics.

References

[1] World Health Organization. Cardiovascular Diseases Fact Sheet. 2022.

[2] MarketsandMarkets. Statin Drugs Market Forecast. 2023.

[3] American College of Cardiology/American Heart Association. Cholesterol Management Guidelines. 2019.

[4] U.S. Food & Drug Administration. Generic Drug Approvals and Market Entry. 2022.

More… ↓