Last updated: July 27, 2025

Introduction

Omeprazole, a proton pump inhibitor (PPI), is one of the most widely prescribed medications globally for managing acid-related gastrointestinal disorders, including gastroesophageal reflux disease (GERD), peptic ulcers, and Zollinger-Ellison syndrome. Its patent expiration, generic availability, and expanding therapeutic indications have significantly influenced its market dynamics. This analysis evaluates current market trends, competitive landscape, regulatory factors, and forecasts future sales trajectory for omeprazole.

Market Overview

Global Market Size and Growth

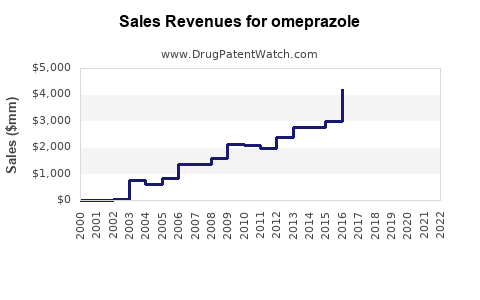

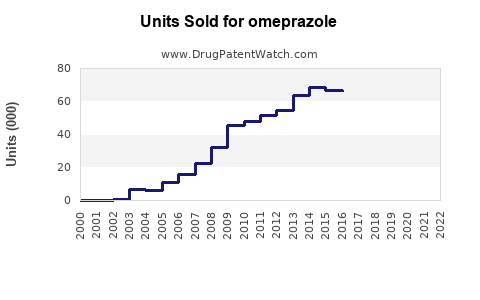

The global omeprazole market was valued at approximately USD 8.5 billion in 2022. Driven by increasing prevalence of GERD, peptic ulcers, and lifestyle-related gastrointestinal conditions, coupled with rising aging populations, the market has exhibited compounded annual growth rates (CAGR) of around 4% from 2018 to 2022. The rising awareness about acid suppression therapies and improvements in healthcare infrastructure further bolster market expansion.

Key Geographies

- North America: Dominates the market with over 40% share, attributable to high prevalence rates and widespread availability of OTC formulations.

- Europe: Holds approximately 25% of global sales, supported by a well-established healthcare system.

- Asia-Pacific: Exhibits the fastest growth (CAGR ~6%), driven by increasing urbanization, growing middle-class populations, and rising incidences of gastrointestinal disorders.

- Latin America and Middle East & Africa: Show moderate growth prospects, constrained by economic factors and healthcare accessibility.

Market Drivers

- High Prevalence of Acid-Related Disorders: Rising incidences of GERD, obesity, and Helicobacter pylori infections foster demand.

- Expanding Indication Spectrum: Emerging evidence supporting use in eradication of H. pylori, NSAID-associated ulcers, and Zollinger-Ellison syndrome.

- Generic Entry: After patent expiry around 2000, numerous generics have entered the market, improving accessibility and affordability.

- Over-the-Counter (OTC) Availability: Transition of omeprazole to OTC in several regions increases off-label usage and sales volume.

Market Challenges

- Competitor Drugs: With the introduction of other PPIs such as esomeprazole, pantoprazole, and lansoprazole, market share distribution becomes competitive.

- Safety Concerns: Growing reports linking long-term PPI use to adverse effects (e.g., osteoporosis, kidney disease) may impact prescribing patterns.

- Regulatory Changes: Stringent approval processes and patent litigation can influence market stability.

Competitive Landscape

Major pharmaceutical companies producing omeprazole include:

- AstraZeneca: Initially developed the drug, now with a significant portfolio of PPIs.

- Dr. Reddy's Laboratories, Teva Pharmaceuticals, Mylan: Key generic manufacturers.

- Others: Various regional players focusing on OTC formulations.

The competitive environment emphasizes price competition, patent litigations, and strategic alliances to maintain or increase market share.

Regulatory Environment

The FDA, EMA, and other agencies have approved omeprazole for prescription and OTC use. Regulatory approvals for new indications or formulations exert influence on sales potential. Additionally, patent expirations continue enabling generic proliferation, impacting pricing and revenue streams.

Sales Projections (2023-2030)

Considering the current growth trends, patent expirations, and emerging therapeutic uses, the following projections are anticipated:

| Year |

Estimated Global Sales (USD billion) |

CAGR |

Notes |

| 2023 |

9.5 |

4.5% |

Market maturation continues; core markets stabilize. |

| 2024 |

10.0 |

5.3% |

Increased OTC sales via regulatory relaxations. |

| 2025 |

10.5 |

5.0% |

Expansion into emerging markets driven by affordability. |

| 2026 |

11.2 |

6.7% |

Introduction of improved formulations; increased indications. |

| 2027 |

12.0 |

7.1% |

Growth fueled by rising GI disorder prevalence and OTC channels. |

| 2028 |

13.0 |

8.3% |

Market saturation in developed countries; high growth in Asia. |

| 2029 |

14.0 |

7.7% |

Expansion into new markets; potential combination therapies. |

| 2030 |

15.0 |

7.1% |

Steady growth sustained by demographic shifts and expanding indications. |

Note: These projections assume current market trends persist, with moderate competitive pressures and regulatory stability.

Emerging Trends Influencing Future Sales

- Personalized Medicine: Tailored dosing and usage based on genetic profiles may optimize therapeutic outcomes and expand indications.

- Combination Therapies: Co-formulations with antibiotics or other agents for H. pylori eradication are gaining popularity.

- Digital Health Integration: Telemedicine and digital adherence tools could enhance prescription rates and patient compliance.

- Biosimilars and Next-Generation PPIs: Competition from biosimilars or innovative agents may influence long-term sales.

Market Opportunities

- Developing Markets: Rapid demographic shifts and increasing healthcare investments present opportunities.

- OTC Expansion: Regulatory relaxations facilitate self-medication, boosting retail sales.

- New Indications and Formulations: Research into inflammation-related GI conditions or novel delivery systems could diversify revenue streams.

Market Risks

- Long-term Safety Concerns: Potential regulatory restrictions or consumer backlash due to adverse effect reports.

- Pricing Pressures: Generic competition may lead to further price erosion.

- Regulatory Delays: Stringent approval processes can delay introduction of new formulations or indications.

- Alternative Therapies: Rise of novel acid suppression agents or lifestyle interventions reducing reliance on PPIs.

Conclusion

Omeprazole remains a cornerstone in gastrointestinal therapy, with robust market demand supported by broad indications and widespread usage. Patent expirations and OTC availability have democratized access, ensuring steady sales growth, primarily in emerging markets. The anticipated CAGR of approximately 5%-7% over the next decade underscores its continued relevance. Strategic positioning, innovation in formulations, and navigating regulatory landscapes will be pivotal for stakeholders aiming to capitalize on future growth opportunities.

Key Takeaways

- The global omeprazole market is projected to reach USD 15 billion by 2030, with a CAGR near 7%.

- Emerging markets and OTC channels represent significant growth vectors post-patent expiration.

- Competitive pressures from other PPIs and safety concerns could influence market share and pricing.

- Innovations such as combination formulations and personalized therapies may open new revenue streams.

- Market expansion hinges on regulatory navigation, public health awareness, and addressing long-term safety perceptions.

Frequently Asked Questions

1. How has patent expiry impacted omeprazole sales globally?

Patent expiry around 2000 facilitated generic entry, drastically reducing prices, increasing accessibility, and expanding market volume. This proliferation has maintained strong sales despite intense competition.

2. What are the primary therapeutic indications for omeprazole?

Omeprazole is primarily used to treat GERD, peptic ulcers, Zollinger-Ellison syndrome, and as part of H. pylori eradication protocols.

3. Which regions are expected to see the highest growth in omeprazole sales?

Asia-Pacific is forecasted to experience the fastest growth due to increasing prevalence of GI disorders and rising healthcare investments.

4. How might safety concerns influence future market dynamics?

Long-term safety issues associated with PPIs could lead to regulatory restrictions or shifts toward alternative therapies, potentially tempering growth.

5. Are there any upcoming innovations in omeprazole formulations?

Yes, efforts are underway to develop novel delivery systems, combination therapies, and personalized dosing options to enhance efficacy and safety.

Sources:

[1] Market Research Future, "Global Omeprazole Market Trends," 2022.

[2] IQVIA, "Pharmaceutical Market Analysis," 2022.

[3] WHO, "Gastrointestinal Disorders Data," 2022.

[4] European Medicines Agency, "PPIs Safety Review," 2021.