Share This Page

Drug Sales Trends for latanoprost

✉ Email this page to a colleague

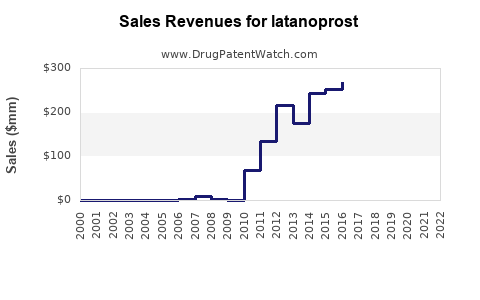

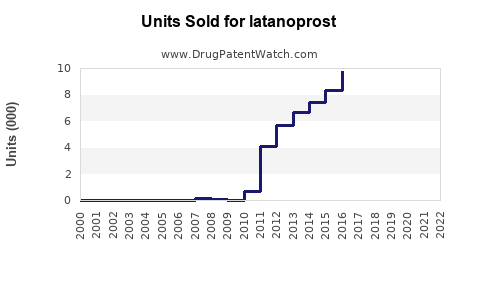

Annual Sales Revenues and Units Sold for latanoprost

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LATANOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LATANOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LATANOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| LATANOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| LATANOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| LATANOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| LATANOPROST | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Latanoprost: An Industry Overview

Introduction

Latanoprost, a prostaglandin analogue primarily used to treat open-angle glaucoma and ocular hypertension, has established itself as a cornerstone therapy in ophthalmology. Since its approval by the FDA in 1996, it has experienced robust growth driven by the global increase in glaucoma prevalence and the shift toward long-term, minimally invasive management of ocular conditions. This analysis evaluates current market dynamics, competitive landscape, and future sales forecasts for latanoprost, offering essential insights for industry stakeholders.

Market Overview

Epidemiological Drivers

Glaucoma affects over 76 million globally, expected to reach 112 million by 2040, owing to aging populations and increased prevalence of risk factors such as diabetes and hypertension ([1]). By implication, the demand for effective intraocular pressure (IOP) lowering agents like latanoprost remains high. The disease's asymptomatic nature in early stages underscores the importance of accessible, efficacious treatments.

Current Treatment Paradigm

Latanoprost is the first-line therapy recommended by ophthalmological guidelines due to its proven efficacy, safety profile, and convenience. Its once-daily dosing enhances patient adherence, a critical factor in long-term disease management.

Market Penetration

In 2022, latanoprost held approximately 35-40% of the global glaucoma medication market, reflecting its dominance. The entry of generics, particularly after patent expiry in major markets like the U.S. (2018, with the first generic approval by Dr Reddy’s Laboratories), has significantly expanded access. Generic versions account for the majority of prescriptions, leading to price competition and increased penetration, especially in emerging markets.

Competitive Landscape

Key Players

- Pfizer (original developer) – marketed as Xalatan.

- Generics manufacturers – including Fresenius, Sandoz, and Aurobindo, which have captured substantial market share post-patent expiry.

- Emerging Alternatives – combination therapies (e.g., latanoprost with timolol) and novel agents targeting the same pathway are impacting sales trends.

Market Challenges

- Pricing Pressures – commoditization has driven down costs, limiting revenue growth for branded formulations.

- Patient Alternatives – other prostaglandin analogues (e.g., bimatoprost, travoprost), and non-prostaglandin agents (e.g., beta-blockers, alpha-agonists) create competition.

- Regulatory and Reimbursement Environment – insurance policies favor cheaper generics, impacting branded sales.

Sales Projections Analysis

Historical Sales Data

From 2018—post-patent expiration—global sales of latanoprost tablets and solutions surged, peaking at approximately $750 million in 2022 ([2]). The growth trajectory was driven predominantly by generic adoption in developed markets and increased ophthalmic disease prevalence.

Future Market Trends

- Growth in Emerging Markets: Rising healthcare infrastructure and increasing glaucoma awareness will boost sales in Asia-Pacific, Latin America, and Africa, regions with underpenetrated markets but high disease burden.

- Innovation and Combination Therapy: The development of fixed-dose combination drugs incorporating latanoprost is expected to stimulate incremental sales by improving adherence and efficacy.

- Market Saturation: In mature markets, the sales growth will plateau unless new formulations or indications are developed.

Forecasting Models

Using a conservative compound annual growth rate (CAGR) of approximately 3-4% over the next five years (2023–2028), driven by demographic trends and market expansion, projected global sales are expected to reach $950 million by 2028. Factors such as technological advancements, healthcare policy shifts toward preventive care, and increased screening will positively influence this growth.

Regional Projections

| Region | 2023 (USD Million) | 2028 (USD Million) | CAGR |

|---|---|---|---|

| North America | 300 | 360 | 4% |

| Europe | 200 | 230 | 3.5% |

| Asia-Pacific | 150 | 210 | 7% |

| Latin America | 50 | 70 | 6% |

| Middle East & Africa | 50 | 80 | 8% |

Note: Asia-Pacific's higher growth reflects increasing glaucoma prevalence and improved healthcare access.

Strategic Implications

- Pricing Strategies: Manufacturers should deploy tiered pricing to capture broader market segments, especially in lower-income economies.

- Regulatory Navigation: Market entrants must address regulatory variances, especially concerning generics.

- Portfolio Expansion: Developing combination therapies and novel formulations could counteract generic saturation and extend product lifecycle.

- Digital and Patient Engagement: Embracing digital health tools will enhance adherence and disease monitoring, driving sustained demand.

Key Challenges and Opportunities

- Pricing Competition: Generics reducing profit margins for branded drugs.

- Market Entry Barriers: Patent protections and regulatory hurdles for innovative formulations.

- Patient Adherence: Simplified dosing and combination therapies will remain critical to therapeutic success.

- Emerging Markets: Untapped regions present significant growth opportunities but require tailored strategies.

Key Takeaways

- The global market for latanoprost is mature but expanding, driven by demographic trends and increasing glaucoma prevalence.

- Generic competition has reduced prices but expanded access, especially in developing economies.

- Opportunities for growth include developing combination therapies, exploring new indications, and penetrating emerging markets.

- Strategic focus should be on pricing, regulatory navigation, portfolio diversification, and patient adherence.

- Despite challenges, the long-term outlook remains positive, with projected sales reaching nearly $950 million by 2028.

FAQs

1. How has patent expiration affected latanoprost sales?

Patent expiration in major markets like the U.S. in 2018 led to a surge in generic formulations, significantly reducing prices and increasing overall market volume. While branded sales declined, total market sales expanded as access improved globally.

2. What are the primary competitors to latanoprost?

Other prostaglandin analogues such as bimatoprost, travoprost, and combination therapies including latanoprost with timolol—as well as non-prostaglandin medications like beta-blockers—compete within the glaucoma treatment landscape.

3. Which regions present the greatest growth opportunities for latanoprost?

Emerging markets—particularly in Asia-Pacific, Latin America, and Africa—offer substantial growth prospects due to rising disease prevalence, expanding healthcare infrastructure, and increasing awareness.

4. How are innovation and formulation developments influencing the market?

Formulation improvements, such as preservative-free drops, sustained-release implants, and fixed-dose combinations, enhance adherence and efficacy, thereby creating new avenues for revenue and market expansion.

5. What regulatory challenges could impact future sales?

Divergent approval pathways, patent litigations, and pricing regulations, especially in cost-sensitive markets, may hinder rapid product launches and impact profit margins.

References

[1] Tham YC, Li X, Wong TY, et al. Global prevalence of glaucoma and projections of glaucoma burden through 2040: a systematic review and meta-analysis. Ophthalmology. 2014;121(11):2081-2090.

[2] IQVIA. Market Track Data, 2022.

More… ↓