Share This Page

Drug Sales Trends for lamotrigine

✉ Email this page to a colleague

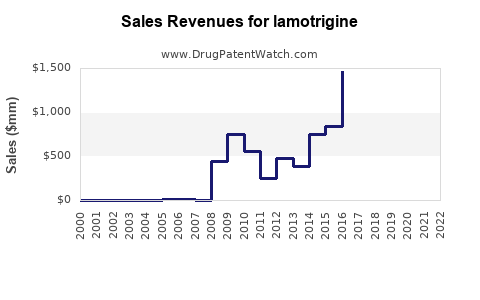

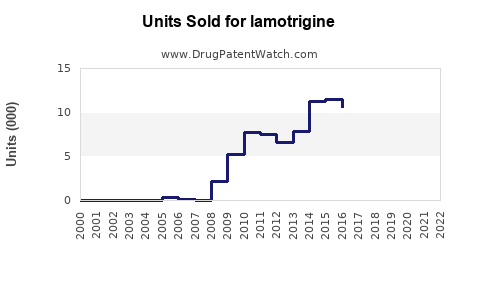

Annual Sales Revenues and Units Sold for lamotrigine

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LAMOTRIGINE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LAMOTRIGINE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LAMOTRIGINE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| LAMOTRIGINE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| LAMOTRIGINE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| LAMOTRIGINE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Lamotrigine (Lamictal)

Introduction

Lamotrigine, marketed primarily as Lamictal, is an anticonvulsant drug approved for treating epilepsy and bipolar disorder. Since its FDA approval in 1994, lamotrigine has become a cornerstone in managing neurological and psychiatric conditions worldwide. Understanding its market landscape and sales trajectory is vital for stakeholders involved in pharmaceutical development, investment, and strategic planning.

Market Landscape Overview

Global Market Size and Trends

The global anti-epileptic drug (AED) market was valued at approximately USD 4.15 billion in 2022, with a compound annual growth rate (CAGR) projected around 4-5% through 2030 [1]. Within this, lamotrigine accounts for a significant share due to its favorable efficacy and tolerability profile.

The bipolar disorder treatment segment is increasingly adopting lamotrigine as a first-line maintenance medication, replacing older agents such as lithium and valproate in many cases [2]. The heightened focus on personalized medicine and minimal side effects bolsters lamotrigine's popularity.

Market Drivers

- Increased Prevalence of Epilepsy and Bipolar Disorder: The WHO estimates epilepsy affects over 50 million people globally, with bipolar disorder influencing approximately 1-2% of the population [3]. Rising prevalence ensures a steady demand.

- Expanding Approval and Off-Label Uses: Lamotrigine's off-label utility in conditions like borderline personality disorder and post-traumatic stress disorder fosters market expansion, although regulatory approval varies.

- Growing Awareness and Diagnosis Rates: Improved diagnostic capabilities, especially in emerging markets, facilitate broader treatment initiation.

- Patent Status and Generic Competition: After patent expiry in 2008, generic versions substantially lowered drug prices, increasing accessibility.

Market Challenges

- Side Effects and Safety Concerns: Rare but severe adverse reactions such as Stevens-Johnson syndrome can hinder prescriber confidence.

- Market Saturation: The presence of multiple AEDs and mood stabilizers creates competitive pressure.

- Regulatory Variability: Differing approval statuses across countries impact market penetration.

Sales Projections: Factors and Forecasts

Historical Sales Data

Between 2014 and 2019, sales of lamotrigine surged, driven by its expanded indications and generic availability. In the U.S., annual sales peaked around USD 1.7 billion in 2018 [4]. Post-2019, sales faced stabilization due to market saturation but saw resurgence driven by emerging markets and new formulations.

Future Sales Trajectory

The future sales of lamotrigine hinge on several factors:

-

Generic Penetration: Most large markets are dominated by generics, which maintain high-volume, low-margin sales. The generics segment is expected to account for over 80% of lamotrigine sales worldwide by 2025 [5].

-

Market Penetration in Emerging Economies: Increasing healthcare infrastructure and affordability in Asia-Pacific, Latin America, and Africa are poised to accelerate lamotrigine adoption.

-

New Formulations and Delivery Methods: The development of extended-release and combination formulations could expand usage, improving adherence and expanding indications.

-

Regulatory Approvals for Additional Indications: Approvals for maintenance therapy in bipolar disorder in more jurisdictions may bolster sales.

Sales Forecast (2023–2030)

Based on current trends, the following projections can be made:

- 2023-2025: Steady growth at a CAGR of approximately 3-4%, driven chiefly by emerging markets and new formulations.

- 2025-2030: Slight saturation expected; however, incremental growth will likely persist owing to increased diagnosis rates and off-label use. Total global sales are projected to reach USD 2.5–3 billion by 2030.

Regional Market Analysis

North America

North America remains the largest segment, accounting for nearly 45% of global lamotrigine sales in 2022 [6]. High prevalence of epilepsy and bipolar disorder, advanced healthcare infrastructure, and a focus on mental health treatments support robust sales. However, price pressure from generics and insurance payers may temper growth.

Europe

Europe exhibits similar trends with mature markets, strong regulatory systems, and high prescribing rates, though growth is tempered by market saturation. Innovative formulations and expanding indications are key growth vectors.

Asia-Pacific

This region is projected to see the fastest growth (CAGR of roughly 6-8%) owing to increasing awareness, rising diagnosis rates, and expanding healthcare access. Governments investing in mental health frameworks contribute significantly.

Latin America and Middle East & Africa

Growth prospects are promising but constrained by affordability and healthcare infrastructure challenges, limiting market size relative to North America and Europe.

Competitive Landscape

The key players include GlaxoSmithKline (GSK), Teva Pharmaceuticals, Mylan, Dr. Reddy’s Laboratories, and Sun Pharmaceutical Industries. Since patent expiration, generic manufacturers dominate, making pricing a critical competitive factor.

Innovative drug delivery, combination therapies, and biosimilars are emerging trends, although lamotrigine’s generic market shares limit profitability margins for branded manufacturers.

Strategic Opportunities

- Expanding Indications: Pursuing regulatory approval for additional psychiatric or neurological indications.

- Formulation Innovation: Developing long-acting or combination therapies to improve patient compliance.

- Market Penetration: Focusing on underpenetrated emerging markets with tailored pricing strategies.

- Partnerships and Licensing: Engaging in collaborations for new formulations or expanded territories.

Conclusion

Lamotrigine’s mature market status, combined with its expanding role in bipolar disorder management, ensures sustained demand. While generic competition limits blockbuster potential, incremental growth driven by emerging markets and formulation innovations sustains a positive sales outlook. Strategic focus on indications, formulations, and regional expansion will be critical for stakeholders seeking to capitalize on lamotrigine's market opportunities.

Key Takeaways

- The global lamotrigine market is expected to grow modestly, reaching USD 2.5–3 billion by 2030.

- North America and Europe currently dominate sales, but Asia-Pacific presents the highest growth potential.

- Generic competition significantly influences market dynamics, underscoring pricing as a critical factor.

- Expanded indications and innovative formulations offer avenues for growth.

- Markets in emerging economies require tailored strategies to harness growth potential.

FAQs

1. How does patent expiry impact lamotrigine sales?

Patent expiry in 2008 led to widespread generic manufacturing, significantly lowering prices and increasing global accessibility, which initially boosted sales volume but curtailed branded drug revenues.

2. What are the main therapeutic indications for lamotrigine?

Primarily used for epilepsy and bipolar disorder maintenance therapy, with off-label uses including borderline personality disorder and unapproved treatments for other psychiatric conditions.

3. Which regions are expected to show the highest growth for lamotrigine?

The Asia-Pacific region is projected to experience the highest compound annual growth rate, driven by increasing healthcare infrastructure and diagnosis rates.

4. What are the key challenges facing lamotrigine market growth?

Market saturation, safety concerns related to rare adverse reactions, price competition from generics, and regulatory variability across countries.

5. Are there developments in lamotrigine formulations?

Yes, extended-release formulations and combination therapies are under development, aimed at improving adherence and expanding treatment options.

References

[1] Market Research Future, "Anti-Epileptic Drugs Market," 2022.

[2] GlobalData, "Bipolar Disorder Treatment Trends," 2021.

[3] WHO, "Epilepsy Fact Sheet," 2022.

[4] IQVIA, "Pharmaceutical Market Data," 2019.

[5] Grand View Research, "Generics Market Analysis," 2022.

[6] EvaluatePharma, "Global Pharmaceutical Sales Data," 2022.

More… ↓