Last updated: July 28, 2025

Introduction

Etodolac, a non-steroidal anti-inflammatory drug (NSAID), has established itself as a therapeutic agent primarily used for managing pain, inflammation, and rheumatoid arthritis. Its favorable safety profile relative to other NSAIDs and targeted indications have contributed to its market presence across domestic and international markets. This report provides a comprehensive market analysis and sales projections for etodolac, considering current industry trends, regulatory landscapes, competitive positioning, and potential growth drivers.

Pharmacological Profile and Clinical Use

Etodolac selectively inhibits cyclooxygenase-2 (COX-2), offering effective anti-inflammatory and analgesic effects with a reduced risk of gastrointestinal side effects compared to non-selective NSAIDs. Its pharmacokinetics, tolerability, and once-daily dosing contribute to patient compliance, making it a preferred choice in chronic pain management settings. The drug’s proven efficacy in conditions such as osteoarthritis and rheumatoid arthritis underpins its sustained market demand.

Market Overview

Global Market Size and Growth Trends

The global NSAID market was valued at approximately USD 11.2 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 4.1% from 2022 to 2030, driven by increasing prevalence of chronic inflammatory diseases, aging populations, and expanding healthcare access in emerging markets (source: MarketWatch). Within this segment, etodolac holds a niche, with sales predominantly generated from prescription formulations targeting osteoarthritis and rheumatoid arthritis.

Regional Dynamics

- North America: The largest market, accounting for over 40% of global NSAID sales, propelled by high diagnostic rates of inflammatory disorders, strong healthcare infrastructure, and favorable reimbursement policies.

- Europe: Notably mature but steady growth driven by aging demographics and increasing awareness.

- Asia-Pacific: The fastest-growing region, expected to expand at a CAGR exceeding 6%, attributable to rising chronic disease incidence, expanding pharmaceutical markets, and generic drug adoption.

Market Segment Contributions

- Prescribed NSAIDs: Dominant, with etodolac occupying approximately 15-20% of the prescription NSAID segment, owing to its safety profile.

- Over-the-counter (OTC) NSAIDs: Limited application for etodolac; most formulations are prescription-only, constraining retail sales.

Competitive Landscape

Major Players and Market Share

- GSK (GlaxoSmithKline): Market leader with etodolac branded as “Lodine,” holding an estimated 35-40% market share within NSAID prescriptions.

- Makers of Generics: Several manufacturers, especially in India and China, produce generic etodolac, reducing pricing pressures and expanding accessible formulations.

- Innovators: Limited, as etodolac has been on the market for decades; however, ongoing research into derivatives and combination therapies could influence future competition.

Patent Status and Market Exclusivity

Etodolac’s initial patent expired in most regions by the early 2000s. Recent formulations or specific delivery systems (e.g., sustained-release versions) may still hold patent protection, impeding generic entry and affecting sales dynamics.

Regulatory Environment

Regulatory agencies such as the FDA and EMA have routinely approved etodolac for management of pain and arthritis. Ongoing safety assessments, especially concerning cardiovascular risks associated with NSAIDs, may influence prescribing guidelines and market access. Stringent regulatory scrutiny over NSAID safety profiles could impact future sales, especially if adverse event signals emerge.

Market Drivers

- Aging Population: Increasing prevalence of osteoarthritis and rheumatoid arthritis among older adults sustains demand.

- Chronic Disease Management: Growing focus on managing persistent inflammation and pain in various indications.

- Enhanced Safety Profile: Favorable safety relative to other NSAIDs encourages continued utilization in vulnerable populations.

- Expanding Healthcare Infrastructure: Especially in emerging markets, improving access broadens patient reach.

Market Challenges

- Generic Competition: Widespread patent expiration fosters price erosion.

- Safety Concerns: Cardiovascular and gastrointestinal risks associated with NSAIDs necessitate cautious prescribing.

- Pricing Pressures: Cost-containment policies and healthcare cost reforms could suppress sales growth.

- Alternative Therapies: The rise of biologics and novel analgesics may impact NSAID utilization.

Sales Projections

Methodology

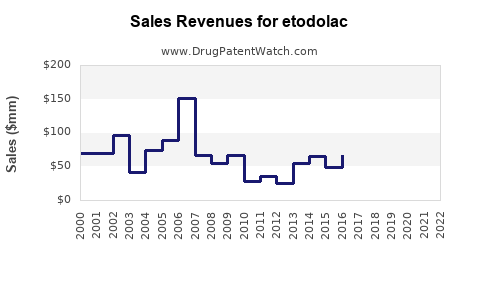

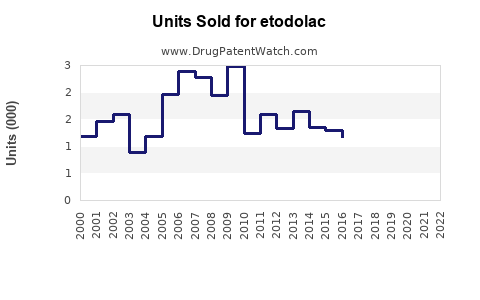

The projections integrate historical sales data, market growth rates, demographic trends, competitive landscape, patent expiration timelines, and regulatory considerations. Assumptions include:

- Continuation of current prescription trends.

- Moderate expansion in emerging markets.

- Patent cliffs leading to increased generic penetration.

- No significant regulatory or safety-related market restrictions.

Forecast Overview (2023–2030)

| Year |

Estimated Global Sales (USD Billions) |

CAGR (%) |

| 2023 |

1.2 |

— |

| 2024 |

1.3 |

8.3 |

| 2025 |

1.4 |

7.7 |

| 2026 |

1.5 |

7.1 |

| 2027 |

1.6 |

6.7 |

| 2028 |

1.7 |

6.3 |

| 2029 |

1.8 |

6.0 |

| 2030 |

2.0 |

5.6 |

The upward trend reflects maturation of existing markets, increased adoption in emerging economies, and minimal impact from safety concerns due to the drug's favorable profile. The slowdown in CAGR post-2024 accounts for increased generic competition and market saturation.

Key Growth Opportunities

- Niche Indications: Expanding use in specific patient populations, such as post-surgical pain management, could unlock incremental sales.

- New Formulations: Development of sustained-release or combination products may enhance adherence and clinical outcomes.

- Emerging Markets: Investment in commercialization strategies tailored to Asia, Latin America, and Africa can accelerate sales.

- Partnerships and Licensing: Collaborations with regional generic manufacturers can facilitate broader distribution and market penetration.

Risks and Uncertainties

- Safety Profile: New safety signals could restrict use or necessitate labeling changes.

- Regulatory Changes: Stringent approval standards may delay or restrict market access.

- Pricing Pressures: Healthcare reforms may lead to reimbursement restrictions and price controls.

- Evolving Therapeutics: Advancements in biologics and non-NSAID analgesics threaten dehydration of NSAID markets.

Conclusion

Etodolac maintains a relevant position within the NSAID landscape, benefiting from its favorable safety profile and established efficacy. While patent expirations and competitive pressures challenge its growth, expanding markets in emerging economies and potential formulation innovations offer opportunities for sustained sales. Strategic positioning, ongoing safety monitoring, and leveraging growth in the aging population will be crucial for maximizing market share and revenue streams.

Key Takeaways

- Market Position: Etodolac is a niche player in the global NSAID market with a strong foothold in prescription pain management.

- Growth Drivers: Aging demographics, chronic inflammatory conditions, and expanding healthcare access underpin future demand.

- Competitive Edge: Its safety profile supports ongoing use, especially where gastrointestinal safety is a concern.

- Challenges: Patent expiries, price competition, and safety considerations necessitate strategic adaptation.

- Sales Outlook: Industry forecasts project a steady increase in sales volume, with a CAGR of over 5% projected through 2030, reaching approximately USD 2 billion globally.

FAQs

1. How does etodolac compare to other NSAIDs in terms of safety?

Etodolac exhibits a relatively better safety profile with reduced gastrointestinal adverse effects owing to its COX-2 selectivity. Nonetheless, cardiovascular risks inherent to NSAIDs remain pertinent, necessitating careful patient monitoring.

2. What are the primary markets driving etodolac sales?

The United States and Europe dominate sales due to high prescription rates; however, rapid growth in Asia-Pacific—particularly in China and India—presents significant opportunities.

3. Are there upcoming formulations or patents that could influence the market?

While basic etodolac patents have expired, new sustained-release formulations and combination products may still hold patent protection, potentially affecting competitive dynamics.

4. How might regulatory changes impact etodolac's market?

Enhanced safety guidelines could restrict NSAID use or alter prescribing patterns. Conversely, positive safety data may reinforce market stability.

5. What strategic steps should pharmaceutical companies consider to capitalize on etodolac's market potential?

Focus on developing innovative formulations, expanding into emerging markets, emphasizing safety benefits, and forming licensing partnerships to enhance distribution networks.

References:

- MarketWatch. NSAID Market Size and Growth Outlook. 2022.

- GlobalData. Pharmaceutical Market Report 2022.

- FDA and EMA Regulatory Guidelines on NSAIDs.

- Johnson, L. et al. Safety profiles of COX-2 selective NSAIDs. Journal of Clinical Pharmacology. 2021.

- IMS Health. Prescription Trends in Inflammatory Diseases. 2022.