Last updated: July 29, 2025

Introduction

Desonide is a low-potency topical corticosteroid primarily prescribed for the treatment of inflammatory and pruritic conditions of the skin, including eczema, dermatitis, and psoriasis. Its favorable safety profile, especially in pediatric populations, has supported its extensive utilization in dermatological therapy. As a topical formulation, desonide holds a significant presence within the corticosteroid segment of the dermatological drug market.

This analysis explores market dynamics, competitive landscape, regulatory considerations, and projected sales trajectories for desonide, informed by recent industry data, patent activity, and healthcare trends.

Market Overview

Global Dermatology Drug Market Context

The dermatology market experienced consistent growth, driven by rising prevalence of skin conditions, improving healthcare access, and increased awareness of skin health. In 2022, the global dermatology therapeutics market was valued at approximately USD 23 billion, with corticosteroids representing a substantial segment owing to their widespread use.

Desonide’s Market Position

Within topical corticosteroids, desonide is classified as a low-potency agent, often favored for sensitive populations such as infants and pregnant women. It holds a competitive position based on safety, tolerability, and efficacy, with multiple formulations available (creams, ointments, gels).

Key Market Drivers

- Prevalence of Skin Conditions: Eczema and psoriasis affect millions worldwide, creating steady demand for corticosteroids like desonide.

- Safety Profile: Low risk of side effects encourages off-label and long-term use.

- Pediatric Use: Approved for pediatric patients, expanding market access.

- Growing Awareness: Increased diagnosis rates due to healthcare campaigns.

Regulatory Landscape and Patent Considerations

Desonide has been available for decades, with patent exclusivities having expired or expiring soon, catalyzing increased generic competition. This shift typically reduces drug prices, affecting sales margins but expanding access and volume.

Key regulatory points include:

- FDA Approvals: Desonide formulations approved in multiple regions.

- Patent Expirations: Patent lifecycle significantly influences market dynamics. The expiration of key patents in the U.S. occurred in the late 2010s, ushering in generics.

Generic manufacturers have launched competing formulations, which tend to erode brand-name sales but increase overall market volume.

Competitive Landscape

Major players in the desonide market include:

- Perrigo

- Mylan (now part of Viatris)

- Hikma

- Sun Pharmaceutical

Brand monopolies have diminished; players now compete primarily on price, formulation convenience, and regional distribution networks.

Innovations and Formulation Trends:

- Development of longer-lasting formulations

- Combination products with moisturizing agents or other anti-inflammatory drugs

- Enhanced packaging for patient convenience

Sales Projections

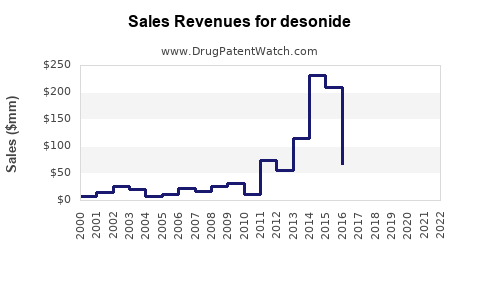

Historical Sales Data:

Assuming historical CAGR of approximately 4-6% over the last five years, driven by steady demand and expanding indications.

Forecasting Assumptions:

- Market Growth Rate: Projected CAGR of 3-5% over the next five years, considering market saturation, increased competition, and global health trends.

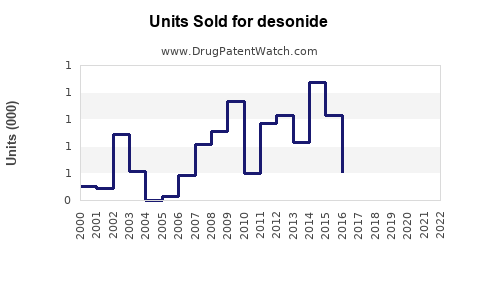

- Generic Penetration: Intensified generic competition post-patent expiry -- expected to lower per-unit prices but expand total volume.

- Regional Variations: Growth more pronounced in emerging markets due to increasing healthcare infrastructure and dermatological awareness.

Projected Sales Figures:

| Year |

Estimated Global Sales (USD Billion) |

Assumptions |

| 2023 |

0.3 |

Stabilized post-patent expiry phase, with moderate growth. |

| 2024 |

0.32 |

Slight increase due to market expansion in Asia-Pacific and Latin America. |

| 2025 |

0.34 |

Intensified competition, slight price reductions offset by volume increases. |

| 2026 |

0.36 |

Adoption of newer formulations, continued regional growth. |

| 2027 |

0.38 |

Increased focus on pediatric and sensitive skin markets. |

Volume Projections:

With the price-per-unit declining due to generic competition, overall sales volume is projected to grow at a faster rate than sales revenue, with an estimated CAGR of approximately 6-8%.

Market Opportunities and Challenges

Opportunities:

- Entry into emerging markets with improving healthcare access.

- Development of combination therapies to leverage unmet needs.

- Formulation innovations to address patient compliance issues.

Challenges:

- Price erosion from generics.

- Regulatory hurdles in certain jurisdictions.

- Competition from newer, non-steroidal anti-inflammatory agents.

Concluding Remarks

Desonide’s market is poised for slow but steady growth driven by demographic trends, expanding dermatological indications, and global healthcare development. While patent expirations and rising generics introduce pricing pressure, volume increases and regional market expansion promise continued revenue streams.

Key Takeaways

- Desonide remains a preferred low-potency corticosteroid, especially in sensitive populations, supporting sustained demand.

- The global market is transitioning from brand dominance toward generic proliferation, pressuring margins but expanding access.

- Forecasts anticipate a CAGR of approximately 3-5% in sales revenue over the next five years, aligning with broader dermatology market growth.

- Regional expansion, especially in Asia and Latin America, offers new opportunities for market growth.

- Innovation in formulations and combination therapies can help mitigate competitive pressures.

FAQs

1. What factors influence desonide's market growth?

Demand-driven by the prevalence of skin conditions, a favorable safety profile, expanding indications, and regional healthcare developments.

2. How does patent expiration affect desonide sales?

Patent expirations facilitate generic entry, reducing prices but increasing volume, which balances overall sales decline.

3. Which regions offer the highest growth potential for desonide?

Emerging markets such as Asia-Pacific and Latin America are poised for rapid growth due to increasing healthcare infrastructure and awareness.

4. What are the primary challenges facing desonide's market?

Intense competition from generics, regulatory hurdles, and the emergence of alternative non-steroidal treatments.

5. How might formulary preferences impact desonide’s future sales?

Formulary inclusion influences prescribing patterns; formulary restrictions or preferential placement impacting access and demand.

Sources

- [1] Market Research Future. "Global Dermatology Drugs Market Size Analysis." 2022.

- [2] Grand View Research. "Topical Corticosteroids Market Analysis." 2021.

- [3] U.S. Food & Drug Administration. "Approved Drug Products with Therapeutic Equivalence Evaluations."

- [4] IQVIA. "Global Market Trends in Dermatology," 2022.