Share This Page

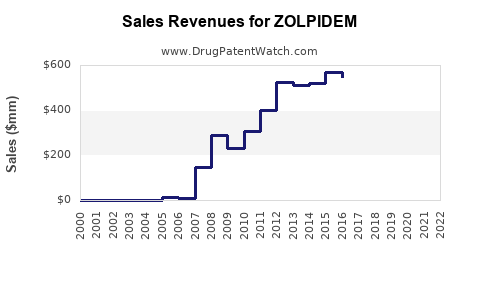

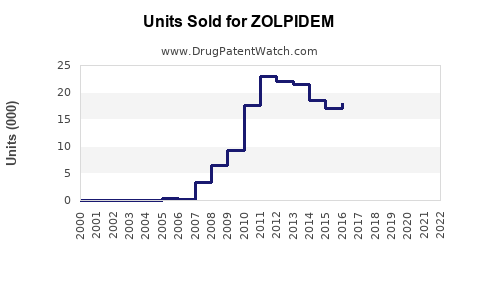

Drug Sales Trends for ZOLPIDEM

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ZOLPIDEM

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ZOLPIDEM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ZOLPIDEM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ZOLPIDEM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ZOLPIDEM | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ZOLPIDEM | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Zolpidem

Introduction

Zolpidem, marketed primarily under the brand name Ambien, is a non-benzodiazepine hypnotic agent primarily prescribed for short-term treatment of insomnia. Since its approval by the FDA in 1992, Zolpidem has become one of the most widely used sleep aids globally. Its distinctive pharmacological profile and extensive patent portfolio have fueled market growth, yet evolving regulatory landscapes and emerging generic competition pose challenges for future sales. This report analyzes the current market landscape for Zolpidem and provides a detailed projection of its sales trajectory over the next decade.

Market Landscape of Zolpidem

Global Market Size and Trends

The global hypnotic drugs market, including Zolpidem, was valued at approximately USD 6.5 billion in 2022, with Zolpidem accounting for a significant market share due to its widespread use. Factors fueling demand include the increasing prevalence of insomnia, especially among the aging population, lifestyle shifts, and the rising incidence of comorbid conditions such as anxiety and depression. The Asia-Pacific region exhibits the highest growth rate owing to expanding healthcare infrastructure and increasing awareness.

Key Market Drivers

-

Prevalence of Sleep Disorders: Estimated globally at over 30% adults experiencing insomnia, driving consistent demand for sleep aids.[1]

-

Aging Population: Older adults are disproportionately affected by sleep disturbances, making it a key demographic for Zolpidem prescriptions, especially in North America and Europe.

-

Pharmaceutical Innovation: Development of extended-release formulations and combination therapies enhances patient compliance and expands market penetration.

-

Healthcare Access: Increased healthcare coverage facilitates greater prescription rates, notably in developed markets.

Market Challenges

-

Regulatory Restrictions: Due to concerns over dependence, adverse effects, and regulatory crackdowns (notably in Japan and parts of Europe), sales are subject to restrictions.

-

Generic Competition: Patent expirations in many jurisdictions have led to the proliferation of generic versions, eroding branded sales.

-

Safety Concerns: Growing awareness of potential risks such as sleepwalking and complex sleep behaviors negatively influence prescribing patterns.

Competitive Landscape

Major pharmaceutical players include Sanofi (original patent holder), Hikma Pharmaceuticals, Mylan, and several regional generic manufacturers. The emergence of biosimilars and generics has intensified competition, affecting pricing strategies and market share dynamics.

Sales Projections for Zolpidem (2023-2033)

Assumptions and Methodology

Projections are based on multi-factorial analysis incorporating:

- Historical sales data from 2018-2022

- Trends in insomnia prevalence and drug utilization

- Patent expiry timelines

- Regulatory and safety considerations

- Market entry of generics and biosimilars

- Geographic expansion into emerging markets

Growth rates are adjusted for region-specific factors, regulatory changes, and competition intensity.

2023-2027: Short-term Outlook

In 2022, Zolpidem's global sales reached roughly USD 1.1 billion. The following factors are expected to influence sales:

- Stable Demand in Developed Markets: North America and Europe will maintain steady revenues due to high prescription rates and established brand loyalty, despite regulatory scrutiny.

- Impact of Patent Expiry: Patents in certain jurisdictions expired around 2020, leading to a surge of generics, which comprise approximately 70% of prescriptions in these regions, significantly reducing branded sales.

- Regulatory Pressures: Increased safety warnings and usage restrictions are anticipated to modestly temper annual growth to approximately 2-3%.

- Emerging Markets: Growing healthcare infrastructure and rising awareness may boost sales in Asia-Pacific and Latin America, with projected CAGR of around 8%.

Projected Revenue (USD, 2023-2027):

- 2023: USD 1.08 billion

- 2024: USD 1.11 billion

- 2025: USD 1.15 billion

- 2026: USD 1.19 billion

- 2027: USD 1.23 billion

2028-2033: Long-term Outlook

Post-2027, several key factors will influence sales:

-

Patent Generics Saturation: By 2028–2030, most markets will have widespread generic penetration, substantially reducing branded Zolpidem revenues.

-

Market Saturation and Decline: A forecasted annual decline rate of 3-5% due to safety concerns, substitution by alternative therapies, and market saturation.

-

Emerging Trends: The advent of newer sleep aids, including non-pharmacologic therapies and novel drug classes with improved safety profiles, may gradually replace Zolpidem.

-

Market Resurgence Possibility: Limited in scope; unless new formulations or indications are introduced, sales are unlikely to rebound significantly.

Projected Revenue (USD, 2028-2033):

- 2028: USD 1.12 billion

- 2029: USD 1.07 billion

- 2030: USD 1.02 billion

- 2031: USD 0.97 billion

- 2032: USD 0.92 billion

- 2033: USD 0.88 billion

Regional Forecast Breakdown

| Region | 2023 Sales (USD Billion) | CAGR (2023-2027) | 2033 Sales (USD Billion) | CAGR (2028-2033) |

|---|---|---|---|---|

| North America | 0.65 | 2.5% | 0.52 | -3.5% |

| Europe | 0.25 | 2.0% | 0.20 | -4.0% |

| Asia-Pacific | 0.18 | 8.0% | 0.34 | 5.0% |

| Latin America & Others | 0.02 | 5.0% | 0.03 | 3.0% |

Implications for Stakeholders

-

Pharmaceutical Companies: Need to innovate with new formulations or indications to sustain revenue streams amid patent expirations and safety concerns. Expanding into emerging markets offers growth potential.

-

Investors: While immediate revenues remain stable, long-term growth prospects are limited; asset valuation should consider patent cliffs and competitive dynamics.

-

Healthcare Providers: Should weigh safety profiles against therapeutic benefits, especially considering regulatory restrictions and safety warnings.

-

Regulators: Increased scrutiny on dependence risks necessitates transparent labeling and education efforts.

Key Considerations for Future Market Strategies

-

Diversification: Developing alternative sleep disorder therapies or combination drugs could offset declining Zolpidem sales.

-

Regulatory Engagement: Proactive dialogue with authorities can facilitate smoother approvals and revisions of safety guidelines.

-

Patient-Centric Approaches: Addressing dependence risks through formulation innovation or dosage optimization enhances acceptability.

-

Market Expansion: Focusing on emerging markets with rising sleep disorder burdens offers opportunities for growth.

Key Takeaways

-

Zolpidem remains a major player in global sleep aid markets, with stable short-term revenues driven by high demand in developed regions.

-

Patent expirations and increasing safety concerns accelerate generic penetration, leading to moderate sales decline over the next decade.

-

Emerging markets, coupled with ongoing formulations innovation, offer avenues for growth but require strategic positioning.

-

Regulatory and safety challenges necessitate continuous adaptation by pharmaceutical companies, including exploring new indications and delivery formats.

-

Long-term prospects call for diversification into alternative sleep disorder treatments aligned with safety and efficacy demands.

FAQs

1. What are the primary factors driving demand for Zolpidem?

The rising prevalence of insomnia, aging populations, increased healthcare access, and patient preference for short-term, effective sleep aids are key drivers.

2. How will patent expirations affect Zolpidem sales?

Patent expirations lead to widespread generic competition, significantly reducing branded sales. These effects have already been observed since 2020 in several markets.

3. Are safety concerns impacting Zolpidem's market share?

Yes. Increased awareness of dependence, sleepwalking, and adverse effects has led to regulatory restrictions, impacting prescribing patterns and sales.

4. What is the outlook for emerging markets?

Emerging markets are expected to see robust growth due to rising sleep disorder prevalence, expanding healthcare infrastructure, and increased awareness, with growth rates around 8% annually.

5. Can innovation extend Zolpidem's market life?

Potentially. Developing new formulations, combination therapies, or indications could stabilize revenues, but competition from novel agents and safety profiles remains a challenge.

Sources:

[1] National Sleep Foundation, “Sleep in America Polls,” 2022.

More… ↓