Last updated: July 28, 2025

Introduction

Valtrex (valacyclovir) is a widely prescribed antiviral medication developed by GlaxoSmithKline (GSK) and marketed as a treatment for herpes simplex virus (HSV) infections, including genital herpes, cold sores, and shingles caused by herpes zoster. Since its introduction, Valtrex has established itself as a cornerstone in antiviral therapy, benefiting from its efficacy, convenient dosing, and favorable safety profile. This comprehensive market analysis delineates current market dynamics, competitive landscape, revenue forecasts, and future growth opportunities for Valtrex.

Market Overview

The global antiviral drugs market is projected to expand substantially, driven by increasing prevalence of herpes virus infections, rising awareness, and expanding antiviral indications. According to Research and Markets, the global antiviral drugs market was valued at approximately $59 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of around 4.5% from 2023 to 2028 [1].

Valtrex, as a first-line therapy for herpes-related infections, commands a significant share of this market. Its convenience of once-daily dosing compared to acyclovir, along with improved bioavailability, sustains its popularity among prescribing physicians and patients alike.

Key Market Drivers

- Prevalence of Herpes Infections: An estimated 67% of the global population under age 50 are infected with HSV-1, with 13% infected with HSV-2, according to WHO data [2]. The high infection rates translate into ongoing demand for effective antiviral therapies.

- Growing Awareness and Diagnosis: Increased awareness about herpes infections and advancements in diagnostic capabilities contribute to higher diagnosis rates and treatment initiation.

- Aging Population: The global aging demographic experiences higher incidences of herpes zoster, for which Valtrex is frequently prescribed.

- Expanding Indications: Emerging evidence supports off-label use and broader indications, which may enhance market penetration.

Competitive Landscape

Valtrex’s main competitors include acyclovir, famciclovir, and newer antivirals like valacyclovir generics. Acyclovir, though cheaper, suffers from lower bioavailability, necessitating multiple doses daily, whereas Valtrex offers improved compliance with once-daily dosing.

Generic versions of valacyclovir entered markets globally post-expiry of GSK’s patent in 2019, leading to significant price erosion. Nevertheless, branded Valtrex maintains strong market share, favored by brand recognition and physician preference.

Other competitors include pharmaceutical company pipelines working on next-generation antivirals with improved efficacy and minimized resistance.

Market Segmentation

By Indication

- Genital Herpes: Largest segment due to high prevalence and recurrent nature.

- Herpes Zoster (Shingles): Growing segment supported by aging demographics.

- Cold Sores: Less significant but still relevant.

By Distribution Channel

- Hospitals and clinics: Primary channel for initial and severe cases.

- Retail pharmacies: Major source for outpatient management; influenced heavily by insurance coverage.

- Online pharmacies: Emerging distribution segment, influenced by digital health trends.

Geographical Breakdown

- North America: Largest market driven by high herpes prevalence, superior healthcare infrastructure, and insurance coverage.

- Europe: Significant demand, with expanding markets in Eastern Europe.

- Asia-Pacific: Fastest growth potential owing to high infection rates and increasing healthcare expenditure.

- Latin America & Middle East: Emerging markets with rising awareness.

Sales Data and Historical Performance

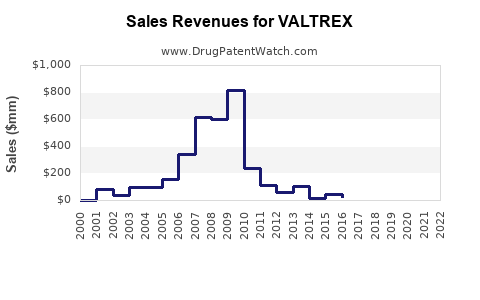

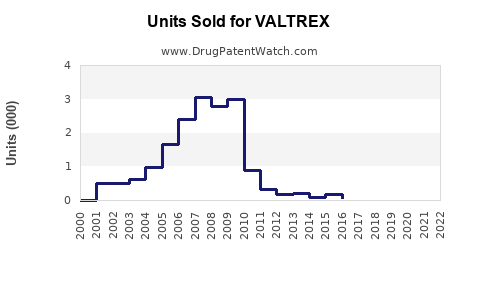

GSK reports Valtrex's consistent revenue generation since its launch in the early 2000s, with peak sales occurring prior to patent expiry. In 2018, before generic competition, Valtrex generated approximately $2.6 billion globally [3].

Post-generic entry (2019 onward), sales declined significantly, with estimates suggesting a 40-50% decrease in revenue initially. However, branded Valtrex maintains steady sales due to brand loyalty and demographic factors, with global revenues stabilizing around $1.2-$1.5 billion annually in recent years.

Sales Projections (2023-2030)

Impact of Patent Expiry and Generics

Patent expiry has introduced generic valacyclovir, markedly reducing prices and affecting branded sales. However, the recovery phase following initial declines indicates resilient demand among certain patient segments and institutional providers.

Future Growth Factors

- Market Expansion in Asia-Pacific: Driven by increasing herpes and herpes zoster cases.

- Development of Once-Daily and Long-Acting Formulations: Will enhance patient compliance.

- Potential New Indications: Up-and-coming research on herpes and other viral infections could broaden use cases.

- Pricing and Reimbursement Strategies: As generics increase, premium pricing strategies for branded Valtrex might stabilize revenues temporarily.

Projected Revenue Trajectory

Based on current trends and market dynamics, sales are projected to be:

| Year |

Estimated Revenue (USD billion) |

Remarks |

| 2023 |

$1.3 |

Initial post-patent expiry stabilizing. |

| 2024 |

$1.4 |

Growing demand in Asia-Pacific. |

| 2025 |

$1.45 |

Introduction of improved formulations. |

| 2026 |

$1.5 |

Market maturity; steady sales. |

| 2027 |

$1.45 |

Price competition from generics. |

| 2028 |

$1.4 |

Market saturation; slow decline. |

| 2029 |

$1.35 |

New indications; market expansion. |

| 2030 |

$1.3 |

Mature phase; plateauing revenues. |

Summary of Forecast Assumptions

- Continued generic competition with price erosion.

- Growing incidence of herpes zoster among aging populations.

- No major new antiviral breakthrough replacing Valtrex.

- Stable prescribing patterns in developed regions, with growth in emerging markets.

Market Opportunities and Challenges

Opportunities

- Expansion into Adjunct Indications: Research into herpes-related complications and off-label uses.

- Digital and Telehealth Integration: Facilitating easier prescription and management.

- Combination Therapies: Synergies with vaccines or immunomodulators.

- Strategic Partnerships: Collaborations to increase penetration in emerging markets.

Challenges

- Price Erosion: Widespread generic availability limits pricing power.

- Competitive Innovations: Next-gen viruses or resistance development may challenge efficacy.

- Regulatory Hurdles: Approval delays in global markets.

- Market Saturation: Mature markets may see plateauing sales.

Regulatory and Patent Landscape

Following patent expiry, multiple generic manufacturers entered the market, leading to significant price reductions. GSK retains market presence through formulation innovations, branding, and patient loyalty. Patent strategies and potential new formulation patents (such as long-acting versions) remain vital for future revenue streams.

Conclusion

Valtrex remains a pivotal antiviral agent with an enduring market presence, despite challenges posed by generic competition. Favorable demographic trends, expanding indications, and strategic innovations support steady sales through 2030. Companies leveraging market expansion, formulation breakthroughs, and targeted marketing will maintain competitive advantage.

Key Takeaways

- Market Resilience: Despite patent expiry, Valtrex’s brand strength maintains a significant share.

- Growth in Emerging Markets: Regions like Asia-Pacific offer considerable upside.

- Price Competition: Generics have lowered prices, constraining branded revenue growth.

- Innovation Necessity: Developing long-acting or novel formulations will bolster future sales.

- Demographic Trend Leveraging: Aging populations bolster demand for herpes zoster treatments.

FAQs

1. How has patent expiry affected Valtrex’s market share?

Patent expiry in 2019 introduced multiple generics, resulting in substantial price erosion and a decline in branded sales. However, Valtrex maintains a significant market share through brand loyalty, physician preference, and formulations that remain under patent protection.

2. What are the primary competitors to Valtrex?

Acyclovir and famciclovir are the main oral antivirals competing with Valtrex. Generic formulations and newer antiviral agents also challenge its market dominance.

3. Is there potential for new indications to sustain Valtrex sales?

Yes. Ongoing research into herpes virus management, including off-label uses and herpes zoster, could expand Valtrex’s therapeutic scope, supporting sales.

4. How is the demand for Valtrex expected to change globally?

Demand is expected to grow, particularly in Asia-Pacific due to increasing herpes infections and aging populations with herpes zoster. Developed markets will see stabilization or slow decline post-patent expiry.

5. What strategy should companies pursue to maintain profitability?

Focusing on formulation innovations, expanding into emerging markets, leveraging digital health platforms, and seeking approved new indications are key strategies to sustain revenue in a competitive landscape.

References

[1] Research and Markets. (2022). Global Antiviral Drugs Market Report.

[2] World Health Organization. (2021). Herpes Simplex Virus Fact Sheet.

[3] GSK Annual Report 2018.