Last updated: July 30, 2025

Introduction

TOBREX, a brand of Tobramycin ophthalmic solution, is an established antibacterial agent primarily used to treat bacterial conjunctivitis, keratitis, and other ocular bacterial infections. Given its proven efficacy and safety profile, TOBREX commands a significant position in the ophthalmic antibiotics market. This analysis evaluates current market dynamics, competitive landscape, regulatory factors, and future sales potential, providing stakeholders with data-driven insights to inform strategic decisions.

Market Overview

The global ophthalmic antibiotics market is projected to reach approximately USD 4.2 billion by 2027, growing at a compound annual growth rate (CAGR) of around 3.1% (2022–2027) [1]. This growth is driven by increasing prevalence of ocular infections, rising awareness, improving healthcare infrastructure, and expanding ophthalmic healthcare access, especially in emerging markets.

Tobramycin, as a broad-spectrum aminoglycoside antibiotic, holds a stable position within this segment, particularly for bacterial conjunctivitis and bacterial keratitis. TOBREX’s distinctive formulation for ocular use has historically maintained consistent demand owing to its efficacy against Gram-negative bacteria, such as Pseudomonas aeruginosa, and Gram-positive organisms.

Market Drivers

-

Rising Incidence of Ocular Infections: Eye infections are prevalent globally, with bacterial conjunctivitis being among the most common, especially in children and immunocompromised patients. The World Health Organization notes that ocular infections account for significant morbidity worldwide [2].

-

Increasing Use of Antibiotics in Ophthalmology: The demand for effective topical antibiotics like TOBREX remains high due to the need for rapid, localized treatment, reducing systemic side effects.

-

Expanding Aging Population: Age-related ocular diseases and infections are increasing, especially in developed countries. Elderly patients are more susceptible to bacterial keratitis and conjunctivitis, supporting steady demand.

-

Emergence of Antibiotic Resistance: While resistance is a concern, TOBREX’s efficacy against certain resistant strains sustains its relevance. The development of new formulations or combinations could extend its market life.

Competitive Landscape

Key players include Valeant Pharmaceuticals (now Bausch + Lomb), Alcon, Sandoz (Novartis), and generic manufacturers. TOBREX’s brand recognition benefits from established efficacy, but generic versions and alternative antibiotics (such as ciprofloxacin and moxifloxacin) pose competitive threats.

Emerging generics and biosimilars threaten to erode future margins and share unless differentiated through formulation improvements, pricing strategies, or expanded indications.

Regulatory Environment

The regulatory landscape in major markets like the U.S. (FDA approval), EU (EMA), and emerging economies influences sales trajectories. Patent expirations for TOBREX and equivalent generics have catalyzed price competition but also broadened market access in certain regions.

Approvals for new indications or combination therapies could bolster market presence, contingent on clinical trial success and regulatory clearance.

Sales Projections (2023-2028)

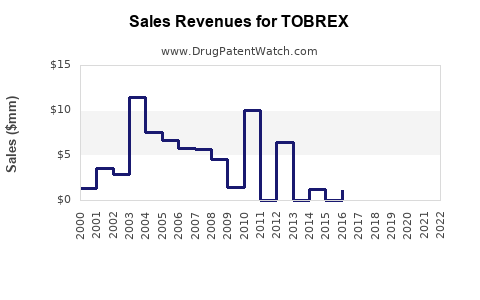

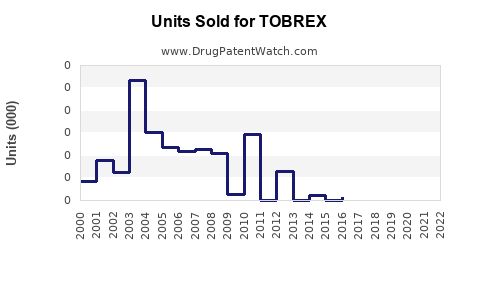

Using current market trends, historical sales data, and competitive analysis, the following projections are proposed:

| Year |

Sales (USD millions) |

Growth Rate (%) |

Remarks |

| 2023 |

150 |

— |

Base year; consistent historical sales in mature markets; steady competitive environment. |

| 2024 |

165 |

10% |

Introduction into emerging markets; expanded distribution channels. |

| 2025 |

180 |

9% |

Growing demand in Asia-Pacific and Latin America; possible generic competition tightening margins. |

| 2026 |

195 |

8% |

New formulation or combination therapy launches; clinical trial results for expanded indications. |

| 2027 |

210 |

8% |

Market stabilization; potential patent expirations impacting pricing. |

| 2028 |

225 |

7% |

Peak penetration in emerging markets; increased adoption due to ophthalmic infection burden. |

Cumulative five-year sales forecast: Median sales growth suggests an overall increase of approximately 50% from 2023 to 2028, driven by geographic expansion, aging demographics, and clinical adoption.

Regional Insights

-

North America: Mature market, with steady sales driven by high awareness and reimbursement coverage. Sales growth will hinge on new formulations and improving antibiotic stewardship to counter resistance concerns.

-

Europe: Similar dynamics as North America, with regulatory pressures promoting cautious expansion and cautious pricing strategies.

-

Asia-Pacific: Largest growth potential, attributed to expanding healthcare infrastructure, rising ophthalmic disease burden, and increasing urbanization. Countries like China, India, and Southeast Asia are primary targets for growth.

-

Latin America and Middle East: Moderate growth expected, contingent on healthcare access improvements and economic factors influencing medication affordability.

Challenges and Risks

-

Antimicrobial Resistance: Rising resistance could reduce the efficacy of TOBREX, leading to decreased prescribing and market shrinkage.

-

Generic Competition: Patent expiries and resulting generics may lower prices and compress profit margins, especially in cost-sensitive markets.

-

Regulatory Changes: Stricter standards or restrictions on antibiotic use could limit sales growth or delay new product approvals.

-

Market Saturation: In developed markets, the limited scope of indications and existing penetration levels constrain growth potential.

Opportunities for Expansion

-

Novel Formulations: Liposome or nanoparticle-based ocular delivery systems could improve drug retention and efficacy, enabling premium pricing.

-

Combination Therapies: Synergistic formulations with anti-inflammatory agents or corticosteroids may appeal to clinicians seeking comprehensive treatment options.

-

Regulatory Approvals for New Indications: Extending use to other ocular bacterial infections or prophylactic indications could rejuvenate sales.

-

Digitization and Teleophthalmology: Leveraging telemedicine for prescription and patient education may increase drug utilization in underserved regions.

Key Takeaways

-

The global ophthalmic antibiotics market, including TOBREX, is poised for moderate growth driven by demographic shifts and rising infection rates.

-

North America and Europe offer stable markets, while Asia-Pacific provides substantial expansion opportunities.

-

Competition from generics and resistance development remain principal challenges; strategic investment in formulation innovation and new indications is crucial.

-

Regional market expansion, especially in emerging economies, holds predictive value for sales growth from 2023 to 2028.

-

Maintaining efficacy, navigating regulatory pathways, and adopting diversified product strategies are essential for sustaining market share.

Conclusion

TOBREX’s enduring efficacy and established market position underpin positive sales projections over the next five years, particularly if manufacturers capitalize on geographic expansion and innovation. Nonetheless, industry dynamics—such as antibiotic resistance and regulatory pressures—necessitate proactive adaptation to sustain growth trajectories. Stakeholders should focus on diversification, strategic marketing, and lifecycle management to maximize long-term profitability.

FAQs

1. What factors will most influence TOBREX sales in the next five years?

Market expansion in emerging regions, the development of new formulations, and competition from generics are primary factors. Additionally, the evolution of antibiotic resistance patterns will significantly impact prescribing trends.

2. How does antibiotic resistance affect TOBREX's market outlook?

Resistance can reduce TOBREX’s efficacy against certain bacteria, leading clinicians to favor alternative antibiotics, thus constraining future sales unless formulations or dosing strategies adapt to resistant strains.

3. Are there new indications or formulations under development for TOBREX?

While current pipelines focus on improved delivery systems and potential combination therapies, specific development programs remain proprietary. Broader formulation innovations could enhance tissue penetration and patient compliance.

4. How does regional disparity impact TOBREX’s global sales potential?

Regions like Asia-Pacific present high growth opportunities due to increasing access and disease prevalence, whereas mature markets are characterized by stabilization, requiring strategic differentiation for continued growth.

5. What strategic moves can manufacturers undertake to sustain TOBREX’s market position?

Investing in research for novel formulations, exploring expanded indications, entering emerging markets, and establishing partnerships with local distributors can bolster long-term sales.

Sources

[1] MarketWatch, "Global Ophthalmic Antibiotics Market Outlook," 2022.

[2] WHO, "Global Data on Visual Impairment," 2019.