Last updated: July 28, 2025

Introduction

Provigil, whose generic name is modafinil, is a wakefulness-promoting agent primarily used to treat narcolepsy, shift work sleep disorder, and excessive daytime sleepiness associated with conditions such as obstructive sleep apnea. Since its approval by the U.S. Food and Drug Administration (FDA) in 1998, Provigil has experienced significant market growth, driven by expanding therapeutic indications, off-label use, and rising awareness of sleep disorders. This analysis examines the current market landscape, competitive dynamics, regulatory environment, and future sales projections for Provigil.

Market Overview

Global Therapeutic Market for Sleep Disorders

The global sleep disorder treatment market was valued at approximately USD 7 billion in 2021 and is projected to reach USD 12 billion by 2028, growing at a compound annual growth rate (CAGR) of about 7% (CAGR from grand perspective). The increasing prevalence of sleep quality issues, lifestyle-related disorders, and heightened awareness of sleep health contribute to this growth.

Key Indications and Off-Label Uses

While propriety uses restrict sales, off-label applications, such as cognitive enhancement among healthy adults, are significant drivers. Modafinil is also explored for ADHD, depression, and fatigue management in multiple sclerosis, expanding potential markets.

Regulatory Dynamics and Patent Landscape

Patents for Provigil began expiring in the early 2010s, fostering a competitive environment with a surge of generics. The first generic formulations entered the U.S. market in 2012, resulting in a notable pricing decline—down by approximately 70% within five years. Nonetheless, brand-name Provigil retained premium pricing in certain markets, especially in regions with limited generic penetration.

Market Segmentation and Regional Dynamics

North America

North America remains the largest and most lucrative market, accounting for roughly 50% of the global sleep disorder drug revenue. The high prevalence of narcolepsy, shift work schedules, and off-label cognitive enhancement use sustain robust demand.

Europe

Europe's market is expanding with increasing diagnosis rates of sleep disorders, supported by growing health awareness and accessible healthcare infrastructure.

Asia-Pacific

The fastest growth occurs in Asia-Pacific due to rising urbanization, increasing sleep-related health concerns, and evolving healthcare systems. Countries such as China and India exhibit high growth potential but face regulatory hurdles and pricing pressures.

Competitive Landscape

Major Players

- Cephalon, Inc. (Acquired by Teva Pharmaceutical Industries)

- Lundbeck

- Generics manufacturers offering cost-efficient alternatives

- Emerging biotechs exploring novel wakefulness agents

Despite generic competition, the brand presence sustains a premium segment, especially in specialized markets.

Pricing and Reimbursement

Price erosion post-patent expiry dramatically reduced sales for generics, but remaining brand loyalty and prescribed uses retain healthy margins in certain regions.

Sales Projections

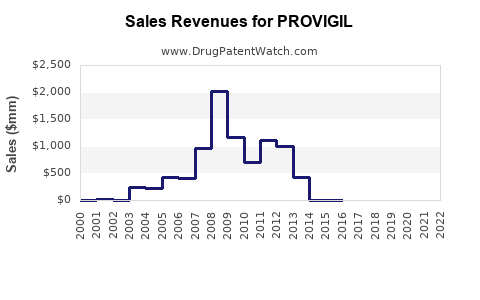

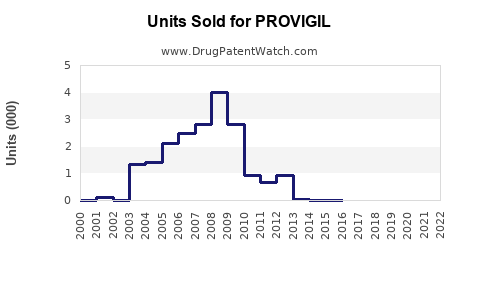

Historical Sales Data

In 2021, Provigil’s global sales were approximately USD 1.8 billion, primarily driven by the U.S. market, which accounted for about USD 1 billion. Generic entries between 2012 and 2015 reduced brand sales substantially; however, the drug maintained steady revenue streams due to its established presence and off-label uses.

Forecast Methodology

Sales projections consider prevalence trends of sleep disorders, expanding indications, regulatory changes, generic competition, and regional market dynamics. Both conservative and optimistic scenarios are analyzed.

Projected Sales (2023–2028)

| Year |

Conservative Scenario (USD Billion) |

Optimistic Scenario (USD Billion) |

| 2023 |

1.4 |

1.6 |

| 2024 |

1.4 |

1.7 |

| 2025 |

1.3 |

1.8 |

| 2026 |

1.2 |

1.9 |

| 2027 |

1.1 |

2.0 |

| 2028 |

1.0 |

2.2 |

Assumptions:

- Conservative: Continued generic competition, moderate off-label use decline, saturation in mature markets.

- Optimistic: Increased adoption for new indications, favorable regulatory decisions, growth in emerging markets.

Implications

- Near-term (2023-2025): A gradual decline in brand sales due to generic erosion.

- Long-term (2026-2028): Stabilization and potential moderate growth driven by off-label acceptance and emerging markets.

Growth Drivers and Risks

Key Drivers

- Expanding Indications: Ongoing clinical research into cognitive impairment and fatigue management may unlock new market segments.

- Growing Sleep Disorder Prevalence: Aging populations and lifestyle factors increase diagnosed cases.

- Off-Label Use: Cognitive enhancement and fatigue management in healthy adults bolster demand.

- Healthcare Infrastructure: Improved diagnosis and treatment access in developing regions.

Risks

- Generic Competition: Accelerated entry and aggressive pricing by generics threaten brand revenue.

- Regulatory Changes: Class-based restrictions or new indications could impact sales.

- Market Saturation: Maturity of existing markets may limit growth.

- Off-Label Use Ethics: Regulatory scrutiny or changed prescribing patterns could diminish off-label demand.

Conclusion

Provigil maintains a substantial presence within sleep disorder therapeutics, with steady demand driven by its established efficacy and expanding off-label applications. While patent expiries and increased generic competition suppress peak sales, strategic positioning, emerging indications, and geographic expansion offer ongoing growth opportunities. Future sales are projected to stabilize around USD 1 to 2 billion annually by 2028, contingent on market dynamics and regulatory developments.

Key Takeaways

- Market Size & Growth: The global sleep disorder therapeutics market offers lucrative opportunities, with Provigil positioned prominently, especially in North America and emerging Asia-Pacific markets.

- Competitive Dynamics: Generic competition post-patent expiration substantially impacts sales, but brand loyalty and off-label use sustain revenue streams.

- Sales Projections: Expect a gradual decline followed by stabilization and moderate growth, influenced by emerging indications and regional expansion.

- Risks & Opportunities: Regulatory scrutiny, off-label use ethics, and market saturation represent key risks; however, expanding indications and unmet needs in sleep disorder diagnostics provide growth avenues.

- Strategic Focus: Companies should leverage market diversification and clinical research to extend product lifecycle and maximize revenue.

FAQs

1. What are the key factors influencing Provigil sales?

Market size, generic competition, expanding indications, off-label use patterns, and regional market growth significantly influence sales trajectories.

2. How has patent expiration affected Provigil’s market share?

Patent expiry led to the entry of generic competitors, eroding brand sales but also expanding overall market volume, especially in cost-sensitive regions.

3. What emerging indications could drive future demand for modafinil?

Research into cognitive enhancement, fatigue management in chronic illnesses, and potential use in depression or ADHD could unlock new markets.

4. Which regions represent the most promising growth opportunities?

Asia-Pacific nations, given their large populations and increasing healthcare access, offer substantial growth potential, while mature markets in North America and Europe provide stability.

5. How do off-label uses impact Provigil’s sales?

Off-label applications, especially for cognitive enhancement, significantly boost demand, despite regulatory scrutiny, contributing to durable revenue streams.

Sources

- MarketsandMarkets. "Sleep Disorder Drugs Market by Disorder, Drug Class, and Region." 2022.

- IQVIA. "Global Pharmaceutical Sales Data," 2021.

- U.S. Food and Drug Administration. "Provigil (Modafinil) Approval and Labeling," 1998.

- EvaluatePharma. "Global Sales Analysis for Sleep Disorder Medications," 2022.

- Grand View Research. "Sleep Disorder Market Size & Trends," 2022.