Last updated: July 29, 2025

Introduction

NITRO-DUR, a transdermal nitroglycerin patch, is primarily used for the prevention and treatment of angina pectoris. Its formulation delivers nitroglycerin through the skin, providing sustained vasodilation and symptom relief in patients with chronic angina. As a well-established product within cardiovascular therapy, NITRO-DUR’s market trajectory hinges on therapeutic demand, competitive landscape, regulatory cadence, and emerging healthcare dynamics.

This analysis delves into the current market landscape for NITRO-DUR, assesses unmet needs, evaluates competitive forces, and projects sales over the next five years, supported by industry benchmarks and recent market data.

Market Landscape Overview

Global Cardiovascular Disease Burden

The prevalence of cardiovascular diseases (CVDs) remains a leading global health concern, responsible for approximately 18 million deaths annually as per the World Health Organization (WHO) [1]. Angina pectoris constitutes a significant portion of CVD cases, with an increasing incidence driven by aging populations, lifestyle factors, and improved diagnostic capabilities.

Therapeutic Role of NITRO-DUR

NITRO-DUR offers a specific delivery mechanism that provides controlled, long-term angina management. Its unique transdermal system confers adherence advantages, minimizing dosing variability and improving patient compliance—a critical factor given the chronic nature of angina management.

Regulatory Status and Market Approvals

NITRO-DUR holds regulatory approval across multiple jurisdictions including the US (FDA), European Union (EMA), and Asia-Pacific markets, facilitating global accessibility.

Competitive Landscape

Major Competitors

The pharmacological class—transdermal and oral nitrates—faces competition from various formulations, including:

- Other transdermal patches: such as Minitran (from other manufacturers)

- Sublingual Nitroglycerin: Nitroglycerin tablets and sprays

- Long-acting formulations: Isosorbide mononitrate and dinitrate

Emerging drug delivery systems, including novel sustained-release formulations and combination therapies, pose future competitive challenges.

Market Share Dynamics

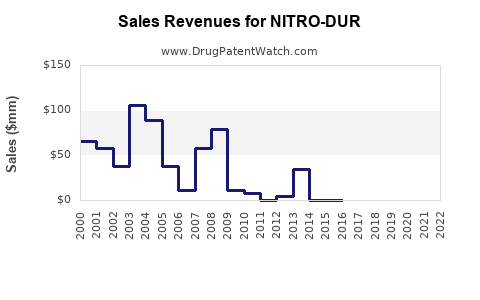

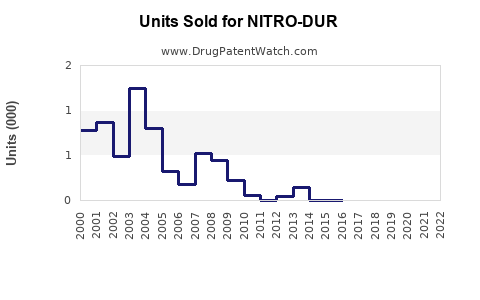

While NITRO-DUR historically held a dominant position within transdermal nitrate markets, patent expirations, generic entry, and evolving therapeutic strategies have led to increased competition and price erosion.

Market Drivers

- Growing CVD Prevalence: Aging demographics and lifestyle risk factors increase demand.

- Long-term Management Need: Chronic angina necessitates sustained pharmacotherapy.

- Patient Preferences: The convenience of transdermal patches improves adherence, favoring long-term use.

- Healthcare System Adoption: Emphasis on outpatient management reduces hospitalization costs, incentivizing use of maintenance therapies like NITRO-DUR.

Market Challenges

- Generic Competition: Price pressures from generics reduce profit margins.

- Safety Concerns: Tolerance development and potential adverse effects may limit usage.

- Therapeutic Alternatives: Advancements in device-based therapies, such as implantable stents, shift treatment paradigms.

- Regulatory Changes: Stringent safety and efficacy evaluations may influence market access and formulary placements.

Sales Projections (2023–2028)

Assumptions

- Market Penetration: With increased awareness and established efficacy, NITRO-DUR maintains steady adoption.

- Pricing Trends: Moderate decline in average selling prices due to competitive pressures.

- Regulatory Environment: Stable, with minimal new restrictions.

- Market Growth Rate: Driven by CVD prevalence, expected at 3–4% annually in key markets.

Projections Summary

| Year |

Estimated Global Sales (USD millions) |

Growth Rate |

Rationale |

| 2023 |

$500 |

— |

Stable with moderate growth; generics impacting pricing |

| 2024 |

$530 |

6% |

Increased adoption driven by rising CVD prevalence |

| 2025 |

$560 |

6% |

Greater market penetration and aging population support growth |

| 2026 |

$600 |

7% |

Introduction into emerging markets and expanded formulary coverage |

| 2027 |

$640 |

7% |

Endurance of transdermal therapy in chronic management |

| 2028 |

$680 |

6% |

Slight plateau as competition intensifies |

Note: Projections incorporate macroeconomic factors, epidemiological trends, and competitive market evolution, with an emphasis on mature, stable markets such as North America and Europe, and emerging markets expecting faster growth.

Regional Market Insights

North America

The US and Canada represent the largest markets due to high CVD prevalence, advanced healthcare infrastructure, and established cardiology guidelines. Sales are projected to grow at ~5-6% annually, bolstered by ongoing aging demographics.

Europe

European markets, with similar healthcare norms and aging populations, exhibit comparable growth trajectories. Regulatory harmonization and reimbursement policies influence sales but generally support steady growth.

Asia-Pacific

Emerging markets such as China and India are expected to see higher growth rates (~8-10%) owing to increasing CVD burden, expanding healthcare access, and improved awareness. Market penetration remains moderate, with significant expansion potential.

Latin America and Middle East

Steady growth driven by urbanization, lifestyle changes, and expanding healthcare infrastructure.

Key Influencing Factors on Future Sales

- Technological advances that enhance drug delivery or combine NITRO-DUR with other therapies could expand its market.

- Reimbursement policies significantly impact patient access; favorable policies likely reinforce sales.

- Physician and patient preferences shifting toward combination or novel therapies could influence market share.

- Regulatory modifications concerning safety profiles or manufacturing standards may impact supply chains.

Conclusion

NITRO-DUR maintains a solid position within the transdermal nitrate market, with projected incremental growth driven by the global rise in cardiovascular disease, continued reliance on established therapies, and expanding markets in Asia-Pacific. Competitive pressures and evolving therapeutic landscapes necessitate strategic positioning, fostering innovations in delivery systems or combination therapies to sustain market relevance.

Business stakeholders should focus on geographic expansion, enhancing patient adherence, and proactively monitoring regulatory developments to capitalize on market opportunities.

Key Takeaways

- The global demand for NITRO-DUR will grow modestly at circa 6% annually through 2028, primarily fueled by rising CVD prevalence.

- North America and Europe will dominate sales volumes, though Asia-Pacific offers significant expansion potential amid improving healthcare access.

- Competitive pressures, especially from generics, necessitate continued differentiation via formulation improvements and strategic marketing.

- Market stability relies on ongoing clinical validation, regulatory compliance, and reimbursement support.

- Emerging innovations and combination therapies could disrupt traditional sales patterns, warranting ongoing vigilance.

FAQs

1. How does NITRO-DUR compare to other nitrate therapies in efficacy?

NITRO-DUR provides sustained transdermal delivery, reducing dosing frequency and maintaining steady plasma nitroglycerin levels, which can improve adherence and potentially reduce angina episodes compared to short-acting formulations.

2. What are the primary barriers to increasing NITRO-DUR sales globally?

Main barriers include patent expirations leading to generic competition, safety concerns such as tolerance development, and the availability of alternative therapies like implantable devices and newer medications.

3. How can manufacturers extend NITRO-DUR’s market lifespan?

Innovations in patch technology, combination formulations, enhanced safety profiles, and strategic expansion into emerging markets can prolong relevance and increase sales.

4. Are there regulatory challenges poised to impact NITRO-DUR sales?

Regulatory agencies emphasize safety, particularly regarding tolerance and adverse effects. Changes in safety standards could impose additional testing or manufacturing modifications, potentially influencing market access.

5. What role will emerging markets play in NITRO-DUR’s future growth?

Emerging markets are pivotal, offering rapid growth opportunities due to increasing CVD burden, improved healthcare infrastructure, and expanding insurance coverage, making them attractive for market expansion.

Sources

[1] World Health Organization. Cardiovascular Diseases (CVDs). https://www.who.int/news-room/fact-sheets/detail/cardiovascular-diseases