Share This Page

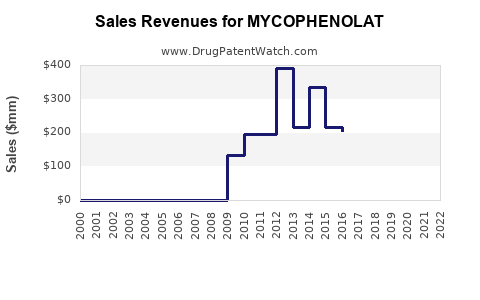

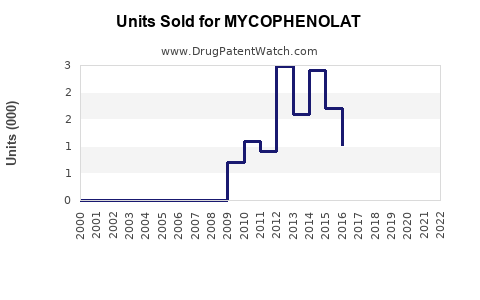

Drug Sales Trends for MYCOPHENOLAT

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for MYCOPHENOLAT

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MYCOPHENOLAT | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MYCOPHENOLAT | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MYCOPHENOLAT | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for MYCOPHENOLATE

Introduction

Mycophenolate, commercially known as Mycophenolate Mofetil (brand names include CellCept and Myfortic), is an immunosuppressant agent primarily used to prevent organ rejection post-transplantation and to treat autoimmune diseases such as lupus erythematosus. As a cornerstone in transplant medicine, its market dynamics are shaped by the expanding global transplant population, increasing autoimmune disorder prevalence, and ongoing pharmaceutical innovations. This analysis examines the current market landscape for mycophenolate, forecasted sales trajectories, and key factors influencing future growth.

Market Overview

Product Profile and Therapeutic Applications

Mycophenolate functions by inhibiting inosine monophosphate dehydrogenase, crucial for lymphocyte proliferation. Its primary indications include:

- Prevention of allograft rejection in solid organ transplantation (kidney, heart, liver)

- Treatment of severe autoimmune conditions such as lupus nephritis

The drug’s efficacy and relatively favorable safety profile have cemented its position as a first-line immunosuppressant.

Global Market Size and Trends

The global immunosuppressant market was valued at approximately USD 8.2 billion in 2022, with mycophenolate constituting a significant share due to its widespread acceptance. The transplant segment dominates this share owing to the high need for effective immunosuppression to improve graft survival rates.

Competitors and Market Share

Key competitors include tacrolimus, cyclosporine, corticosteroids, and newer agents like belatacept. Mycophenolate’s market share varies geographically; North America and Europe are mature markets with high adoption rates, while Asia-Pacific demonstrates rapid growth potential due to increasing transplant procedures and autoimmune disease prevalence.

Market Drivers

-

Rising Transplant Procedures: Annual global kidney transplants reached approximately 85,000 in 2021, with steady growth projected (Global Observatory on Donation and Transplantation). Mycophenolate remains essential in transplant immunosuppressive regimens.

-

Increasing Autoimmune Disease Prevalence: Lupus affects an estimated 5 million people worldwide, with a growing trend linked to improved diagnostics and awareness, expanding potential patient populations.

-

Regulatory Approvals and Label Expansion: Ongoing approvals for new indications and formulations, including delayed-release tablets, boost market reach.

-

Advancements in Pharmacogenomics: Personalized immunosuppressive therapy enhances treatment outcomes, promoting continued use of established agents like mycophenolate.

Market Challenges

-

Side Effects and Safety Concerns: Teratogenicity, gastrointestinal disturbances, and infection risks can limit usage, especially in certain demographics.

-

Generic Competition: Patent expirations, notably of CellCept in major markets, have led to an influx of generic versions, exerting downward pressure on prices and margins.

-

Monitoring and Compliance: Managing immunosuppressant therapy requires rigorous monitoring, impacting market growth in resource-constrained settings.

-

Emerging Therapies: Biologic agents and novel immunosuppressants in clinical development could substitute current regimens.

Regional Market Insights

-

North America: Dominates due to high transplantation volume, advanced healthcare infrastructure, and strong pharmaceutical presence. The U.S. alone performs approximately 23,000 kidney transplants annually.

-

Europe: Similar market characteristics with robust transplant programs and regulatory support.

-

Asia-Pacific: Fastest-growing segment owing to increasing healthcare investments, transplant infrastructure expansion, and rising autoimmune disease prevalence.

Sales Projections (2023-2030)

Methodology

Forecasting combines historical sales data, market growth rates, demographic trends, regulatory landscape analysis, and pipeline dynamics. The base year is 2022, with projections extending to 2030, reflecting compounded growth rates (CAGR).

Projected Market Growth

-

Global Revenue: Expected to grow from approximately USD 2.8 billion in 2022 to over USD 4.5 billion by 2030, representing a CAGR of 6.2%.

-

Segmented Trends:

- Organ Transplant Use: CAGR of 5.8%, driven by rising transplant numbers.

- Autoimmune Diseases: Faster growth at 7.2%, supported by expanding diagnostic and treatment access.

-

Impact of Generic Enterity: Post-patent expiry, generic competition is projected to dilute gross sales but increase overall accessibility and volume sales.

Market Entry and Expansion Opportunities

- Emerging Markets: Strategic entry into regions with low current penetration presents substantial growth potential.

- New Formulations: Development of improved delivery systems (e.g., extended-release formulations) could command premium pricing.

- Combination Therapies: Partnering with biologics or other immunosuppressants may unlock additional indications and markets.

Key Factors Influencing Future Sales

- Regulatory Developments: Approvals for biosimilars and generics will shape competitive dynamics.

- Healthcare Infrastructure: Improved healthcare access and transplant infrastructure in developing regions will expand potential markets.

- Patient Management Protocols: Evolving guidelines emphasizing personalized medicine and therapeutic drug monitoring will influence prescribing trends.

- Pricing and Reimbursement: Cost-containment pressures and insurance coverage policies will significantly impact sales volumes and margins.

Conclusion

Mycophenolate stands as a vital agent within immunosuppressive therapy, with a resilient market outlook influenced by relentless demand in transplantation and autoimmune diseases. While patent expiration and competition introduce challenges, strategic innovations and market expansion, particularly into emerging regions, can sustain growth. The forecasted CAGR of approximately 6.2% until 2030 underscores its continued relevance in transplant medicine.

Key Takeaways

- The global mycophenolate market is poised for steady growth, driven by increased transplantation rates and autoimmune disease prevalence.

- Patent expiries have catalyzed a shift towards generic versions but also offer opportunities for volume-based expansion.

- Developing markets in Asia-Pacific and Latin America present significant growth potential due to rising healthcare investments.

- Innovation in formulations and combination therapies can enhance market share and profitability.

- Regulatory and reimbursement landscapes will critically influence future sales trajectories.

FAQs

-

What are the main indications for mycophenolate?

Mycophenolate is primarily used for preventing organ rejection in kidney, heart, and liver transplants, and for treating autoimmune conditions like lupus nephritis. -

How does patent expiry affect mycophenolate sales?

Patent expiration typically leads to increased generic entry, reducing drug prices and margins but increasing access and volume sales globally. -

Which regions offer the highest growth opportunities for mycophenolate?

The Asia-Pacific region is the fastest-growing market due to expanding healthcare infrastructure and transplant procedures. -

What challenges could hinder future market growth?

Challenges include safety concerns, competition from newer therapies, regulatory hurdles, and cost pressures in healthcare systems. -

Are there any promising pipeline developments for mycophenolate?

Currently, focus is on developing new formulations, biosimilars, and combination therapies to enhance efficacy, safety, and market reach.

Sources:

[1] Global Observatory on Donation and Transplantation. “Transplant Data & Analysis,” 2022.

[2] Market Research Future. “Immunosuppressant Market Forecast,” 2022.

[3] IQVIA. “Global Immunosuppressant Market Trends,” 2022.

[4] U.S. National Kidney Foundation. “Transplant Statistics,” 2021.

[5] WHO. “Autoimmune Disease Prevalence Data,” 2022.

More… ↓