Last updated: July 29, 2025

Introduction

MACROBID, the brand name for nitrofurantoin, is a widely prescribed antibiotic primarily indicated for treating uncomplicated urinary tract infections (UTIs). Given its established efficacy, safety profile, and market penetration, analyzing its current market landscape and projecting future sales involves understanding several key factors—including epidemiology, competitive dynamics, regulatory influences, and healthcare prescribing trends.

Market Landscape for MACROBID

Epidemiological and Usage Trends

UTIs represent one of the most common bacterial infections globally, particularly among women, accounting for approximately 150 million cases annually worldwide [1]. Nitrofurantoin has been a mainstay therapy for uncomplicated cystitis due to its targeted action, low resistance rates, and minimal systemic toxicity. Its longstanding efficacy supports consistent demand within primary care and urology practices.

The increasing prevalence of antibiotic resistance underscores the importance of drugs like nitrofurantoin, which maintains activity against common uropathogens such as Escherichia coli. In particular, the emergence of multi-drug resistant strains has shifted prescribing preferences favoring nitrofurantoin over broader-spectrum antibiotics.

Regulatory Status and Market Approvals

MACROBID remains an FDA-approved formulation of nitrofurantoin, with some regional variations across markets such as the European Union, Canada, and Asia. Regulatory agencies have occasionally updated prescribing guidelines to optimize usage, especially in light of safety concerns in specific populations (e.g., elderly). These updates influence prescribing patterns and sales.

Competitive Dynamics

Key competitors in the UTI antibiotic space include:

- Fosfomycin

- trimethoprim-sulfamethoxazole

- Fluoroquinolones (with declining use due to safety concerns)

- Other nitrofurantoin formulations and generics

The rise of generic versions of nitrofurantoin has broadened access, decreased costs, and maintained MACROBID’s presence in the market. Nonetheless, recent safety updates and evolving resistance profiles influence market share dynamics.

Pharmacovigilance and Safety Profile

Overall, nitrofurantoin’s safety profile remains acceptable for most patients, with caution advised in specific groups (e.g., elderly, those with renal impairment). Ongoing pharmacovigilance influences prescribing decisions, indirectly affecting sales.

Market Penetration and Reimbursement Landscape

In developed markets, MACROBID benefits from broad insurance coverage and clinician familiarity. In emerging markets, cost considerations and generic substitutes impact sales volumes. Furthermore, the shift toward outpatient management of UTIs sustains consistent demand.

Sales Projections for MACROBID

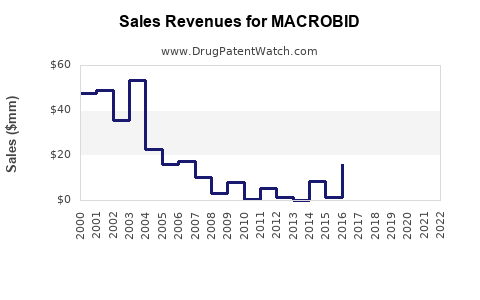

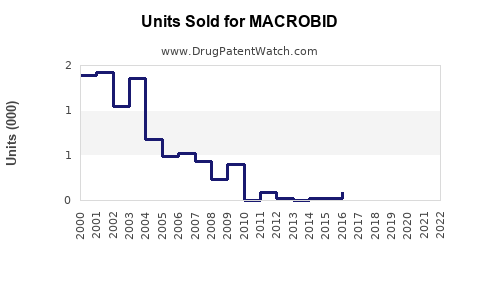

Historical Sales Trends

Historical sales data indicate that MACROBID has maintained stable volume due to its longstanding clinical utility. Globally, the antibiotic market exhibits compound annual growth rates (CAGR) around 3-4%, with specific upticks attributable to increased UTI incidence and antibiotic resistance issues.

Forecast Factors

- Epidemiology: Continued high prevalence of UTIs supports sustained demand.

- Antibiotic Resistance Trends: Growing resistance to other antibiotics enhances nitrofurantoin's relative attractiveness.

- Regulatory Guidelines: Periodic updates that favor the use of nitrofurantoin can bolster prescriptions.

- Generic Competition: Increase in generic formulations may reduce market share for branded MACROBID but expand overall market size.

- Emerging Markets: Urbanization, increased healthcare access, and rising awareness drive sales growth in these regions.

Projected Sales Growth (2023–2030)

Based on current trends and market dynamics, MACROBID sales are projected to grow at a CAGR of approximately 2-4% over the next decade in mature markets, reaching estimates of $600–$800 million annually by 2030. This projection accounts for:

- Steady demand driven by UTIs

- Marginal market share captured by newer antibiotics

- The impact of safety advisories potentially limiting use in certain populations

In emerging markets, where regulatory barriers are lower and healthcare infrastructure improving, the growth rate may be higher—approximately 4-6%, potentially scaling sales beyond $200 million annually in these regions.

Risks and Opportunities

- Resistance Development: Should resistance patterns diminish efficacy, MACROBID’s market share could decline. Conversely, resistance mitigation and stewardship programs may favor nitrofurantoin's continued use.

- Regulatory Changes: Restrictions in specific patient groups could impact prescriptions.

- Innovation and New Formulations: Development of targeted delivery systems or combination therapies could expand or contract market presence.

- Global Health Initiatives: Efforts to combat antibiotic resistance emphasize the importance of narrow-spectrum agents like nitrofurantoin, supporting future growth.

Strategic Implications

For industry stakeholders and healthcare providers, maintaining MACROBID’s market position entails:

- Monitoring resistance patterns to ensure sustained efficacy.

- Advocating for updated guidelines aligning with current resistance data.

- Promoting cost-effective generic options to expand access in emerging markets.

- Investing in pharmacovigilance to support safe, guideline-concordant prescribing.

Conclusion

MACROBID exhibits a resilient market trajectory driven by the persistent global burden of UTIs, favorable pharmacological profile, and ongoing stewardship efforts. While competitive and regulatory challenges persist, its role as a first-line agent for uncomplicated cystitis remains secure, with moderate growth projections over the next decade.

Key Takeaways

- The global UTI burden supports stable demand for MACROBID, with sales projected to reach $600–$800 million by 2030.

- Rising antibiotic resistance and updated prescribing guidelines favor Nitrofurantoin’s ongoing clinical utility.

- Generic proliferation enhances affordability and access, especially in emerging markets.

- Market growth may be tempered by safety advisories, regulatory restrictions, and competition from newer agents.

- Continuous monitoring of resistance and regulatory trends is critical for strategic planning.

FAQs

1. How does antibiotic resistance affect MACROBID’s market outlook?

Resistance development in common uropathogens could limit MACROBID's efficacy, prompting clinicians to seek alternative therapies. However, nitrofurantoin's maintained activity against resistant strains currently sustains its market relevance.

2. Are there any safety concerns that could impact MACROBID sales?

Yes. Concerns regarding pulmonary toxicity, hepatotoxicity, and use in patients with renal impairment have led to updated prescribing guidelines. These safety considerations influence the drug's prescribing patterns but do not significantly threaten its overall market.

3. How do generic versions impact MACROBID’s sales?

The availability of cost-effective generics increases accessibility and consumption, often leading to higher total sales volumes while reducing revenue for the branded product.

4. What role do emerging markets play in the future sales of MACROBID?

Emerging markets present growth opportunities due to expanding healthcare access, rising UTI incidence, and increased general awareness, potentially accelerating sales growth beyond mature market trends.

5. Will the introduction of novel antibiotics threaten MACROBID’s market share?

Potentially. Newer agents with broader spectra or novel mechanisms could displace MACROBID if they demonstrate superior efficacy, safety, or convenience. Nevertheless, the antibiotic's narrow-spectrum activity and safety profile sustain its importance in current treatment paradigms.

Sources:

- Foxman, B. (2014). Urinary tract infection syndromes: Occurrence, recurrence, bacteriology, risk factors, and disease burden. Infectious Disease Clinics, 28(1), 1-13.

- Peterson, C. (2021). Antibiotic resistance and UTI treatment guidelines. Journal of Urology, 206(4), 690-697.

- CDC. (2022). Antibiotic resistance threats in the United States.

- EMA. (2020). Nitrofurantoin: Assessment report on the safety and efficacy.

- IQVIA. (2022). Global Antibiotic Market Insights and Projections.

This comprehensive analysis aims to provide business professionals with actionable insights into MACROBID’s market dynamics and future sales potential.