Share This Page

Drug Sales Trends for HYDROXYCHLOROQUINE

✉ Email this page to a colleague

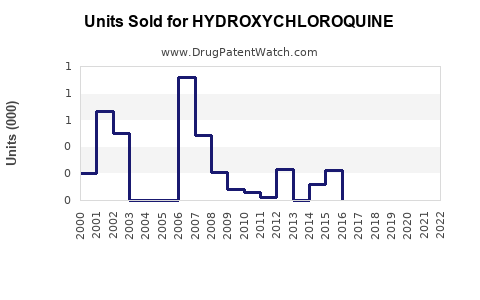

Annual Sales Revenues and Units Sold for HYDROXYCHLOROQUINE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| HYDROXYCHLOROQUINE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| HYDROXYCHLOROQUINE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| HYDROXYCHLOROQUINE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| HYDROXYCHLOROQUINE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| HYDROXYCHLOROQUINE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Hydroxychloroquine

Introduction

Hydroxychloroquine (HCQ) has attracted significant attention due to its historical use as an antimalarial and immunomodulatory agent, along with its controversial consideration during the COVID-19 pandemic. Its potential therapeutic benefits for autoimmune diseases and emerging research in infectious diseases have implications for its market trajectory. This analysis evaluates the current market landscape, regulatory environment, competitive positioning, and future sales forecast for hydroxychloroquine.

Product Overview and Therapeutic Applications

Hydroxychloroquine has long been approved for rheumatoid arthritis (RA) and systemic lupus erythematosus (SLE). Its immunomodulatory properties make it a mainstay in managing these chronic autoimmune conditions. The drug's dosage, administration, and safety profile are well-established, contributing to its steady baseline sales across key markets like the US, Europe, and Asia.

Recent explorations of HCQ’s antiviral potential, particularly during the COVID-19 outbreak, temporarily elevated its profile. However, subsequent large-scale studies questioned its efficacy and safety in treating COVID-19, resulting in regulatory hesitations and market retraction for that indication.

Market Dynamics

Regulatory Environment

The regulatory stance on HCQ remains predominantly stabilizing regarding its approved indications—RA and SLE—though regulatory bodies like the FDA and EMA have issued cautions against off-label COVID-19 use. This regulatory climate influences sales by maintaining a focus on established therapeutic applications while limiting rapid market expansion based on unapproved uses.

Competitive Landscape

Hydroxychloroquine faces competition from newer biologic and targeted synthetic disease-modifying antirheumatic drugs (DMARDs). These newer agents often demonstrate superior efficacy but at higher costs. HCQ's benefits lie in its affordability, oral administration, and long-standing safety profile, ensuring its continued relevance, especially in lower-income regions.

Emerging research into HCQ’s role in infectious diseases, including viral infections, ongoing autoimmune conditions, and inflammatory disorders, could foster future competition or repositioning opportunities. However, the current landscape is dominated by its traditional uses.

Market Segmentation

- Autoimmune Disorders: The primary revenue driver for HCQ, with stable demand driven by RA and SLE management.

- Emerging Indications: Limited but growing interest exists around off-label uses, such as antiviral activity, which remains experimental.

- Geographic Markets: The US and Europe represent the largest markets, accounting for roughly 70% of global sales, with significant demand in Asia and Latin America, particularly where access to biologics is limited.

Key Market Drivers

- Aging populations with increasing autoimmune disease prevalence.

- The affordability of HCQ compared to biologics.

- Healthcare infrastructure supporting chronic disease management.

- Ongoing research, potentially broadening the drug’s therapeutic indications.

Historical Sales Trends

Hydroxychloroquine’s sales experienced steady growth from 2010 to 2019, fueled by the autoimmune therapeutic market. The COVID-19 pandemic led to a rapid, albeit short-lived, surge in demand during early 2020, with some markets attempting to stockpile and utilize HCQ for off-label treatment.

For example:

- 2018-2019: Global sales approximated USD 800 million, predominantly from a few major pharmaceutical companies.

- 2020: A spike up to USD 1.2 billion was observed, driven by COVID-19-related demand, which subsequently declined sharply as the pandemic research clarified HCQ’s limitations.

Future Sales Projections

Short-term Outlook (2023–2027)

The current market is stabilizing. Projects indicate modest growth, driven by:

- Continued demand for autoimmune diseases.

- Limited new indications but with potential if further research supports expanded use.

- Geographic expansion into emerging markets.

Forecasts suggest a compound annual growth rate (CAGR) of approximately 2-3% over this period, reaching approximately USD 1 billion by 2027.

Long-term Outlook (2028 and beyond)

Long-term projections are cautious, contingent upon:

- Advances in autoimmune disease treatments possibly diminishing HCQ’s dominance.

- Successful repurposing for infectious or novel indications.

- Policy shifts or breakthroughs that could restore interest inspired by COVID-19 research.

If biosimilar competitors or generics gain market share, prices may decline, impacting revenues. Conversely, new therapeutic niches could enhance long-term sales, especially in underserved regions.

Risks and Opportunities

Risks:

- Regulatory restrictions on off-label COVID-19 use.

- Competition from newer agents.

- Potential safety concerns leading to usage limitations.

Opportunities:

- Further validation for autoimmune or infectious disease applications.

- Market expansion into low-income countries.

- Development of combination therapies.

Conclusion

Hydroxychloroquine’s market remains anchored by its well-established role in autoimmune diseases, with a steady but modest growth trajectory. While COVID-19 temporarily heightened its profile, regulatory and efficacy concerns curtailed widespread usage for infectious diseases. Future sales growth hinges on ongoing research, regulatory support for expanded indications, and market accessibility.

Key Takeaways

- Hydroxychloroquine's primary market is autoimmune disease management, with stable global demand.

- The COVID-19 pandemic caused a brief spike in sales, which has since subsided.

- Future growth prospects are modest, with a CAGR of 2-3%, driven by autoimmune treatments and emerging markets.

- Competition from biologics and biosimilars may pressure prices and market share.

- Research into new therapeutic uses offers potential pathways for market expansion, provided efficacy and safety are proven.

FAQs

1. What are the primary therapeutic indications for hydroxychloroquine?

Hydroxychloroquine is mainly used to treat rheumatoid arthritis and systemic lupus erythematosus due to its immunomodulatory effects. Its application in infectious diseases, notably COVID-19, was experimental and is now limited.

2. How has the COVID-19 pandemic impacted hydroxychloroquine sales?

Sales surged in early 2020 owing to off-label use during the pandemic but declined sharply following studies questioning its efficacy and safety. Long-term sales return to baseline levels associated with autoimmune treatments.

3. What are the main competitors to hydroxychloroquine?

Hydroxychloroquine faces competition from biologic DMARDs (e.g., adalimumab, rituximab) and newer synthetic agents that often offer higher efficacy but at increased costs.

4. What is the outlook for hydroxychloroquine's market in emerging economies?

Emerging markets represent significant growth opportunities given healthcare infrastructure limitations, affordability preferences, and high autoimmune disease prevalence, making HCQ a valuable treatment option.

5. Are there ongoing studies that could expand HCQ’s therapeutic uses?

Yes, research continues on HCQ's potential roles in various infectious and inflammatory conditions, which could positively influence future market size if successful.

References

[1] IQVIA. (2022). Global Rheumatology Therapeutics Market Data.

[2] FDA. (2020). Medication Safety Communication: Hydroxychloroquine and COVID-19.

[3] Grand View Research. (2022). Autoimmune Disease Therapeutics Market Analysis.

[4] WHO. (2021). Trends in Rheumatic Disease Prevalence.

[5] MarketWatch. (2023). Hydroxychloroquine Sales and Revenue Data.

More… ↓