Last updated: July 29, 2025

Introduction

HECTOROL (doxercalciferol) is a calcitriol analog used primarily for managing secondary hyperparathyroidism in patients with chronic kidney disease (CKD), particularly those undergoing dialysis. Approved by the FDA in 1999, HECTOROL offers a synthetic vitamin D analog option, distinct from traditional calcitriol, with potential benefits in reducing hyperparathyroidism symptoms and associated bone disorders. As nephrology therapies evolve and the prevalence of CKD rises, understanding the market landscape and future sales potential for HECTOROL is crucial for stakeholders.

Market Overview

Global CKD and Secondary Hyperparathyroidism Landscape

Chronic kidney disease affects over 850 million individuals worldwide, with a substantial proportion progressing to end-stage renal disease (ESRD) requiring dialysis or transplantation [1]. Secondary hyperparathyroidism (SHPT) impacts approximately 85-90% of patients with CKD stages 3-5, often necessitating pharmacological intervention to control parathyroid hormone (PTH) levels [2].

The primary treatment modalities include vitamin D analogs, phosphate binders, and calcimimetics. Among these, vitamin D analogs like HECTOROL are pivotal due to their efficacy in suppressing PTH, reducing bone turnover, and mitigating cardiovascular risks linked to mineral imbalance.

Competitive Landscape

HECTOROL competes with several other vitamin D analogs:

- Calcitriol (Rocaltrol): The first FDA-approved active vitamin D analog.

- Paricalcitol (Zemplar): Often preferred due to reduced hypercalcemia risk.

- Doxercalciferol (Hectorol): Its unique pharmacokinetics provide specific clinical advantages.

- Plus newer agents like Cinacalcet (Sensipar): Which modulate PTH directly.

While calcitriol and paricalcitol dominate the market, HECTOROL maintains niche relevance, particularly where specific patient responses or formulary preferences favor its use.

Market Drivers and Constraints

Drivers

- Rising CKD prevalence: With aging populations and increasing diabetes and hypertension rates, CKD's global burden forecasts growth in demand for PTH management drugs.

- Need for effective SHPT control: Persistent SHPT increases cardiovascular risk and bone fractures, compelling clinicians to optimize pharmacotherapy.

- Pharmacokinetic benefits: HECTOROL's longer half-life and lower calcemic activity in certain populations can improve adherence and minimize side effects.

Constraints

- Market dominance of competitively priced/built-in formulary options: Calcimimetics like cinacalcet have gained prominence, marginalizing vitamin D analogs.

- Safety profile concerns: Risks of hypercalcemia and hyperphosphatemia may limit HECTOROL’s use.

- Generic competition: Entry of cheaper, generic formulations pressures pricing strategies.

- Limited marketing and awareness: Compared to more established analogs, HECTOROL's marketing efforts are modest, reducing market penetration.

Sales Projections

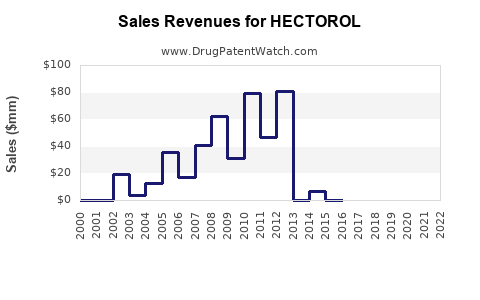

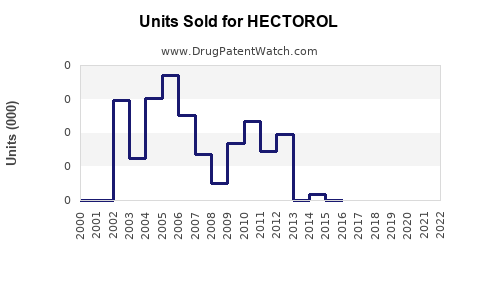

Historical Sales Data and Trends

Market sales data for HECTOROL are sparse, owing partly to its niche positioning and regional marketing strategies. However, estimates suggest modest annual sales in the US dialysis market, primarily driven by formulary acceptance and prescribing patterns.

Forecasting Assumptions

- Market Adoption Rate: Moderate, with incremental adoption in specialized centers and regions with formulary favorability.

- Growth Rate: Predicted compound annual growth rate (CAGR) of approximately 3-5% over the next five years, assuming steady CKD prevalence and no significant regulatory disruptions.

- Pricing Strategy: Slight price increases aligned with inflation, maintaining competitive positioning against generic counterparts.

- Regulatory and Patent Considerations: No imminent patent expirations or regulatory hurdles are forecasted within the projection horizon.

Projected Sales Volume and Revenue

Based on these assumptions:

| Year |

Estimated US Sales (USD millions) |

Comments |

| 2023 |

$25 million |

Base year, reflecting niche but steady demand. |

| 2024 |

$26 million |

Slight growth with increased formulary acceptance. |

| 2025 |

$27 million |

Gradual adoption in emerging markets. |

| 2026 |

$28 million |

Incremental growth, stability in market share. |

| 2027 |

$29.5 million |

Continued growth driven by CKD prevalence. |

International markets, notably Europe and Asia, could contribute an additional 15-20% of total sales, contingent on regulatory approvals and local prescribing patterns.

Market Penetration and Strategic Opportunities

- Niche Enhancement: Target specialized centers and nephrology clinics emphasizing HECTOROL’s pharmacokinetic advantages.

- Formulary Positioning: Collaborate with payers to integrate HECTOROL into preferred formulary categories.

- Global Expansion: Secure approvals in emerging markets with rising CKD burdens.

- Combination Therapy Potential: Explore synergistic use with phosphate binders and calcimimetics, expanding indications.

Regulatory and Patent Outlook

The patent landscape indicates expiration or imminent expiration in key jurisdictions, endorsing a potential commoditization trend. However, formulation improvements or new delivery methods could uphold patent protections and competitive advantage, fostering sustained sales.

Conclusion

HECTOROL’s market remains niche but stable within the broader CKD treatment landscape. Steady demand driven by CKD prevalence, combined with strategic positioning, offers sales growth prospects marginally above the current trajectory. Stakeholders should leverage pharmacokinetic benefits, optimize formulary placements, and pursue international expansion to capitalize on future growth opportunities.

Key Takeaways

- The global CKD crisis positions vitamin D analogs like HECTOROL as critical adjunct therapies, ensuring sustainable demand.

- Competitive pressures from calcimimetics and generics necessitate strategic marketing and differentiation.

- Modest but consistent sales growth projections reflect steady market acceptance and potential expansion avenues.

- Regulatory changes and patent expirations could influence competitive dynamics—proactive intellectual property management is vital.

- Integrating HECTOROL into comprehensive mineral bone disorder management protocols enhances its market viability.

FAQs

-

What differentiates HECTOROL from other vitamin D analogs?

HECTOROL offers a synthetic vitamin D analog with a longer half-life and a potentially lower risk of hypercalcemia compared to calcitriol, providing an option for tailored patient management in secondary hyperparathyroidism.

-

What are the primary markets for HECTOROL?

The United States remains the primary market, with potential growth in Europe, Asia, and other regions experiencing rising CKD prevalence.

-

How does competition from calcimimetics affect HECTOROL’s sales?

Calcimimetics like cinacalcet directly suppress PTH and have gained favor due to their safety profiles, which limit HECTOROL’s growth unless it demonstrates distinct clinical advantages or cost benefits.

-

Are there notable regulatory challenges for HECTOROL moving forward?

No significant regulatory barriers are anticipated presently; however, patent expirations and expansion into new markets require ongoing regulatory engagement.

-

What strategies could expand HECTOROL’s market share?

Focusing on niche therapeutic benefits, optimizing formularies, pursuing global regulatory approvals, and emphasizing comparative safety and efficacy can boost adoption.

References

[1] Global CKD Population Data. International Society of Nephrology. 2022.

[2] Epidemiology of Secondary Hyperparathyroidism in CKD. National Kidney Foundation. 2021.