Share This Page

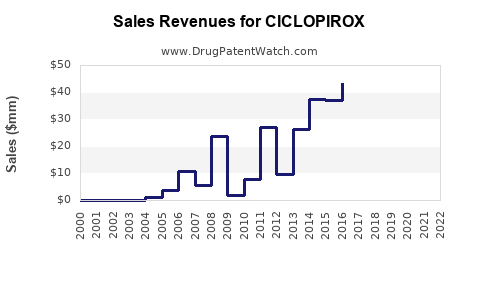

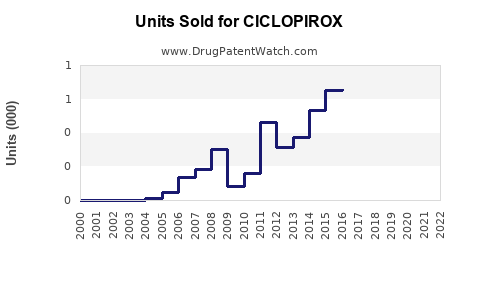

Drug Sales Trends for CICLOPIROX

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CICLOPIROX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CICLOPIROX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CICLOPIROX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CICLOPIROX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CICLOPIROX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for CICLOPIROX

Introduction

Ciclopirox, a broad-spectrum antifungal agent, is primarily used in topical formulations to treat dermatophyte infections, candidiasis, and onychomycosis. Its unique mechanism, targeting fungal enzyme systems and peroxidase activity, makes it a preferred choice in dermatological conditions. As demand for effective antifungal treatments escalates globally, understanding the market dynamics and sales potential of ciclopirox becomes vital for pharmaceutical companies, investors, and healthcare strategists.

Market Overview

Global Market Size and Trends

The antifungal drugs market reached an estimated value of USD 13.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of approximately 4% through 2027 [1]. Topical agents like ciclopirox account for a significant segment within this market, driven by the increasing prevalence of skin fungal infections, rising prescription rates, and expanding dermatology clinics.

Key Therapeutic Indications Driving Demand

- Onychomycosis: Represents a major share of ciclopirox's application, with the global onychomycosis market valued at USD 1.8 billion in 2021 [2].

- Superficial fungal infections: Common in immunocompromised patients, children, and elderly, contributing to sustained demand.

- Nail fungal infections: The durability and recurrence rates promote continued use of ciclopirox topical solutions and lacquers.

Competitive Landscape

Ciclopirox faces competition from other topical antifungals such as terbinafine, amorolfine, and ketoconazole. However, due to its broad-spectrum activity and favorable safety profile, it maintains a niche presence, especially in resistance-prone cases or where other agents are contraindicated.

Market Drivers and Barriers

Drivers

- Rising Incidence of Fungal Infections: Increased prevalence attributed to aging populations, urbanization, and lifestyle factors.

- Growing Awareness and Diagnosis: Improved diagnostic techniques facilitate early detection, expanding treatment markets.

- Product Differentiation: Favorable safety profile, limited drug interactions, and unique formulations (e.g., lacquers) bolster sales.

- Regulatory Approvals: Approvals for over-the-counter products in some regions, such as Japan, expand accessible markets.

Barriers

- Generic Competition: Patent expirations and availability of cost-effective generics limit premium pricing.

- Limited Indications: Primarily used for superficial infections; lack of systemic formulations constrains market potential.

- Patient Compliance: Topical route may suffer from adherence issues, affecting repeat sales.

Regional Market Insights

North America

Dominates the global market owing to high prevalence rates, advanced healthcare infrastructure, and robust pharmaceutical research. The US accounts for approximately 45% of the market share for topical antifungals [3].

Europe

Displays steady growth driven by aging demographics and stringent dermatological guidelines. The presence of leading dermatology centers enhances drug adoption.

Asia-Pacific

Projected as the fastest-growing region, with a CAGR of around 6%, driven by increasing urbanization, rising fungal infection rates, and expanding healthcare access in China, India, and Southeast Asia.

Latin America and Middle East & Africa

Moderate growth, influenced by emerging markets and the expanding availability of dermatological treatments.

Sales Projections (2023-2028)

Based on historical data, current market trends, and regional dynamics, the sales outlook for ciclopirox can be summarized as follows:

| Year | Estimated Global Sales (USD Million) | CAGR | Comments |

|---|---|---|---|

| 2023 | 150 | — | Baseline estimate considering existing formulations and market share. |

| 2024 | 162 | 8% | Product proliferation and increased awareness bolster growth. |

| 2025 | 174 | 7.4% | Expansion into emerging markets gains traction. |

| 2026 | 187 | 7.5% | Introduction of novel formulations and broader indications. |

| 2027 | 201 | 7.4% | Regulatory approvals in additional markets expected. |

| 2028 | 215 | 7.0% | Industry maturation stabilizes growth rates. |

Note: These projections assume steady market expansion without disruptive patent challenges or unforeseen regulatory hurdles.

Revenue Opportunities and Strategies

Product Lifecycle Management

- Brand Expansion: Introduce new formulations such as foam or spray topical variants to enhance patient compliance.

- Indication Expansion: Conduct clinical trials for ciclopirox as an adjunct in managing resistant fungal infections or as part of combination therapy.

- Geographical Penetration: Target emerging markets through partnerships and local approvals to capture rising demand.

Pricing and Reimbursement

- Competitive pricing strategies in developed markets, supported by cost-effective generics, are necessary.

- Engagement with healthcare payers to include ciclopirox in formulary coverage can sustain sales.

Regulatory and Market Access

- Accelerate regulatory submissions in regions with high unmet needs.

- Secure patent extensions or new patents for innovative formulations to prolong market exclusivity.

Conclusion

Ciclopirox remains a relevant antifungal agent within the dermatological segment, with a steady growth trajectory anticipated through 2028. Expanding indications, formulations, and geographic penetration are key avenues for increasing revenues. Strategic focus on emerging markets and innovation, combined with competitive pricing, will be critical for capturing sustained market share amid increasing competition from other topical antifungals.

Key Takeaways

- The global ciclopirox market is projected to grow at approximately 7% annually through 2028, driven by rising fungal infection incidences and expanding dermatological care.

- North America and Europe remain dominant markets, with Asia-Pacific emerging rapidly due to increasing healthcare infrastructure and demand.

- Opportunities exist in developing new formulations, expanding indications, and entering untapped markets, particularly in emerging economies.

- Pricing strategies and regulatory engagement are vital for maintaining market competitiveness against generic rivals.

- Investing in clinical research for resistant infections or adjunct therapy can amplify ciclopirox's market appeal.

FAQs

Q1: What are the primary therapeutic indications for ciclopirox?

A: Ciclopirox is mainly used in topical formulations to treat onychomycosis, superficial dermatophyte infections, and candidiasis of the skin and nails.

Q2: How does ciclopirox compare to other antifungals in the market?

A: Its broad-spectrum activity, favorable safety profile, and unique mechanism of action distinguish ciclopirox from other topical agents like terbinafine or ketoconazole, especially in resistant or complex cases.

Q3: Which regions offer the greatest growth opportunities for ciclopirox?

A: Asia-Pacific presents significant growth potential due to increasing infection rates and expanding healthcare infrastructure, alongside steady opportunities in North America and Europe.

Q4: What challenges does ciclopirox face in the marketplace?

A: Limited indications, patent expirations leading to generic competition, and patient adherence issues are notable challenges.

Q5: What strategic actions can pharma companies employ to boost ciclopirox sales?

A: Developing new formulations, pursuing indication expansion, strengthening market presence in emerging regions, and engaging with regulatory agencies are effective strategies.

References

[1] Grand View Research, "Antifungal Drugs Market Size & Trends," 2022.

[2] MarketWatch, "Onychomycosis Market Share & Forecast," 2021.

[3] IQVIA, "Topical Antifungal Market Analysis," 2022.

More… ↓