Share This Page

Drug Sales Trends for CAMBIA

✉ Email this page to a colleague

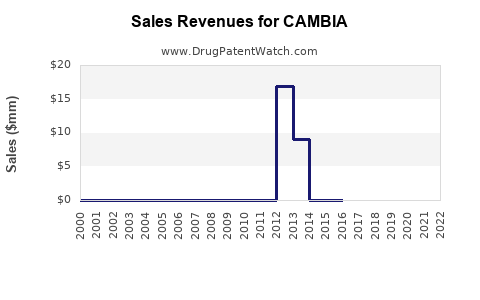

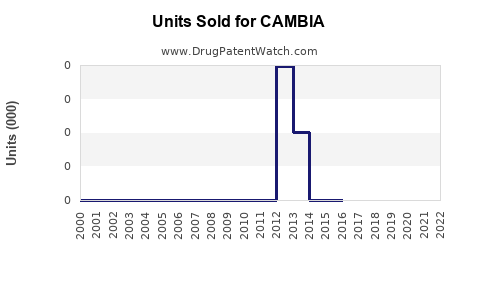

Annual Sales Revenues and Units Sold for CAMBIA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CAMBIA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CAMBIA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CAMBIA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CAMBIA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| CAMBIA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Cambia (Diclofenac Potassium)

Introduction

Cambia, a proprietary formulation of diclofenac potassium, is a nonsteroidal anti-inflammatory drug (NSAID) primarily prescribed for short-term treatment of acute pain, such as postoperative discomfort, musculoskeletal injuries, and inflammatory conditions. Its unique powder form allows for fast absorption, offering rapid relief. Analyzing its market landscape involves understanding its therapeutic positioning, competitive environment, regulatory approvals, and projected sales trajectories.

Market Overview

The global NSAID market was valued at approximately $14.3 billion in 2021 and is projected to reach $20.8 billion by 2028, expanding at a compound annual growth rate (CAGR) of around 5.4% (source: Fortune Business Insights). This growth is driven by factors including increasing prevalence of chronic pain, osteoarthritis, rheumatoid arthritis, and unmet needs in acute pain management.

Within this landscape, Cambia occupies a niche segment: prescription NSAID formulations for acute pain relief. The drug's rapid onset of action and targeted use cases contribute to its therapeutic differentiation. Its key competitors include traditional oral NSAIDs like ibuprofen and naproxen, as well as other prescription agents such as Voltaren (diclofenac gel), and newer formulations like AMR-101 (icosapent ethyl).

Regulatory Status and Market Penetration

Cambia has received FDA approval for acute pain indications, with a label emphasizing its utility in post-surgical and injury-related pain. The drug’s over-the-counter (OTC) counterparts, such as diclofenac gels, serve broader but less targeted markets. The prescription-only status enhances Cambia’s clinical positioning but limits population-wide reach, confining sales largely to healthcare settings.

In the U.S., Cambia faces regulatory competition from other NSAID formulations and emerging analgesic modalities, including opioids and non-opioid alternatives, with ongoing scrutiny over NSAID-associated safety profiles, particularly gastrointestinal and cardiovascular risks.

Market Dynamics Influencing Sales

1. Epidemiology of Acute Pain and NSAID Prescriptions

Rising incidences of acute injuries, surgical procedures, and inflammatory conditions fuel demand. According to CDC data, approximately 78 million surgeries occur annually in the U.S., generating substantial analgesic needs. Post-operatively, NSAIDs like Cambia are favored for their opioid-sparing effect.

2. Prescriber and Patient Preferences

Physician prescribing patterns favor rapid-onset, well-tolerated options for short-term pain management. Cambia’s formulation directly targets this niche. Patient willingness to adopt prescription NSAIDs over OTC alternatives depends on perceived efficacy, safety profile, and cost.

3. Regulatory and Safety Considerations

Growing awareness of NSAID risks influences prescribing trends. Safety concerns may limit Cambia’s market penetration but also open opportunities for targeted marketing emphasizing appropriate use and safety profiles.

4. Competitive Pricing and Reimbursement Policies

Pricing strategies significantly impact sales. Cambia’s premium positioning as a specialized formulation requires favorable reimbursement coverage from insurers and pharmacy benefit managers (PBMs) to sustain market share.

5. Market Penetration and Geographic Expansion

In the U.S., Cambia’s primary market is hospitals, outpatient clinics, and pain management centers. Expansion into international markets depends on regulatory approvals, local prescribing trends, and competitive landscapes.

Sales Projections

Historical Performance

As of 2022, Cambia’s sales are modest relative to the broader NSAID market, with estimates around $100–150 million annually in the U.S. The drug’s niche positioning limits rapid growth but provides stable revenue streams. Sales have benefited from the increased focus on opioid reduction strategies and enhanced pain management protocols.

Forecasted Growth

Considering the market drivers, sales are projected to grow at a CAGR of approximately 4–6% over the next five years, reaching roughly $180–220 million by 2028. This conservative estimate accounts for increased prescribing in acute pain settings, ongoing safety considerations, and moderate international expansion.

Key factors influencing sales growth include:

- Increased surgical volume: An aging population undergoing more procedures sustains demand.

- Enhanced awareness of NSAID safety: Optimized use protocols may expand eligible patient populations.

- Product lifecycle and competition: The introduction of new formulations or combination therapies could impact Cambia’s market share.

- Regulatory environment: Reimbursement policies and safety regulations could either accelerate or hinder sales.

Market Opportunities

- Expansion into international markets: Regulatory approvals in Europe, Asia, and Latin America represent significant potential, albeit with regional competition and pricing challenges.

- Combination products: Developing combination therapies (e.g., NSAID plus gastroprotective agents) could broaden indications.

- Hospital and Postoperative Settings: Strengthening partnerships with healthcare providers post-surgery could drive incremental sales.

- Differentiated Marketing: Emphasizing Cambia’s rapid absorption and fast relief benefits can attract prescribers seeking effective acute pain solutions.

Risks and Challenges

- Safety concerns: Adverse effects associated with NSAIDs, including cardiovascular and gastrointestinal events, may restrict prescribing.

- Competitive pressures: Generic diclofenac formulations, OTC variants, and alternative pain therapies threaten Cambia's premium segment.

- Pricing and reimbursement pressures: Cost containment strategies could impair margins and sales growth.

- Market saturation: Limited scope in chronic pain markets constrains long-term growth prospects.

Key Takeaways

- Cambia occupies a specialized niche within the NSAID market, emphasizing rapid pain relief for acute conditions.

- The global NSAID market remains robust, with consistent growth driven by rising surgical rates and pain prevalence.

- Sales are expected to grow modestly at a CAGR of 4–6% through 2028, reaching approximately $180–220 million in the U.S.

- Expansion opportunities include international markets, combination formulations, and increasing utilization in postoperative care.

- Challenges include safety concerns, intense competition, and regulatory hurdles, necessitating strategic positioning and targeted marketing.

FAQs

1. What are the primary indications for Cambia?

Cambia is indicated for the short-term management of acute pain, including postoperative pain, musculoskeletal injuries, and inflammatory conditions.

2. How does Cambia differentiate itself from other NSAIDs?

Its fast absorption and onset of action provide rapid pain relief, making it preferable in acute care settings.

3. What are the main competitors to Cambia?

Traditional NSAIDs (ibuprofen, naproxen), other diclofenac formulations (gels, patches), and newer analgesics like opioids or non-opioid alternatives.

4. What market factors could impede Cambia’s sales growth?

Safety concerns regarding NSAID adverse effects, regulatory constraints, generic competition, and pricing pressures.

5. What are the prospects for Cambia's international expansion?

Opportunities are promising but contingent on obtaining regulatory approvals and navigating regional competition and reimbursement landscapes.

Sources

- Fortune Business Insights. NSAID Market Size, Share & Industry Analysis. 2022.

- Centers for Disease Control and Prevention (CDC). Pain and Surgical Data. 2021.

- FDA Approvals and Labeling for Cambia. U.S. Food and Drug Administration. 2021.

- MarketWatch. NSAID Market Forecast and Trends. 2022.

- Industry Reports on Analgesic Market Dynamics. 2022.

More… ↓