Last updated: August 3, 2025

Introduction

ACCUPRIL (perindopril) is a well-established angiotensin-converting enzyme (ACE) inhibitor used primarily for managing hypertension and heart failure. Since its launch, ACCUPRIL has benefited from a strong clinical profile and proven efficacy. This analysis evaluates the current market landscape, competitive dynamics, and future sales trajectories for ACCUPRIL, factoring in pharmaceutical trends, patent status, regulatory considerations, and evolving treatment guidelines.

Market Overview

Global Prevalence of Hypertension and Heart Failure

Hypertension affects approximately 1.28 billion adults worldwide, serving as a key driver for ACE inhibitor prescriptions [1]. The global heart failure population exceeds 60 million, with ACE inhibitors being foundational in management protocols [2]. As the prevalence of these chronic conditions continues to climb—particularly in aging populations—the demand for effective antihypertensives like ACCUPRIL remains significant.

Market Size and Growth Drivers

The global antihypertensive drug market was valued at around USD 27 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 4-6% through 2030 [3]. Key growth factors include increasing awareness, expanding healthcare coverage, and rising screening programs. Additionally, the shift toward personalized medicine and combination therapies enhances the role of ACE inhibitors.

Competitive Landscape

ACCUPRIL competes with a broad array of ACE inhibitors (e.g., lisinopril, ramipril), angiotensin receptor blockers (ARBs), and novel antihypertensive agents. Its longstanding market presence and proven efficacy contribute to a solid competitive position. However, patent exclusivity, generic entry, and formulary dynamics significantly influence market share.

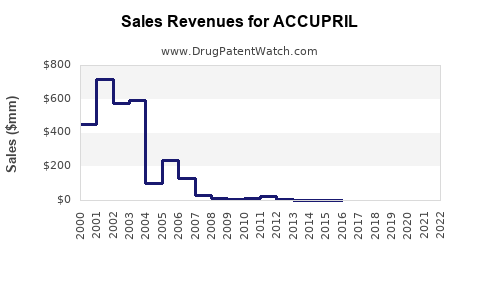

Regulatory and Patent Status

ACCUPRIL was first approved in the late 1980s. Patent protections have since expired, leading to the proliferation of generic formulations, which typically erode branded sales. Despite this, some formulations or specific indications may retain exclusivity or branding advantages in certain markets.

In emerging markets, brand loyalty, physician preferences, and healthcare policies favor brand extensions or targeted marketing, potentially preserving a premium segment for ACCUPRIL.

Market Dynamics Influencing Sales

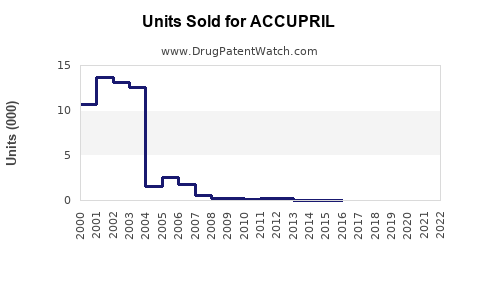

Generic Competition

The advent of generics has drastically reduced prices and margins for ACCUPRIL, limiting revenue growth but expanding overall market volume. As generics dominate, branded sales are largely driven by brand recognition and healthcare provider loyalty.

Prescribing Trends and Treatment Guidelines

Updated clinical guidelines emphasize combination therapy and individualized treatment plans. ACE inhibitors like ACCUPRIL remain first-line options for many patients, particularly those intolerant to ARBs.

Patient Compliance and Safety Profile

Perindopril's favorable safety profile, including low incidence of hyperkalemia and cough, supports sustained use. However, side effects and contraindications may influence prescribing patterns.

Sales Projections (2023–2030)

Baseline Scenario

Considering brand-to-generic erosion, a conservative CAGR of 1-2% is plausible within mature markets, with regional variations.

-

2023: Estimated global sales around USD 400 million, primarily driven by Europe and Asia.

-

2025: Projected sales approximately USD 410–420 million.

-

2030: Anticipated total global sales near USD 430–440 million, with incremental growth mainly from emerging markets and stable brand presence.

Growth Opportunities

-

Emerging Markets: Rapid urbanization and increasing hypertension prevalence in regions like India, Southeast Asia, and Latin America may foster higher growth rates (CAGR 3-5%), buoyed by increased healthcare investments and improving access.

-

Specialized Indications: Expansion into indications like diabetic nephropathy and resistant hypertension could generate incremental revenues if supported by clinical evidence and regulatory approvals.

-

Combination Therapies: Development of fixed-dose combinations incorporating perindopril could capture additional prescribing volume.

Risks and Challenges

- Market Saturation: Saturation in mature markets constrains growth.

- Pricing Pressures: Payor negotiations and healthcare reforms could further reduce pricing of branded products.

- Regulatory Changes: New guidelines favoring ARBs or novel agents could diminish ACE inhibitor utilization.

- Patent and Exclusivity: Loss of patent protection accelerates generic competition.

Strategic Recommendations

- Innovation: Focus on formulation enhancements (e.g., sustained-release) and new delivery systems.

- Market Expansion: Prioritize emerging markets with high growth potential.

- Brand Differentiation: Emphasize clinical evidence, safety profiles, and patient adherence benefits.

- Partnerships: Collaborate with healthcare systems to reinforce ACCUPRIL’s positioning.

Key Takeaways

-

ACCUPRIL remains a key player in the antihypertensive market, with steady but moderate sales growth driven by global disease prevalence.

-

The entry of generics has compressed profit margins but expanded market volume; thus, future sales depend on geographic expansion and therapeutic positioning.

-

Emerging markets present significant growth opportunities, leveraging increasing healthcare access and disease burden.

-

Ongoing financial success hinges on maintaining clinical relevance amidst evolving guidelines favoring ARBs and other novel therapies.

-

Innovation, strategic marketing, and market diversification are essential to sustain ACCUPRIL’s market footprint over the next decade.

FAQs

1. How has patent expiration affected ACCUPRIL sales?

Patent expiration facilitated widespread generic competition, reducing prices and brand dominance but simultaneously expanding overall market volume. While branded sales declined, total market sales increased in volume terms, especially in regions where generics are priced competitively.

2. What are the primary regions influencing ACCUPRIL’s future growth?

Emerging markets, notably India, Southeast Asia, and Latin America, offer substantial growth potential due to increasing hypertension prevalence and expanding healthcare infrastructure.

3. How do clinical guidelines impact ACCUPRIL’s market share?

Guidelines favoring ARBs or newer antihypertensive agents can reduce ACE inhibitor prescription rates. However, ACCUPRIL’s established safety and efficacy profile sustain its usage, especially in patients intolerant to other drug classes.

4. Are there upcoming developments or formulations that could influence sales?

Yes, fixed-dose combinations, sustained-release formulations, and new delivery systems could enhance patient adherence and expand indications, positively impacting sales.

5. What risks could jeopardize ACCUPRIL’s market position?

Major risks include intensified generic competition, evolving treatment guidelines favoring alternatives, regulatory constraints, and price-based healthcare reforms reducing profitability.

References

[1] World Health Organization. Hypertension fact sheet. 2022.

[2] Ponikowski P, et al. 2021 ESC Guidelines for the diagnosis and treatment of acute and chronic heart failure. European Heart Journal. 2021.

[3] Grand View Research. Antihypertensive Drugs Market Analysis. 2022.