Last updated: July 27, 2025

Introduction

Sucralfate, a crystalline aluminum hydroxide complex, is a longstanding gastrointestinal (GI) therapeutic used primarily to treat and prevent duodenal ulcers. Approved in the early 1980s, sucralfate has established its position globally as an effective, albeit niche, medication in the gastroenterology sector. The aging population, rising prevalence of GI disorders, and evolving treatment paradigms influence its market dynamics. This report delivers a comprehensive analysis of sucralfate’s market landscape, competitive positioning, growth drivers, challenges, and future sales projections.

Market Overview

Therapeutic Landscape

Sucralfate functions as a cytoprotective agent by forming a protective barrier over ulcerated mucosa, facilitating healing. Its indications extend to managing gastric ulcers, stress ulcers, and maintenance therapy in inflammatory bowel disease. Despite being off-patent, sucralfate remains a prescribed option, especially in regions prioritizing cost-effectiveness and safety profiles.

Global Market Size

The global GI therapeutics market was valued at approximately USD 19 billion in 2022, with the anti-ulcer segment occupying a significant share. Although proton pump inhibitors (PPIs) dominate, sucralfate retains relevance in specific niches, particularly in regions with limited access to newer medications or those contraindicated for PPI use.

Regional Variations

- North America: Mature market with stable demand, driven by the high prevalence of GERD, peptic ulcer disease, and increased healthcare expenditure.

- Europe: Similar to North America, with a focus on generic formulations and prescription-based utilization.

- Asia-Pacific: Growing markets owing to high GI disorder prevalence and increasing healthcare access, with notable use of sucralfate as a cost-effective therapy.

- Emerging Markets: Strong demand driven by limited healthcare budgets and reliance on older, established drugs.

Competitive Landscape

Sucralfate’s manufacturing is dominated by generic pharmaceutical companies, with several key players providing formulations globally:

- Bayer AG (formerly responsible for original formulations)

- Zhejiang Hisun Pharmaceutical Co. Ltd.

- Glenmark Pharmaceuticals

- Rottapharm

- Sun Pharmaceutical Industries

Developments in formulations include tablets, suspensions, and topical gels, catering to diverse consumer needs. The drug’s off-patent status results in intense price competition, which constrains revenue growth but enhances accessibility.

Market Drivers

Rising Incidence of GI Disorders

Increasing prevalence of peptic ulcers, NSAID-induced ulcers, and stress-related mucosal disease sustains clear demand for protective agents like sucralfate.

Preference for Safety

Sucralfate’s safety profile favors use among vulnerable populations such as the elderly and pregnant women, especially where PPI use is contraindicated or poses risks.

Cost-Effectiveness

In developing regions, sucralfate remains a staple due to its affordability relative to newer drugs like PPIs and biologics.

Regulatory Approvals and Guidelines

Some clinical guidelines endorsed sucralfate as adjunct therapy or alternative, especially in cases of PPI intolerance or resistance, thereby supporting sales continuity.

Market Challenges

Competition from PPIs

Proton pump inhibitors such as omeprazole, lansoprazole, and esomeprazole dominate the GI market, offering superior efficacy and convenience. This reduces sucralfate’s market share.

Limited Innovation

Lack of formulations tailored to current patient preferences (e.g., once-daily dosing) diminishes appeal, especially among younger populations.

Off-Label and Underutilization

In some markets, prescribing patterns favor newer agents owing to perceived superior outcomes, leading to underutilization of sucralfate.

Patent and Regulatory Environment

While off-patent, regulatory hurdles and generic proliferation affect pricing strategies and profitability.

Future Sales Projections

Short-term Outlook (2023–2025)

The global sucralfate market is expected to experience modest growth of approximately 2-4% annually. Factors contributing include:

- Continued demand in low-resource settings.

- Stable prescription rates for duodenal ulcer treatment.

- Increased use in combination therapies for complex GI conditions.

Long-term Outlook (2026–2030)

Growth may plateau or marginally decline as newer therapies gain acceptance. However, several factors could sustain or improve sales:

- Market penetration in emerging economies: Expanding access and awareness.

- Application in specialized treatments: Adjunct therapy in complex ulcers or gastrointestinal mucosal protection.

- New formulations or delivery methods: Once-daily tablets or sustained-release formulations could improve patient compliance and expand market share.

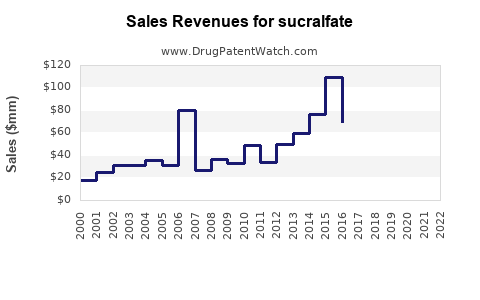

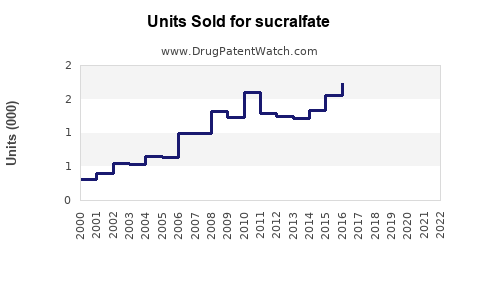

Quantitative Sales Projection

Assuming current annual global sales approximate USD 200 million (including generics), a conservative CAGR of 2.5% suggests sales could reach approximately USD 230 million by 2030. This projection accounts for market saturation in developed regions and growth opportunities in emerging markets.

Strategic Opportunities

- Product Differentiation: Developing formulations with improved dosing schedules.

- Regional Expansion: Targeted marketing in underserved markets.

- Combination Therapies: Developing fixed-dose combinations to enhance efficacy and compliance.

- Educational Campaigns: Raising awareness among healthcare providers about sucralfate’s niche benefits.

Conclusion

Sucralfate remains a relevant, cost-effective agent within the GI therapeutic landscape. While challenged by newer drugs, its safety profile, affordability, and specific indications support steady demand, especially in developing regions. Strategic initiatives focusing on formulation innovation, regional expansion, and clinical education can sustain and potentially elevate sales. Nonetheless, the overall market is expected to grow modestly, constrained by competition and limited innovation.

Key Takeaways

- Steady Demand in Niche Markets: Sucralfate maintains consistent use where cost and safety are prioritized.

- Growth Predominantly in Emerging Markets: Untapped regions present growth avenues, bolstered by expanding healthcare access.

- Innovation Constraints Limit Upside: Lack of new formulations restricts market expansion in mature regions.

- Competitive Pressure from PPIs: Dominant positioning of PPIs necessitates strategic differentiation to sustain sales.

- Potential for Growth through Regional and Formulation Strategies: Focusing on emerging markets and innovative delivery methods can offset competition and drive revenue.

FAQs

1. What are the primary clinical indications for sucralfate?

Sucralfate is indicated for the treatment and prevention of duodenal ulcers, stress ulcers, gastric ulcers, and as an adjunct in managing inflammatory bowel disease.

2. How does sucralfate compare to proton pump inhibitors in efficacy?

While effective in ulcer healing, sucralfate generally exhibits a slower onset of action and lower healing rates compared to PPIs. However, it offers a superior safety profile, especially for patients intolerant to PPIs.

3. Are there ongoing developments to improve sucralfate formulations?

Currently, innovation is limited. Some companies are exploring sustained-release formulations or combining sucralfate with other agents to enhance compliance and efficacy.

4. What are the key regions driving future sucralfate sales?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa and the Middle East offer significant growth opportunities due to increasing GI disorder prevalence and healthcare infrastructure development.

5. What is the outlook for sucralfate in the next decade?

Expect modest growth maintained by demand in developing regions and niche indications, with the potential for increased use if new formulations or combination therapies are introduced.

References

[1] Market research reports on global GI therapeutics.

[2] Clinical guidelines for gastroenterology.

[3] Industry analyses of generic pharmaceutical markets.

[4] Regional healthcare access and prevalence studies.

[5] Patent and regulatory frameworks impacting drug formulations.