Share This Page

Drug Sales Trends for ondansetron

✉ Email this page to a colleague

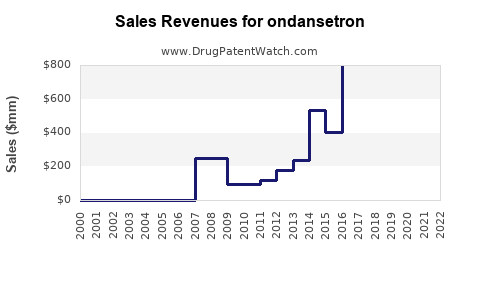

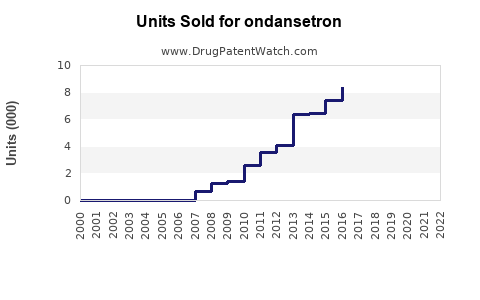

Annual Sales Revenues and Units Sold for ondansetron

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ONDANSETRON | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ONDANSETRON | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ONDANSETRON | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ONDANSETRON | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ONDANSETRON | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ONDANSETRON | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| ONDANSETRON | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Ondansetron

Introduction

Ondansetron, a selective 5-HT3 receptor antagonist, is widely utilized to prevent nausea and vomiting associated with chemotherapy, radiotherapy, and postoperative procedures. Since its launch in the early 1990s, ondansetron has cemented itself as a cornerstone in antiemetic treatment protocols, prompting sustained demand globally. This analysis evaluates current market dynamics, competitive landscape, regulatory influences, and projects sales trajectories through the next five years, providing vital insights for stakeholders navigating the antiemetic market.

Market Overview

Historical Market Performance

Since the FDA approval in 1991, ondansetron’s sales have steadily increased, driven by expanding indications and rising cancer prevalence. The drug’s proven efficacy, relatively mild side effect profile, and inclusion in clinical guidelines contribute to consistent demand. According to IQVIA, the global antiemetic market reached approximately $1.8 billion in 2022, with ondansetron accounting for a significant share owing to its first-mover advantage and widespread use.

Market Drivers

-

Cancer Incidence Growth: Rising global cancer cases, projected to reach 28.4 million new cases annually by 2040, sustain demand for antiemetics [1].

-

Advancements in Oncology Treatments: Increased adoption of aggressive chemotherapy regimens necessitates effective antiemetics, bolstering ondansetron’s role.

-

Regulatory Approvals & Expanding Indications: Approved for nausea post-surgery and radiotherapy, broadening market scope.

-

Generic Entry and Price Competition: Patent expirations in key markets have led to a proliferation of generics, expanding access but compressing margins.

Market Challenges

-

Emerging Safety Concerns: Rare but serious adverse effects, such as QT prolongation, prompt regulatory scrutiny and impact prescribing practices.

-

Competition from Alternative Agents: Serotonin receptor antagonists like granisetron and palonosetron, and NK1 antagonists such as aprepitant, vie for market share, especially in combination therapies.

-

Regulatory Restrictions: Certain regulatory bodies have issued warnings or restricted use in specific populations, affecting sales.

Competitive Landscape

Major Players

-

Pfizer: Original patent holder, with the brand-name drug Zofran. Despite patent expirations, Pfizer maintains significant market share through global distribution.

-

Teva Pharmaceuticals & Sandoz: Leading generic manufacturers offering cost-effective formulations.

-

Mylan (now part of Viatris): Key provider of generic ondansetron, facilitating broader access globally.

Product Segmentation

-

Brand vs. Generic: Generics dominate volume, with price competitiveness fueling increased prescribing.

-

Formulation Variants: Intravenous (IV) and oral tablets are standard; newer formulations like dissolvable tablets augment convenience and compliance.

Market Concentration

The market exhibits moderate concentration, with Pfizer historically leading, but generics capturing substantial share in mature markets. Emerging markets, characterized by lower penetration, present growth opportunities.

Regulatory and Patent Landscape

-

Patent Expiry: The primary patent on Zofran expired globally between 2006-2015, leading to widespread generic manufacturing.

-

Regulatory Focus: Agencies like the FDA and EMA emphasize safety profile updates, impacting formulary decisions.

-

Orphan & Pediatric Indications: Limited, although ongoing studies may expand use cases.

Sales Projections (2023–2028)

Methodology

Projections integrate historical sales data, epidemiological trends, regulatory impacts, and competitive dynamics. CAGR estimates are derived from company reports, industry analyses, and healthcare utilization trends.

Global Market Forecast

-

2023 Revenue: Estimated at $1.6 billion, driven by existing demand and growth in emerging markets.

-

Growth Trajectory: Projected CAGR of 3.5% from 2023 to 2028, reaching approximately $2 billion by 2028.

-

Regional Insights:

- North America: Predominant market, expected to sustain ~45% share. Intense generic competition and rigorous safety monitoring temper growth.

- Europe: Stable growth (~3%), with increased adoption due to oncology treatment expansion.

- Asia-Pacific: Fastest growth (~5.5%), propelled by rising cancer burden, improving healthcare infrastructure, and expanding insurance coverage.

Key Influencing Factors

-

Emerging Markets: Rapid population growth and increasing healthcare access will stimulate demand, offsetting some pricing pressures.

-

Combination Therapy Trends: Growing preference for multi-agent regimens with NK1 inhibitors provisionally limits ondansetron monotherapy growth but sustains demand in combination settings.

-

Innovation & New Formulations: The development of sustained-release or injectable formulations can catalyze incremental sales.

Market Risks & Opportunities

-

Risks: Safety concerns and regulatory restrictions complicate future sales; pricing pressures due to generics persist.

-

Opportunities: Expanding indications, innovative formulations, and integrated antiemetic protocols can foster growth.

Key Takeaways

-

The ondansetron market remains fundamentally robust, driven by rising cancer prevalence and broader clinical use.

-

Patent expirations and the proliferation of generics have facilitated volume growth while compressing margins.

-

Strategic focus on emerging markets, formulation innovation, and safety profile management will be vital to sustain sales momentum.

-

Competition from alternative agents and regulatory environments necessitate adaptive market strategies.

-

Sales are projected to grow at a modest CAGR of 3.5% over the next five years, reaching approximately $2 billion globally by 2028.

FAQs

1. How has the patent expiration affected ondansetron sales?

Patent expiration led to widespread generic manufacturing, significantly reducing prices and increasing accessibility. While this expanded total market volume, it squeezed profit margins for original innovators like Pfizer. Overall, sales remained stable due to increased usage, but revenue per unit declined.

2. What are the main competitors to ondansetron?

Key competitors include other serotonin receptor antagonists such as granisetron and palonosetron, and NK1 receptor antagonists like aprepitant. The choice often depends on efficacy, safety profile, and cost considerations, especially in combination regimens.

3. Are there emerging formulations of ondansetron?

Yes. New formulations include dissolvable tablets, sustained-release oral formulations, and IV versions, aimed at improving patient compliance and rapid symptom control.

4. How do regulatory concerns impact current sales projections?

Regulatory agencies have highlighted rare cardiac risks associated with ondansetron, leading to cautious prescribing in some populations and potential restrictions that can marginally dampen growth prospects.

5. What future market opportunities exist for ondansetron?

Expanding indications, such as nausea associated with conditions beyond oncology, and integration into combination antiemetic protocols, especially in expanding healthcare markets, represent growth avenues.

References

[1] World Health Organization. (2021). Global Cancer Statistics.

[2] IQVIA. (2022). Global Anti-Emetic Market Report.

[3] FDA. (2020). Safety Updates on Ondansetron.

[4] IMS Health. (2021). Market Shares and Competitive Landscape.

[5] Grand View Research. (2022). Anti-Emetic Drugs Market Size and Forecast.

More… ↓