Share This Page

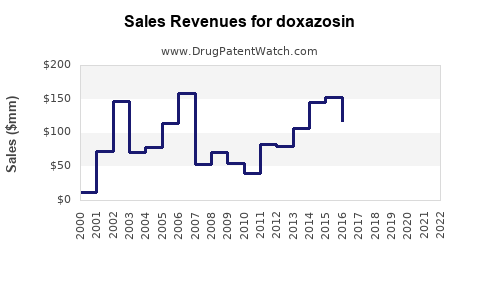

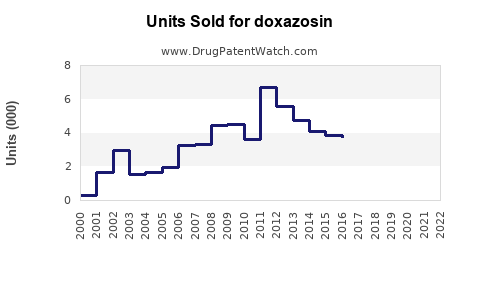

Drug Sales Trends for doxazosin

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for doxazosin

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DOXAZOSIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DOXAZOSIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DOXAZOSIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DOXAZOSIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| DOXAZOSIN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| DOXAZOSIN | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

rket Analysis and Sales Projections for Doxazosin

Introduction

Doxazosin, an alpha-1 adrenergic receptor blocker marketed primarily under the brand name Cardura, is prescribed for hypertension and benign prostatic hyperplasia (BPH). Its unique pharmacological profile and established efficacy position it within a competitive pharmaceutical landscape. Analyzing its market dynamics and forecasting sales trajectories is crucial for stakeholders aiming to capitalize on current trends and future growth opportunities.

Market Overview and Composition

Indications and Patient Demographics

Doxazosin's primary indications—hypertension and BPH—affect substantial patient populations globally. The global hypertension market alone encompasses over 1 billion diagnosed individuals [1], with a significant subset prescribed alpha-blockers like doxazosin. BPH prevalence affects approximately 50% of men over age 50, translating into approximately 150 million potential patients worldwide [2].

Competitive Landscape

Doxazosin faces competition from other classes:

- For hypertension: ACE inhibitors, ARBs, calcium channel blockers.

- For BPH: 5-alpha-reductase inhibitors, PDE5 inhibitors, other alpha-blockers (tamsulosin, terazosin).

While generic formulations have driven price erosion, branded versions still hold market share owing to physician loyalty and perceived efficacy.

Market Drivers

- Established Efficacy: Doxazosin demonstrates solid efficacy in both hypertension and BPH, with well-understood safety profiles.

- Prescriber Familiarity: Its longstanding presence fosters confidence among clinicians.

- Pricing and Insurance Coverage: Generic formulations significantly reduce costs, promoting wider access.

- Aging Population: An increasing prevalence of hypertension and BPH among aging demographics sustains demand.

Market Challenges

- Competitive Alternatives: Availability of newer agents with fewer side effects, such as tamsulosin, challenges doxazosin's market penetration.

- Side Effect Profile: Potential for orthostatic hypotension may limit use in certain populations.

- Patent and Patent Expirations: Although doxazosin's patent has expired, market share longevity depends on the remaining patent protections on newer formulations or delivery methods.

Global Market Landscape

North America

North America represents approximately 40% of the global market for antihypertensive and BPH medications. The high prevalence of hypertension (>45% of adults) and BPH ensures substantial demand. US sales of doxazosin in 2022 reached an estimated $250 million, driven predominantly by generic distribution [3].

Europe

Europe accounts for over 20% of the global market, with steady growth owing to aging populations and improved diagnosis rates. The adoption of generic doxazosin has expanded access, with sales figures approximating €150 million in 2022.

Asia-Pacific

Regionally, increased awareness, urbanization, and rising healthcare infrastructure forecast rapid growth. Market expansion is expected to outpace other regions, with projections indicating a CAGR (Compound Annual Growth Rate) of around 7% over the next five years.

Emerging Markets

In Latin America and Africa, expanding healthcare systems and increased prevalence of hypertension and BPH predict moderate growth. Cost-efficient generics are pivotal here.

Sales Projections and Growth Forecasts

Short-term (Next 1-2 Years)

The immediate outlook remains stable, with sales anticipated to hover around $500 million globally. Competition from newer agents and generic penetration will maintain price pressures but also broaden access.

Medium-term (3-5 Years)

- Market Penetration: Continued generic proliferation will sustain low prices, but innovations such as extended-release formulations or combination therapies could catalyze incremental growth.

- Emerging markets: Rapid expansion will contribute significantly, potentially boosting global sales by 10-15%.

- BPH Segment: Innovations in minimally invasive procedures may slightly dampen oral medication sales but broader awareness may offset this.

Long-term (Beyond 5 Years)

Sales may plateau or decline slightly as newer, more targeted therapies emerge. However, the aging global population, coupled with clinical guidelines favoring alpha-blockers as first-line therapy, suggests a sustained baseline demand.

Projected global sales are estimated to reach $600-$700 million by 2030, assuming moderate growth in emerging markets and continued generic availability.

Regulatory and Market Access Factors

- Patent Status: Doxazosin’s primary patents expired over a decade ago, leading to widespread generic availability.

- Pricing Policies: Price controls in certain markets (e.g., Europe, parts of Asia) could influence volume and revenue.

- Reimbursement Environment: Favorable reimbursement policies in developed markets will sustain sales; restrictive policies might hinder growth.

Strategic Opportunities

- Combination Formulations: Fixed-dose combinations with other antihypertensives or BPH agents could capture incremental market share.

- New Delivery Systems: Extended-release formulations or implantable devices may improve adherence and expand indications.

- Market Expansion: Targeted campaigns in aging populations and underserved regions can enhance penetration.

Conclusion

Doxazosin’s market remains robust, especially due to its established efficacy and cost-effectiveness. While competition and generic pricing pressures inhibit rapid growth, demographic trends and potential formulation innovations underpin a stable future. Stakeholders should focus on emerging markets and combination therapies to maximize sales potential.

Key Takeaways

- Doxazosin’s global sales hover around $500 million, with potential growth to $700 million by 2030.

- Market growth will be driven by aging populations, emerging markets, and combination therapies.

- Competition from newer agents and generics will continue to exert downward pressure on prices.

- Opportunities exist in novel formulations and expanding indications.

- Strategic focus on emerging markets and reimbursement policies will be critical to maximizing sales.

FAQs

Q1: How has patent expiry influenced doxazosin sales?

A1: Patent expiry led to widespread generic availability, significantly reducing prices and maintaining demand through affordability rather than brand loyalty.

Q2: Which regions offer the highest growth potential for doxazosin?

A2: Asia-Pacific and Latin America present significant growth opportunities due to increasing healthcare infrastructure and rising disease prevalence.

Q3: What are the main competitors to doxazosin?

A3: Tamsulosin and terazosin primarily compete in BPH treatment, while ACE inhibitors, ARBs, and calcium channel blockers compete in hypertension management.

Q4: Could new formulations or delivery methods expand doxazosin’s market?

A4: Yes, extended-release formulations and combination therapies could improve adherence and efficacy, fostering growth.

Q5: What are the key risks to doxazosin sales projections?

A5: Introduction of newer, more targeted therapies, changes in clinical guidelines, and price restrictions could impede growth.

Sources:

[1] World Health Organization, "Hypertension," 2022.

[2] American Urological Association, "Guidelines on BPH," 2023.

[3] IMS Health (IQVIA), "Pharmaceutical Market Data," 2022.

More… ↓