Share This Page

Drug Sales Trends for clobetasol

✉ Email this page to a colleague

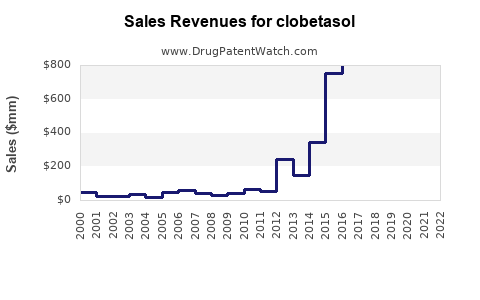

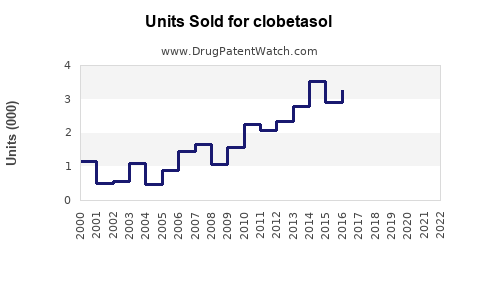

Annual Sales Revenues and Units Sold for clobetasol

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CLOBETASOL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CLOBETASOL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CLOBETASOL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CLOBETASOL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| CLOBETASOL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| CLOBETASOL | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Clobetasol

Executive Summary

Clobetasol propionate is a high-potency topical corticosteroid widely prescribed for treating inflammatory and pruritic conditions such as psoriasis, eczema, and dermatitis. Its strong anti-inflammatory properties position it as a preferred choice in dermatology. The global market for clobetasol is driven by increasing prevalence of skin disorders, expanding dermatological healthcare infrastructure, and rising awareness of treatment options. Despite patent expirations in certain regions, the drug continues to maintain robust sales through authorized generics and off-label uses. This report provides comprehensive market insights and sales projections, guiding stakeholders on potential growth avenues and competitive positioning.

Market Overview

Market Size and Growth Trends

The global corticosteroids market, encompassing both topical and systemic therapies, was valued at approximately USD 4.3 billion in 2022 and is projected to reach USD 6.7 billion by 2030, CAGR of around 6%. Clobetasol, being a high-potency topical corticosteroid, represents a significant segment within this landscape. Its market size is estimated at USD 600 million in 2022, with forecasts indicating a CAGR of 4-5% over the next five years.

Key Drivers

- Rising Incidence of Dermatological Conditions: Psoriasis affects over 125 million globally, with increasing prevalence in developed and developing countries. Eczema and dermatitis similarly contribute to sustained demand.

- Aging Population: Older adults are more prone to chronic skin conditions, enhancing demand for potent treatments like clobetasol.

- Expansion of Healthcare Infrastructure: Improved access to dermatology clinics and pharmacies in emerging markets broadens commercialization.

- Product Innovation: Development of combination therapies and novel formulations enhances therapeutic adherence.

Regulatory Environment

Clobetasol’s patent expiration in several jurisdictions (e.g., the US in 2012) has led to increased availability of generic versions, intensifying market competition. However, brand-name products maintain market share due to brand recognition and formulation advantages.

Market Segmentation

By Application

- Psoriasis: Largest application segment, accounting for approximately 45% of sales.

- Eczema and Dermatitis: 35% share.

- Other Conditions: 20%, including scalp seborrheic dermatitis, lichen planus, and others.

By Distribution Channel

- Hospitals and Clinics: 50%

- Pharmacies and Drugstores: 40%

- Online Pharmacies: 10%

Regional Breakdown

| Region | Share of Market (2022) | Growth Potential | Key Markets |

|---|---|---|---|

| North America | 35% | Moderate | US, Canada |

| Europe | 25% | Moderate | Germany, UK, France |

| Asia-Pacific | 20% | High | China, India, Japan |

| Latin America | 10% | Moderate | Brazil, Mexico |

| Middle East & Africa | 10% | Emerging | Saudi Arabia, South Africa |

Competitive Landscape

The market hosts a mix of branded therapies, off-patent generics, and emerging biosimilars. Major pharmaceutical companies include:

- Pfizer: Marketed as Temovate or Clobex.

- Bayer: Clobetasol formulations and combination products.

- Sun Pharmaceutical, Sandoz: Key generics players in the US and India.

Emerging players focus on novel topical delivery systems, such as liposomal and foam formulations, to enhance patient compliance.

Sales Projections

Short-term Outlook (2023–2025)

Sales revenues are projected to grow at a CAGR of approximately 4.5%. Key factors include expanding markets in Asia-Pacific and Latin America, and increased prescribing trends in developed regions. Estimated global sales will rise from USD 600 million in 2022 to about USD 720 million by 2025.

Mid-term Outlook (2026–2030)

Over this period, sales are expected to grow at a CAGR of 4%, reaching USD 900 million by 2030. Influential factors include:

- Entry of biosimilars and enhanced formulations.

- Increasing burden of chronic skin conditions.

- Potential expansion into new indications (e.g., autoimmune blistering diseases).

Revenue Drivers and Risks

- Drivers: Population aging, advances in dermatology, and expanding healthcare access.

- Risks: Patent expirations leading to price erosion, regulatory changes, and safety concerns about long-term corticosteroid use.

Market Challenges

- Safety Concerns: Long-term use of clobetasol may cause skin atrophy, systemic absorption, and HPA axis suppression, impacting prescribing patterns.

- Regulatory Scrutiny: Heightened regulation regarding topical corticosteroid safety.

- Pricing Pressures: Growing availability of low-cost generics compress margins.

Future Outlook

Emerging formulations and combination therapies hold promise for market expansion. Greater awareness and diagnosis, particularly in developing economies, will further augment demand. Collaboration between pharmaceutical firms and healthcare providers to optimize treatment protocols can enhance market penetration.

Key Takeaways

- Robust Growth: Clobetasol sales are projected to grow steadily, driven by rising dermatological disease prevalence and expanding markets, especially in Asia-Pacific.

- Competitive Dynamics: Patent expiries have intensified competition, but brand loyalty and formulation innovations remain competitive advantages.

- Market Diversification: Opportunities exist in developing combination products, novel formulations, and expanding indications.

- Regulatory Vigilance: Companies must navigate safety concerns and regulatory frameworks to sustain growth.

- Strategic Focus: Stakeholders should prioritize emerging markets and invest in R&D for differentiated products.

FAQs

1. What are the primary therapeutic applications of clobetasol?

Clobetasol is primarily used for treating inflammatory and pruritic skin conditions such as psoriasis, eczema, and dermatitis due to its potent anti-inflammatory effects.

2. How has patent expiration affected the clobetasol market?

Patent expiries have facilitated the entry of generic formulations, increasing affordability and accessibility but also intensifying price competition within the market.

3. What are the main challenges facing the clobetasol market?

Safety concerns related to long-term corticosteroid use, regulatory scrutiny, and competition from low-cost generics are key challenges.

4. Which regions offer the highest growth potential for clobetasol?

Asia-Pacific and Latin America present the highest growth opportunities owing to expanding healthcare infrastructure and rising dermatological disease prevalence.

5. What innovations could influence future sales of clobetasol?

Development of targeted delivery systems, combination therapies with other anti-inflammatory agents, and formulations with improved safety profiles are poised to impact future sales positively.

Sources

[1] MarketWatch. "Global Corticosteroids Market Size, Share & Trends Analysis," 2022.

[2] Grand View Research. "Topical Corticosteroids Market Analysis," 2022.

[3] FDA. "Safety and Efficacy of Topical Corticosteroids," 2021.

[4] IQVIA. "Global Dermatology Market Overview," 2022.

More… ↓