Last updated: September 28, 2025

Introduction

Carbamazepine, an anticonvulsant and mood stabilizer, has been a mainstay in neurological and psychiatric therapeutics since its discovery in the 1950s. It is primarily used for treating epilepsy, bipolar disorder, and trigeminal neuralgia. Despite its age, the drug remains a critical component of neurologic and psychiatric treatment regimens worldwide. This report provides a comprehensive analysis of the market landscape for carbamazepine, including current demand drivers, competitive positioning, regulatory considerations, and sales forecasts up to 2030.

Market Overview

The global carbamazepine market is characterized by steady demand driven by the prevalence of epilepsy and bipolar disorder, especially among aging populations. Despite the arrival of newer antiepileptic drugs (AEDs), carbamazepine continues to hold significant market share due to its proven efficacy, cost-effectiveness, and longstanding clinical use.

Prevalence and Therapeutic Demand

According to the World Health Organization, epilepsy affects approximately 50 million people worldwide, with higher prevalence rates in low- and middle-income countries. Bipolar disorder affects an estimated 45 million individuals globally. These patient populations maintain a consistent demand for carbamazepine, especially where healthcare infrastructure supports its use.

Current Market Players

Key manufacturers include Novartis, GlaxoSmithKline, and generic drug producers in India, China, and Europe. The patent landscape for carbamazepine has long expired, making it predominantly available as a generic medication, which significantly influences pricing and market dynamics.

Drivers and Constraints

Market Drivers

-

Established Efficacy and Safety Profile: Carbamazepine’s decades-long history in clinical use assures prescribers and patients of its effectiveness.

-

Cost-Effectiveness: As a low-cost generic, it remains a first-line therapy in many low-income regions.

-

Growing Prevalence of Indications: Rising incidences of epilepsy, bipolar disorder, and trigeminal neuralgia sustain demand.

-

Expanding Access in Emerging Markets: Improved healthcare infrastructure enhances availability in Africa, Asia, and Latin America.

Market Constraints

-

Availability of Newer AEDs: Drugs such as lamotrigine, levetiracetam, and oxcarbazepine offer improved safety profiles, reducing carbamazepine’s market share.

-

Adverse Effect Profile: Risks of leukopenia, hyponatremia, and severe skin reactions (e.g., Stevens-Johnson syndrome) limit use in certain populations.

-

Regulatory Restrictions: Certain countries impose restrictions owing to safety concerns, impacting adoption rates.

Regulatory and Patent Landscape

With patent expiration decades ago, carbamazepine’s manufacturing is largely off-patent, fostering a highly competitive generics market. Regulatory agencies such as the FDA, EMA, and WHO hold stringent safety and quality standards for its production and distribution. Some countries, notably China and India, dominate the production landscape, supplying both domestic and international markets.

Market Segmentation

-

By Indication

- Epilepsy (generalized and focal seizures)

- Bipolar disorder

- Trigeminal neuralgia

- Other neurological/pyschiatric disorders

-

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

The Asia-Pacific region is expected to witness the fastest growth owing to increasing disease prevalence and improving healthcare access.

Sales Projections (2023-2030)

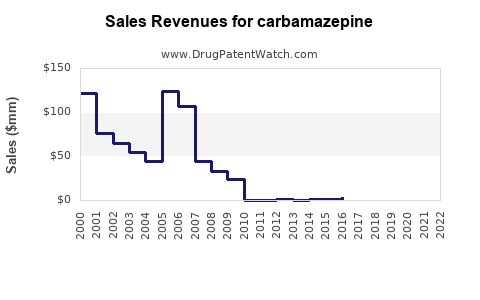

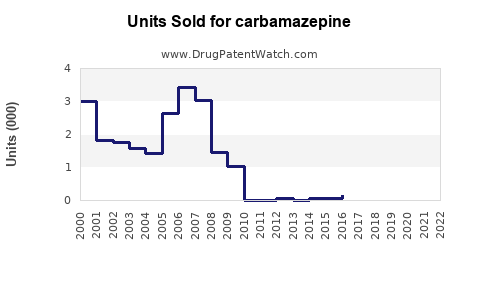

Methodology

Forecasts leverage epidemiological data, historical sales figures, pricing analytics, and competitive market trends. The analysis considers patent expiries, new drug entry, and regional healthcare advancements.

Projected Market Size

- 2023: US$ 600 million

- 2025: US$ 720 million

- 2030: US$ 950 million

The compounded annual growth rate (CAGR) from 2023 to 2030 is estimated at approximately 4.4%.

Factors Influencing Growth

- Steady demand for established indications ensures baseline revenues.

- Growth in emerging markets could raise annual growth rates to 6%, driven by increased healthcare spending.

- Introduction of biosimilars or improved formulations could insulate sales margins.

Regional Outlook

- North America & Europe: Mature markets with moderate growth due to high penetration and competitor drugs.

- Asia-Pacific: Highest growth potential, projected CAGR of around 6%, propelled by demographic shifts and healthcare expansion.

- Latin America & Middle East: Moderate growth with expanding access but constrained by regulatory heterogeneity.

Competitive Landscape

The market is highly competitive with low product differentiation. Companies focus on manufacturing quality, supply reliability, and price competitiveness.

- Generic Dominance: Most sales derive from generic formulations, reducing profit margins.

- Potential for New Formulations: Extended-release formulations and combination therapies may provide incremental growth.

- Quality and Safety Standards: Meeting global standards remains crucial for market access, especially in developed regions.

Key Challenges and Opportunities

Challenges

- Regulatory tightening over safety profiles could restrict use or impose additional safety monitoring.

- Competition from newer AEDs with better tolerability may erode market share.

- Supply chain disruptions, especially in raw materials originating from certain regions.

Opportunities

- Expanding use for off-label indications, such as neuropathic pain, could open new revenue streams.

- Novel formulations (e.g., extended-release) may improve patient compliance and expand market share.

- Emerging markets represent an untapped spectrum with increasing healthcare investments.

Conclusion

Carbamazepine remains a vital medication within its therapeutic classes despite stiff competition. Market forecasts suggest a steady growth trajectory driven by endemic neurology and psychiatry conditions, especially in emerging markets. Companies operating within this space should focus on maintaining regulatory compliance, optimizing manufacturing costs, and exploring innovative formulations to capitalize on untapped regional demand and clinical niches.

Key Takeaways

- The global carbamazepine market is projected to grow at a CAGR of approximately 4.4% from 2023 to 2030, reaching nearly US$ 950 million.

- Generic manufacturing dominates the landscape, with low-cost formulations ensuring broad access, especially in developing regions.

- Competition from newer AEDs with improved safety profiles may limit growth in developed markets but presents opportunities for innovation.

- Emerging markets in Asia-Pacific and Latin America are critical drivers, accounting for the fastest growth and expanding patient populations.

- Regulatory scrutiny concerning safety risks requires ongoing vigilance, and companies must prioritize product quality to maintain market presence.

FAQs

1. What factors could significantly influence carbamazepine sales in the coming years?

Market dynamics depend heavily on regional healthcare policies, safety regulations, patent expiries, and the introduction of newer antiepileptic drugs. Safety concerns may restrict usage, while expanded indications or formulations could elevate sales.

2. How does the expiration of patents impact the carbamazepine market?

Patent expiry led to a surge in generic manufacturing, significantly reducing prices and increasing accessibility globally. This fosters fierce price competition but limits revenue margins for brand-name manufacturers.

3. Are there any recent advancements or formulations of carbamazepine?

While traditional formulations remain dominant, extended-release versions have been developed to improve compliance and reduce side effects. However, no groundbreaking innovations have recently emerged due to its established patent status.

4. Which regions present the most promising markets for carbamazepine?

Asia-Pacific offers the most promising growth opportunities due to increasing disease prevalence, healthcare infrastructure development, and lower drug prices. Africa and Latin America also show expanding markets with rising access.

5. What risks do manufacturers face regarding safety concerns?

Severe adverse reactions like Stevens-Johnson syndrome pose safety risks, potentially leading to regulatory restrictions. Maintaining rigorous quality standards and post-market surveillance is crucial to mitigate these risks.

Sources

[1] WHO. Epilepsy. World Health Organization. 2022.

[2] GlobalData. Antiepileptic Drugs Market Outlook. 2022.

[3] U.S. FDA. Carbamazepine Drug Approval and Safety Information. 2022.

[4] IQVIA. Pharmaceutical Market Data. 2022.

[5] Market Research Future. Antiepileptic Drugs Market Analysis. 2023.