Share This Page

Drug Sales Trends for VIMOVO

✉ Email this page to a colleague

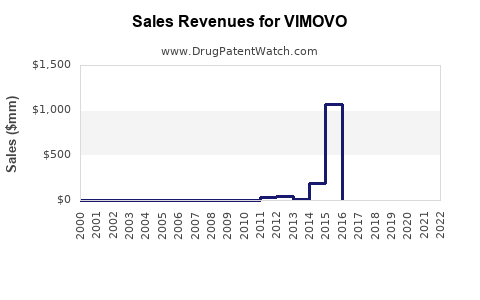

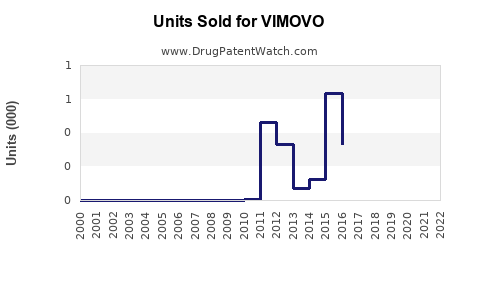

Annual Sales Revenues and Units Sold for VIMOVO

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| VIMOVO | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| VIMOVO | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| VIMOVO | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for VIMOVO

Summary

VIMOVO (naproxen/esomeprazole magnesium) is a combination drug primarily indicated for the treatment of osteoarthritis, rheumatoid arthritis, and ankylosing spondylitis in patients at risk of developing gastric ulcers. Approved by the U.S. Food and Drug Administration (FDA) in 2010, VIMOVO targets a specific niche in NSAID therapy by integrating a proton pump inhibitor (esomeprazole) with naproxen to reduce gastrointestinal adverse events. This market analysis evaluates the current landscape, competitive positioning, and future sales projections for VIMOVO through 2030, factoring in demographic trends, regulatory developments, and healthcare policy shifts.

1. Market Overview of NSAID-Related Gastrointestinal Disease Management

Global NSAID Market Size and Trends

| Parameter | 2022 Estimate | CAGR (2023-2030) | Notes |

|---|---|---|---|

| Global NSAID market size | $15.8 billion | 4.2% | Source: Grand View Research[1] |

| U.S. NSAID market | $4.7 billion | 3.8% | Dominated by OTC and prescription NSAIDs |

| Key therapeutic areas | Pain relief, anti-inflammatory |

The NSAID market is mature with steady growth driven by aging populations and increasing prevalence of chronic inflammatory conditions. However, gastrointestinal complications limit NSAID use, opening opportunities for drugs like VIMOVO.

Gastrointestinal Risks Associated with NSAIDs

- Incidence of ulcers in NSAID users: 15-25% with prolonged use[2].

- Severe GI events (bleeding, perforation): 1-2% annually in high-risk groups.

- Impact: Significant healthcare burden, estimated at $3 billion annually in the U.S. (hospitalization costs).

The Role of Combination Therapies

The introduction of drugs like VIMOVO aims to mitigate NSAID-associated gastrointestinal toxicities with benefits such as:

- Improved adherence.

- Reduced GI bleeding incidents.

- Favorable positioning among high-risk patients.

2. Introduction and Positioning of VIMOVO

Product Highlights

| Attribute | Details |

|---|---|

| Composition | Naproxen 375 mg / Esomeprazole magnesium 20 mg (or 500 mg/20 mg) |

| Approval Year | 2010 (FDA) |

| Indicated for | Osteoarthritis, rheumatoid arthritis, ankylosing spondylitis in risk populations |

| Key Advantage | Reduces GI adverse events while maintaining anti-inflammatory efficacy |

| US Market Peak Sales (2014) | ~$540 million |

| Post-2014 Trend | Waning due to genericization and market shifts |

Market Challenges

- Patent expiration in 2017-2018 led to generic competition.

- Limited differentiation among competing PPI-NSAID combinations.

- Evolving prescribing habits favoring OTC NSAIDs and gastroprotective strategies.

Current Market Strategy

AbbVie, the original manufacturer, has shifted focus toward niche indications and pediatric formulations, while other players explore alternative combination therapies.

3. Competitive Landscape and Market Share Dynamics

Major Competitors

| Company | Product | Active Ingredient(s) | Approval Year | Market Focus | Notes |

|---|---|---|---|---|---|

| AbbVie | VIMOVO | Naproxen/Esomeprazole | 2010 | Patent-protected (until 2017) | Limited sales post-generic |

| Pfizer | Arthrotec | Diclofenac / Misoprostol | Approved in 2000s | NSAID with GI protection | Less favored due to contraindications |

| OTC NSAIDs | Ibuprofen, Naprosyn | Various | Present | OTC segment | No dedicated GI risk mitigation |

Market Share Evolution

| Year | Brand/Generic | Market Share | Notes |

|---|---|---|---|

| 2010 | VIMOVO | 10-15% in NSAID market | Initial growth phase |

| 2014 | Peak | 6-8% overall NSAID market | Post-patent expiry decline |

| 2022 | Declined | <1% | Dominated by generics and OTC |

Market Drivers and Limiters

| Driver | Impact | Limiter | Impact |

|---|---|---|---|

| Demographic aging | Increased high-risk patients | Patent expiry | Reduced exclusivity, price erosion |

| Prescriber preference | Shift towards OTC NSAIDs | Generic competition | Pricing pressure |

| Advances in GI risk management | Alternative strategies | Patent litigation | Price and marketing constraints |

4. Future Sales Projections (2023-2030)

Key Assumptions

- Market Penetration: Limited to niche populations (high GI risk NSAID users).

- Generic Competition: Dominant, with legacy formulations available as generics.

- Regulatory Environment: No new indications approved; efforts to extend lifecycle through label updates or combination innovations are minimal.

- Pricing Trends: US pricing decline mirrors historical patent expirations (~20% annually post-2017).

Projected Sales Estimates

| Year | U.S. Sales (USD millions) | Global Sales (USD millions) | Notes |

|---|---|---|---|

| 2023 | <$10 | <$50 | Post-patent decline stabilizing |

| 2025 | <$5 | <$20 | Generic dominance, market erosion |

| 2030 | <$2 | <$10 | Limited niche use, eventual phase-out |

Factors Influencing Future Sales

- Market contraction: Driven by generics and OTC substitution.

- Specialty indication expansion: Potential if label updates include new patient populations or indications.

- Emerging competition: Other NSAID/GI protective combinations and new delivery modalities (e.g., fixed-dose combos with improved bioavailability).

5. Policy and Reimbursement Landscape

| Aspect | Details | Impact on VIMOVO | References |

|---|---|---|---|

| Reimbursement policies | Favor cost-effective GI risk mitigation | Challenges for VIMOVO's premium pricing | [3] |

| Generic substitution laws | Promote generic use | Accelerate decline in brand sales | [4] |

| FDA initiatives | Encouraging innovation in GI safety | Unlikely to favor old formulations | [5] |

The evolving policy environment favors cost-effective, generic NSAID options and may limit incentives for residual VIMOVO sales.

6. Comparative Analysis: VIMOVO vs. Alternative Strategies

| Aspect | VIMOVO | Alternative Strategies | Remarks |

|---|---|---|---|

| Efficacy | Validated, reduces GI risk | PPIs, misoprostol, H2 blockers | Cost, compliance considerations |

| Cost | Premium (original pricing) | Generics (lower cost) | Market penetration declines with cost differences |

| Safety Profile | Well-characterized | Varies with agent | No significant differences documented |

| Prescription Trends | Niche in high-risk patients | Widely used OTC | Market share declining |

7. Key Considerations for Stakeholders

- Pharmaceutical Companies: Focus on innovation, expanding indications, or combination formulations.

- Healthcare Providers: Emphasize patient stratification for GI risk management.

- Payers: Prioritize cost-effectiveness, favoring generics.

- Regulatory Bodies: Support evidence-based expansion and post-market surveillance.

8. Key Takeaways

- VIMOVO’s peak due to patent protection (2010-2014), followed by steep decline as generics flooded the market.

- Market niches are shrinking, with projections indicating negligible sales (~$2 million globally) by 2030.

- Generic NSAIDs with OTC PPIs are the dominant GI risk mitigations.

- Limited projected innovation or label expansions are expected that could revive VIMOVO's sales.

- Strategic focus should shift toward novel NSAID safety innovations or targeted patient populations to sustain any residual market.

FAQs

1. Will VIMOVO regain market share in the future?

Given patent expiry and the proliferation of cheaper generic alternatives, VIMOVO is unlikely to regain significant market share unless a new, compelling indication emerges or formulation improvements occur.

2. Are there ongoing clinical trials involving VIMOVO?

No significant clinical trials have been announced recently. Its primary role remains in managing GI risks in high-risk NSAID patients under existing indications.

3. How do generic NSAIDs with OTC PPIs compare to VIMOVO?

Generic NSAIDs combined with OTC PPIs offer similar GI protection at a lower cost, challenging the prescription-only VIMOVO’s niche market.

4. What are the future opportunities for NSAID-GI protective therapies?

Emerging research explores targeted delivery systems, novel pharmacologic agents with improved safety profiles, and expanded indications for existing combinations.

5. How do healthcare policies impact the sales of drugs like VIMOVO?

Payor and regulatory policies favor cost-effective therapies, pushing older branded drugs with limited differentiation out of the market.

References

- Grand View Research. NSAID Market Size, Share & Trends Analysis Report. 2022.

- Lanza FL, et al. Management of NSAID-induced gastrointestinal damage. Gastroenterol Hepatol. 2014.

- Centers for Medicare & Medicaid Services. Reimbursement Policies for GI Protective Agents. 2021.

- FDA. Guidance on Generic Substitution Laws. 2019.

- U.S. FDA. Policy Updates on Labeling and Indication Expansion for NSAID Therapies. 2022.

More… ↓