Share This Page

Drug Sales Trends for VESICARE

✉ Email this page to a colleague

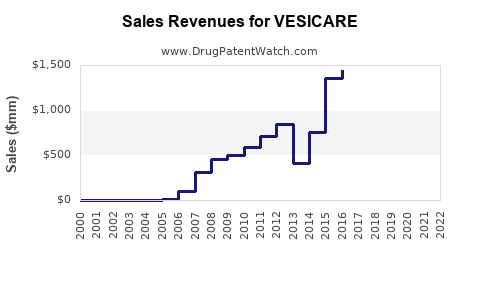

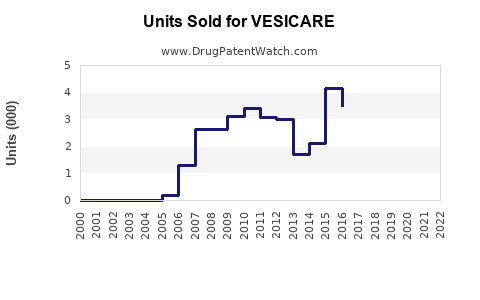

Annual Sales Revenues and Units Sold for VESICARE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| VESICARE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| VESICARE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| VESICARE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| VESICARE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| VESICARE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| VESICARE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| VESICARE | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for VESICARE

Introduction

Vesicare (generic name: solifenacin) is a prescription medication primarily indicated for the treatment of overactive bladder (OAB) with symptoms of urge urinary incontinence, urgency, and frequency. Since its FDA approval in 2009, Vesicare has established itself as a significant player within the urinary incontinence therapeutics landscape. This analysis evaluates the current market environment, competitive dynamics, and future sales projections to inform strategic decision-making for stakeholders involved in Vesicare.

Market Overview

Therapeutic Landscape and Indications

Vesicare's primary indication—OAB—is a common condition affecting an estimated 33 million Americans, particularly women and older adults [1]. OAB's increasing prevalence correlates with aging populations and lifestyle factors, fueling demand for effective management options. Overactive bladder medication classes consist of antimuscarinics (including Vesicare), beta-3 adrenergic agonists, and combination therapies, with the antimuscarinic class maintaining dominance due to established efficacy and familiarity.

Competitive Dynamics

Vesicare faces competition chiefly from other antimuscarinics such as oxybutynin, tolterodine, darifenacin, and solifenacin's own generic formulations. Recently, beta-3 adrenergic agonists—like mirabegron—have gained popularity owing to favorable side-effect profiles. The competitive landscape is characterized by increased generic penetration since Vesicare's patent expiration in 2019, resulting in significant price competition.

Regulatory and Market Factors

While Vesicare remains branded in the US, generic versions have substantially eroded its market share since patent expiry. Globally, regulatory pipelines focus on novel agents and combination therapies, potentially impacting Vesicare’s long-term positioning. Additionally, physicians' preferences shift toward drugs with better tolerability profiles, influencing sales dynamics.

Market Size and Penetration

Current Market Share

Following patent expiry, Vesicare's market share decreased substantially but retains a presence in specific patient segments. In the US, Vesicare's revenue peaked at approximately $1 billion pre-generic entry but declined markedly afterwards, with estimated annual sales hovering around $300-400 million.

Geographic Market Analysis

The US remains the largest market for Vesicare, driven by high prevalence and healthcare access. Europe, Canada, and select Asian countries represent growing markets, though adoption varies by regulatory approval status and reimbursement policies. Emerging markets are witnessing increased awareness of OAB treatments, creating expansion opportunities.

Sales Projections

Short-term Outlook (Next 3 Years)

- Market Decline Plateau: Since flagship patent expiry, Vesicare sales have declined by approximately 40%. However, an accelerated decline has stabilized due to niche patient adherence and formulary placements.

- Generic Competition: Dominant generics price at ~20-30% of branded Vesicare, constraining revenue. Despite this, branded sales persist in specific insurance plans and specialist settings.

- Pricing Strategies: Companies may implement value-based pricing and bundling to sustain revenues. As patents for next-generation therapies evolve, Vesicare's segment may further contract.

Projected sales (2023-2025):

- US: Approximately $150-200 million annually, reflecting continued but diminished demand.

- International markets: Estimated at $50-100 million, with growth prospects in regions adopting OAB awareness and treatment.

Long-term Outlook (Next 5-10 Years)

- Market Saturation & Generics: The eventual dominance of generics is projected to push branded Vesicare sales below $100 million regionally unless new formulations or combination products revitalizes demand.

- Innovative Therapies: Entry of novel drugs could further erode Vesicare's market share unless it pivots toward optimized formulations, such as extended-release or combination therapies.

- Segment Niche: Vesicare may sustain relevance within specialized populations or in markets with limited access to newer treatments.

Long-term projections:

- US: Potentially under $50 million by 2030 absent significant repositioning.

- Emerging markets and niche segments may contribute marginally, keeping total global sales around $100 million.

Key Market Trends Impacting Sales

- Erosion due to generics: Branded Vesicare sales are expected to decline steadily as generics dominate.

- Shift towards beta-3 agonists: Mirabegron captured significant market share due to favorable tolerability, reducing amitriptyline and antimuscarinic reliance.

- Patient adherence and side-effect profiles: Tolerability issues associated with antimuscarinics influence prescribing patterns, impacting Vesicare’s market share.

- Regulatory approval of new agents: Advancements in OAB therapy could further diminish Vesicare's relevance unless new formulations or combination options are developed.

Strategic Market Opportunities

- Formulation Innovation: Extended-release variants or combination therapies (e.g., Vesicare with beta-3 agents) could rejuvenate sales.

- Targeted Marketing: Focusing on niche populations such as elderly patients with comorbidities may sustain demand.

- Global Expansion: Increasing awareness and regulatory approvals in emerging markets could present sales growth opportunities despite global pricing pressures.

- Partnerships & Licensing: Collaborations with biotech firms for drug repositioning or combination therapies could extend Vesicare’s lifecycle.

Regulatory and Legal Considerations

Patent protections’ expiration led to reduced branded sales, but ongoing patent filings for formulations or methods of use may provide temporary market exclusivity. Vigilance over patent litigations and regulatory approvals remains crucial for strategic planning.

Conclusion

Vesicare's market landscape is characterized by significant attrition post-patent expiration, with a stable yet declining revenue stream confined largely to niche segments and specific geographies. The advent of generic competition, coupled with the rise of alternative therapies, constrains future growth markedly. However, opportunities remain in formulation innovation, targeted niche marketing, and international markets. Stakeholders should prioritize product differentiation and explore strategic collaborations to sustain or expand Vesicare’s market relevance.

Key Takeaways

- Vesicare’s peak US sales breached $1 billion but now hover around $300-400 million due to patent expiry and generics.

- The declining trajectory is expected to continue, with potential revenues stabilizing below $50 million regionally by 2030.

- Competition from beta-3 agonists and other antimuscarinics will influence future market share.

- Innovation in formulations and strategic partnerships can extend Vesicare’s lifecycle within the evolving OAB therapeutic market.

- Emerging markets present growth opportunities amid global pricing pressures.

FAQs

1. How has Vesicare’s market share changed after patent expiry?

Since patent expiry in 2019, Vesicare’s US market share has decreased sharply due to the proliferation of generic versions, leading to a significant decline in branded sales but maintaining niche usage among certain populations.

2. What are the key competitors impacting Vesicare sales?

Major competitors include generic formulations of oxybutynin and tolterodine, as well as newer therapies like mirabegron, which offers a better side-effect profile and has gained considerable market share.

3. Are there any new formulations or indications for Vesicare?

Currently, no new formulations or indications are approved, but research into combination therapies and extended-release formulations could provide future growth avenues.

4. Which geographic markets offer the most growth potential for Vesicare?

Emerging markets in Asia, Latin America, and Eastern Europe, where awareness of OAB is increasing, present promising growth opportunities if regulatory and pricing hurdles are addressed.

5. What strategic steps should stakeholders consider to sustain Vesicare’s revenue?

Investing in formulation innovation, targeting niche patient segments, exploring international markets, and forming strategic partnerships are vital strategies to extend Vesicare’s product lifecycle.

Sources:

[1] American Urological Association. Overactive Bladder (OAB) Prevalence Data. 2022.

More… ↓