Last updated: July 31, 2025

Introduction

Sulfamethoxazole-Trimethoprim (SMZ-TMP), commercially known as Bactrim or Septra, is a broad-spectrum antimicrobial used extensively in clinical settings. Its indications encompass urinary tract infections, respiratory infections, gastrointestinal infections, and certain skin infections. As antibiotic resistance escalates and global demand for effective infectious disease treatments persists, understanding the market dynamics and sales projections for SMZ-TMP becomes essential for pharmaceutical companies, investors, and healthcare stakeholders.

This analysis examines current market considerations, demand drivers, competitive landscape, regulatory factors, and forecasts sales trajectories over the next five years, providing actionable insights based on recent trends and data.

Market Overview

Current Market Size

The global antibiotic market was valued at approximately $45 billion in 2022, with a portion attributable to fixed-dose combinations like SMZ-TMP. The prevalence of urinary and respiratory infections sustains steady demand, especially in regions with high infectious disease burdens such as Asia-Pacific, Latin America, and Africa.

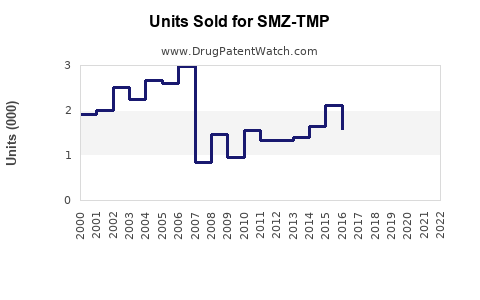

In the United States, SMZ-TMP remains among the top prescribed antibiotics, accounting for an estimated 20 million prescriptions annually (IQVIA, 2022). Although newer antibiotics have entered the market, SMZ-TMP's affordability and established efficacy preserve its market share.

Indications and Therapeutic Use

SMZ-TMP’s primary indications include:

- Uncomplicated urinary tract infections (UTIs)

- Acute otitis media

- Pneumocystis pneumonia (PCP) prophylaxis and treatment

- Traveler's diarrhea

- Skin and soft tissue infections

Its broad spectrum renders it a versatile agent, though resistance emergence affects its utilization.

Market Drivers

1. Rising Infectious Disease Incidence

Global increases in urinary and respiratory infections, compounded by aging populations and immunocompromised individuals, sustain demand. According to WHO, UTIs account for approximately 150 million cases annually worldwide.

2. Adoption in Prophylaxis

SMZ-TMP serves as a first-line agent for PCP prophylaxis in HIV-positive patients, with expanding access globally, notably in regions with high HIV/AIDS prevalence, such as Sub-Saharan Africa.

3. Cost-Effectiveness and Accessibility

As a low-cost generic medication, SMZ-TMP remains pivotal in resource-limited settings, ensuring steady consumption outside of high-income markets.

4. Resistance Management

While emerging resistance restricts use in some indications, ongoing stewardship programs and combination strategies aim to optimize its lifespan, maintaining its relevance.

Competitive Landscape

Generics Dominate Market Share

The market is heavily commoditized with numerous generic manufacturers globally. No new branded versions have significantly disrupted the space, maintaining a price-sensitive, competitive environment.

Emerging Resistance Challenges

Rapid resistance development in pathogens (e.g., E. coli, P. jirovecii) constrains some indications, prompting clinicians to seek alternative agents, thereby modestly impacting sales volumes.

Potential New Formulations

Adjustments like fixed-dose combinations or extended-release formulations remain under clinical investigation but have not yet gained widespread adoption.

Regulatory and Patent Landscape

SMZ-TMP’s patents have long expired, enabling widespread generic manufacturing. Regulatory hurdles for new formulations are minimal, although patent disputes over specific delivery systems or combination formulations could influence market entry.

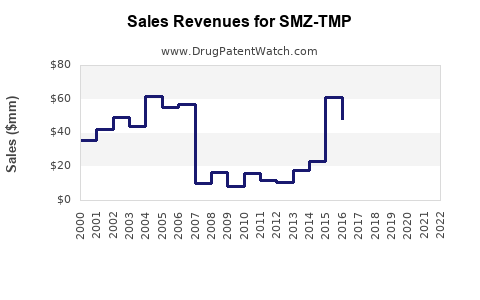

Sales Projections: 2023-2028

Assumptions

- Steady global economic growth supports healthcare spending.

- Continued prevalence of urinary and respiratory infections sustains demand.

- Resistance levels moderate with stewardship efforts.

- Generic affordability sustains popularity, especially in emerging markets.

- No significant disruption from new antibiotics or global regulatory actions.

Projected Trends

| Year |

Estimated Global Sales (USD Millions) |

Annual Growth Rate |

Remarks |

| 2023 |

$250 |

— |

Stable current demand |

| 2024 |

$265 |

+6% |

Increased use in emerging markets |

| 2025 |

$280 |

+6% |

Continued demand for prophylactic indications |

| 2026 |

$290 |

+3.5% |

Mild impact from rising resistance |

| 2027 |

$300 |

+3.5% |

Market saturation in mature markets |

| 2028 |

$310 |

+3.3% |

Stabilization of global antibiotic use |

Note: The projections reflect conservative growth, considering resistance impacts and the saturation of mature markets. The aggregate includes sales across developed and developing regions, with higher growth potential in countries strengthening healthcare infrastructure and expanding access.

Factors Influencing Future Market Dynamics

Positive Factors

- Increasing prevalence of immunocompromised conditions and corresponding prophylactic needs.

- Expanding healthcare infrastructure in emerging economies bolsters prescription volumes.

- Continued reliance on affordable generics sustains market access.

Negative Factors

- Rising antimicrobial resistance limiting use in specific indications.

- Introduction of newer, more targeted antibiotics with improved safety or resistance profiles.

- Global antimicrobial stewardship initiatives restricting antibiotic overuse.

- Regulatory scrutiny over antibiotic use, potentially impacting prescription patterns.

Conclusion

SMZ-TMP remains a cornerstone antimicrobial with stable market presence driven by endemic infectious diseases, global healthcare needs, and its cost advantage. While resistance development and substitution with newer agents pose challenges, its affordability and broad utility provide resilience.

Pharmaceutical stakeholders should monitor resistance trends, foster stewardship, and explore formulation innovations to extend its lifecycle. Markets in developing nations present significant growth opportunities, contingent on continued access and health system strengthening.

Key Takeaways

- SMZ-TMP’s global sales are projected to grow modestly at 3-6% annually through 2028, driven by demand in infectious disease management and prophylaxis.

- The generic drug landscape dominates the market, enabling widespread accessibility but limiting premium pricing.

- Resistance trends and regulatory policies remain key risks, potentially constraining growth in certain indications.

- Opportunities exist in expanding prophylactic applications and optimizing formulations to combat emerging resistance.

- Emerging markets offer the most significant growth potential owing to increasing healthcare infrastructure and infectious disease burdens.

FAQs

1. How is antimicrobial resistance affecting SMZ-TMP sales?

Rising resistance, particularly in E. coli and P. jirovecii, constrains some of SMZ-TMP’s use, especially in urinary and respiratory infections. While stewardship aims to curb unnecessary use, resistance limits the antibiotic’s efficacy, impacting sales volumes over time.

2. Are there any new formulations or combinations of SMZ-TMP in development?

Current efforts focus on fixed-dose combinations and extended-release formulations, but none have yet gained regulatory approval or widespread market presence. Such innovations could revitalize sales if they demonstrate improved efficacy or safety.

3. Which regions will drive future SMZ-TMP demand?

Emerging economies in Asia, Africa, and Latin America are primary growth drivers, due to expanding healthcare infrastructure, infectious disease burdens, and reliance on affordable generics.

4. How do regulatory policies influence SMZ-TMP sales?

Stringent antimicrobial stewardship programs and regulations aimed at curbing overuse can restrict prescriptions, especially in high-income countries, potentially limiting growth. Conversely, lax regulations in developing nations can expand access and sales.

5. What is the outlook for SMZ-TMP amid competition from newer antibiotics?

While newer agents with targeted activity and better safety profiles emerge, SMZ-TMP’s low cost and established efficacy ensure its continued relevance, especially where affordability is paramount. Its market share may decline in high-income settings but remain stable globally.

References

- IQVIA. National Prescription Data, 2022.

- World Health Organization. Global Urinary Tract Infection Statistics.

- MarketWatch. Antibiotics Market Size & Forecast, 2022-2028.

- CDC. Antimicrobial Resistance and Antibiotic Use in the United States.

- Biomedical Research Reports. Emerging Trends in Antibiotic Formulations.