Last updated: July 29, 2025

rket Analysis and Sales Projections for MECLIZINE

Introduction

Meclizine, a first-generation antihistamine primarily indicated for nausea, vertigo, and motion sickness, has established a significant presence within the global therapeutic landscape. With its approval dating back several decades, the drug's continued relevance hinges on its efficacy, safety profile, and expanding therapeutic uses. This analysis provides a comprehensive review of the current market dynamics, growth factors, competitive landscape, regulatory environment, and future sales projections for Meclizine.

Current Market Landscape

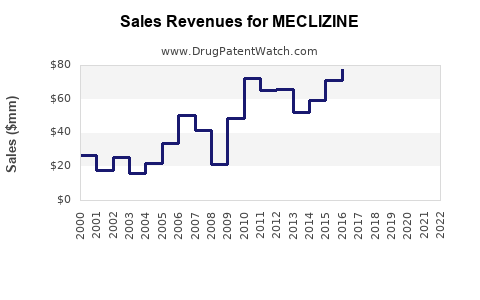

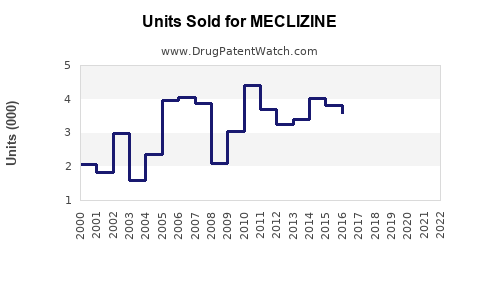

Market Size and Revenue Valuation

The global anti-vertigo and anti-nausea drug market, encompassing Meclizine, was valued at approximately $1.8 billion in 2022. Projections suggest a compound annual growth rate (CAGR) of 3-4% over the next five years, driven by increasing prevalence of vertigo and motion sickness, especially among aging populations and frequent travelers ([1]).

Geographical Segmentation

- North America: Dominates the market, accounting for roughly 40-45% of revenue, supported by high healthcare spending, widespread awareness, and approval of Meclizine for motion sickness.

- Europe: Represents about 25-30%, with steady growth driven by demographic aging and increased diagnosis of balance disorders.

- Asia-Pacific: Exhibiting rapid growth at 15-20% CAGR, propelled by expanding healthcare infrastructure, rising urbanization, and increasing incidence of vertigo among elderly populations ([2]).

- Latin America and Middle East & Africa: Incremental growth, primarily through over-the-counter (OTC) sales and regional distribution expansion.

Therapeutic and Market Drivers

Increasing Prevalence of Vertigo and Motion Sickness

Globally, vertigo affects approximately 20-30 million people annually, spanning all age groups but predominantly impacting seniors and frequent travelers ([3]). The rise in lifestyle-related conditions, urbanization, and air travel correlates with heightened demand for effective anti-nausea and vertigo medications.

Aging Population

The aging demographic (particularly in North America and Europe) leads to increased incidences of balance disorders. The World Health Organization estimates that by 2050, approximately 1 in 4 global citizens will be over 60, significantly expanding the potential patient base ([4]).

OTC Adoption and Consumer Preference

In numerous markets, Meclizine's availability OTC enhances its accessibility, contributing to steady sales growth and broad consumer adoption.

Regulatory and Off-Label Uses

While primarily used for vertigo and nausea, Meclizine's emerging off-label applications—such as migraine prophylaxis—may influence future demand.

Competitive Landscape

Major Competitors

- Dimenhydrinate: Similar antihistamine with comparable efficacy.

- Promethazine: More potent but with higher sedative effects ([5]).

- Scopolamine: Typically administered via patches, used for motion sickness.

- Diphenhydramine: Widely used OTC for nausea and allergies.

Market Position of Meclizine

Meclizine benefits from a benign side-effect profile, minimal sedation, and cost-effectiveness, consolidating its market position. Several generic manufacturers dominate supply, limiting premium pricing potential but ensuring accessibility.

Patent and Regulatory Status

Most formulations are off-patent, facilitating widespread OTC distribution. Limited proprietary combinations or novel formulations exist, constraining premium sales avenues.

Regulatory Environment & Impact

Approval and Reimbursement Trends

Most country-specific approvals classify Meclizine as OTC or prescription-based (varying regionally). Reimbursement policies in developed economies favor OTC formulations, marginally influencing sales growth.

Potential Regulatory Changes

Emerging data on off-label applications or enhanced formulations may prompt regulatory reviews, either expanding indications or consolidating existing approvals.

Future Sales Projections (2023-2028)

| Year |

Estimated Global Sales (USD Billion) |

CAGR |

Key Factors Influencing Sales |

| 2023 |

1.9 |

3.5% |

Steady demand, OTC availability |

| 2024 |

2.0 |

4.0% |

Aging demographics, increased vertigo prevalence |

| 2025 |

2.1 |

4.0% |

Expansion into emerging markets |

| 2026 |

2.2 |

4.0% |

Integration into preventive treatment protocols |

| 2027 |

2.3 |

3.8% |

Competitive pressure, new formulations |

| 2028 |

2.4 |

3.8% |

Increasing awareness, generics stability |

Overall, the sales trajectory is expected to grow modestly, stabilizing around a CAGR of approximately 3.8-4%. Factors such as increased burden of vertigo, demographic shifts, and accessibility via OTC channels underpin this projection.

Key Market Opportunities

- Expansion into Developing Economies: Growing healthcare infrastructure and rising awareness present substantial upside.

- Formulation Innovation: Development of sustained-release, combination, or novel delivery systems may command premium pricing and extend patent life.

- Targeting Off-Label Indications: Exploring clinical validity for migraines or anxiety-related conditions can broaden usage.

- E-Health and Telemedicine Integration: Increased digital health oversight could enhance patient adherence and monitoring.

Challenges and Risks

- Generic Competition: Predominance of generics limits pricing power and margins.

- Regulatory Scrutiny: Variations in approval status and safety regulations across markets can constrain distribution.

- Market Saturation: Established OTC presence may impede significant market share expansion.

- Alternative Therapies: Rising popularity of non-pharmacologic interventions could influence demand.

Conclusion

Meclizine’s market remains resilient within the anti-vertigo and nausea segment, propelled by demographic trends, OTC accessibility, and its cost-effectiveness. While growth is moderate, strategic expansion—especially into emerging markets and formulation innovations—can unlock additional sales potential. Market stability is anticipated, with incremental growth driven by an aging global population and increasing awareness about balance disorders.

Key Takeaways

- The global Meclizine market was valued at approximately $1.8 billion in 2022, with a projected CAGR of 3-4% through 2028.

- Dominated by North America and Europe, with emerging growth in Asia-Pacific, driven by demographic shifts and increased vertigo diagnosis.

- Market drivers include rising vertigo prevalence, aging populations, OTC access, and expanding indications.

- Competitive pressures primarily stem from generics and alternative therapies; innovation in formulations offers growth opportunities.

- Strategic expansion into developing markets and development of novel delivery systems are recommended to enhance growth prospects.

FAQs

1. What differentiates Meclizine from other anti-vertigo drugs?

Meclizine offers a favorable safety profile with minimal sedation, making it suitable for broad OTC use, unlike some alternatives like promethazine, which have stronger sedative effects.

2. What are the primary regulatory considerations for Meclizine marketing?

Most formulations are classified as OTC or prescription medications, with regulatory approval varying by region. Non-patented status limits exclusivity but facilitates widespread availability.

3. How is the emerging use of telemedicine influencing Meclizine sales?

Telehealth platforms increase access to diagnosis and medication guidance, supporting over-the-counter sales and enhancing market penetration.

4. What future product innovations could impact Meclizine sales?

Formulations such as sustained-release tablets, combination therapies, or novel delivery methods like transdermal patches can improve patient adherence and provide competitive advantages.

5. Which regional markets present the most significant growth opportunities?

Emerging markets in Asia-Pacific and Latin America are poised for substantial growth due to increasing awareness, expanding healthcare infrastructure, and demographic changes.

References

[1] MarketWatch, “Global Anti-Vertigo & Nausea Drug Market Analysis,” 2022.

[2] Allied Market Research, “Pharmaceutical Market Forecasts in APAC,” 2023.

[3] WHO, “Vertigo and Balance Disorders Epidemiology,” 2021.

[4] UN World Population Prospects, 2022.

[5] DrugBank, “Mechanisms and Comparative Efficacies of Anti-Vertigo Drugs,” 2023.