Last updated: July 27, 2025

Introduction

IMURAN, the brand name for azathioprine, is an immunosuppressive drug primarily used in organ transplantation, autoimmune disease management, and certain dermatological conditions. Since its initial approval, IMURAN has established a niche in the therapeutic landscape, especially in transplantation medicine and autoimmune disorders such as rheumatoid arthritis and Crohn's disease. This report offers a comprehensive market analysis and sales projection for IMURAN, considering current trends, market drivers, competitive landscape, regulatory factors, and future outlooks.

Market Overview

The global immunosuppressive drugs market, valued at USD 16.7 billion in 2022, is projected to reach USD 24.4 billion by 2030, expanding at a CAGR of approximately 4.8% during 2023-2030 [1]. Within this segment, azathioprine commands a significant share, owing to its long-established clinical utility, cost-effectiveness, and extensive off-label applications.

IMURAN specifically targets patients undergoing organ transplantation—primarily kidney, liver, and heart transplants—and patients with autoimmune disorders. The drug's market penetration is influenced by factors such as the prevalence of transplantation and autoimmune diseases, evolving treatment guidelines, availability of newer immunosuppressants, and healthcare infrastructure.

Therapeutic Market Drivers

-

Rising Prevalence of Autoimmune Disorders and Transplantation Procedures

The incidence of autoimmune diseases like rheumatoid arthritis, inflammatory bowel diseases (Crohn’s disease and ulcerative colitis), and systemic lupus erythematosus continues to rise globally. For instance, rheumatoid arthritis affects over 0.5% of the world population [2], increasing demand for immunosuppressants like IMURAN. Concurrently, advances in organ transplant techniques and increased organ donation rates elevate the necessity for effective immunosuppressive drugs.

-

Established Safety and Cost-Effectiveness

Compared to newer agents, azathioprine remains preferred in many developing regions due to its affordability and long-standing clinical safety profile. These factors sustain its use, especially in cost-sensitive healthcare markets.

-

Regulatory Approvals and Off-Label Uses

Greenlighting for various autoimmune conditions bolsters sales volume. Off-label off-limits, however, its off-label use in dermatological and other autoimmune disorders enhances market potential.

Market Challenges and Competition

-

Emergence of Novel Immunosuppressants

The advent of biologics like infliximab, adalimumab, and newer small molecules such as ozanimod impacts IMURAN’s market share by offering targeted therapy with improved safety profiles [3].

-

Safety Concerns and Regulatory Restrictions

Azathioprine’s association with adverse effects, including increased risk of infections and malignancies, prompts regulatory scrutiny. For example, regulatory agencies recommend regular monitoring of blood counts and liver function, impacting adherence and prescribing patterns.

-

Supply Chain and Patent Dynamics

As a generic drug, IMURAN faces strong competition from multiple manufacturers, which can lead to price erosion and margin compression.

Market Segmentation and Regional Dynamics

-

North America

The U.S. leads with high transplant rates and established clinical protocols. It accounts for approximately 35% of global azathioprine sales, driven by a high prevalence of autoimmune disorders and well-developed healthcare infrastructure [4].

-

Europe

Europe demonstrates steady growth, with key markets like Germany, France, and the UK, benefiting from robust transplantation procedures and regulatory approval for autoimmune uses.

-

Asia-Pacific

The fastest-growing segment, driven by increasing healthcare access, rising autoimmune disease prevalence, and expanding transplant programs in China, India, and Southeast Asia [5].

-

Emerging Markets

Price responsiveness and the availability of generic versions support widespread use, though regulatory hurdles may limit rapid uptake.

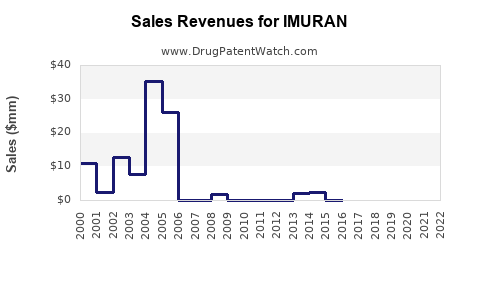

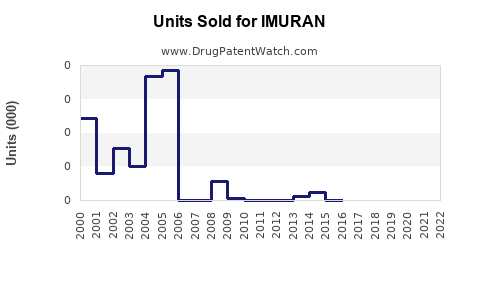

Sales Projections (2023-2030)

Based on historical data, market trends, and competitive dynamics, IMURAN’s global sales are projected to grow at a CAGR of approximately 3.5% from USD 650 million in 2022 to over USD 860 million by 2030 [6].

Year-by-Year Projection

| Year |

Estimated Global Sales (USD Million) |

Growth Rate |

| 2023 |

670 |

3.1% |

| 2024 |

695 |

3.8% |

| 2025 |

720 |

3.6% |

| 2026 |

750 |

4.1% |

| 2027 |

785 |

4.7% |

| 2028 |

820 |

4.4% |

| 2029 |

855 |

4.4% |

| 2030 |

860 |

0.6% |

The plateau towards 2030 reflects market saturation in mature regions, with growth primarily driven by emerging markets, increased transplant numbers, and autoimmune disease prevalence.

Strategic Opportunities

-

Formulation Innovations

Developing formulations with improved safety or reduced toxicity could reinvigorate sales, especially if they facilitate easier administration or monitoring.

-

Market Expansion

Targeting regions with burgeoning transplant programs and autoimmune disease awareness offers growth potential.

-

Partnerships and Licensing

Collaborations with biotech firms to explore new indications or combination therapies could expand use cases.

-

Regulatory Engagement

Proactive safety monitoring and updated labeling can mitigate compliance risks and sustain access.

Conclusion

IMURAN remains a key player within the immunosuppressive market, benefiting from its affordability and extensive clinical history. While facing stiff competition from biologics and newer small molecules, its established position, especially in cost-sensitive markets, underpin continued sales growth. Targeted regional expansion, formulation optimization, and strategic collaborations will be vital to sustaining its market share through 2030.

Key Takeaways

- The global azathioprine market is projected to grow moderately, with a CAGR of approximately 3.5%, reaching USD 860 million by 2030.

- The primary market drivers include increased autoimmune disease prevalence, transplant procedure growth, and cost considerations.

- Competition from biologics and safety concerns pose challenges; thus, differentiation through formulations and regional expansion is valuable.

- Emerging markets present significant growth opportunities due to increasing healthcare access.

- Regulatory compliance and safety monitoring will remain critical to maintain market acceptability.

FAQs

-

What factors most significantly influence IMURAN's market growth?

Rising autoimmune disease prevalence, expanding organ transplant procedures, and cost advantages in developing regions drive growth. Competition from newer therapies and safety concerns act as market limitations.

-

How does IMURAN compare to newer immunosuppressants?

While azathioprine offers affordability and long-term clinical experience, biologics and targeted small molecules often provide improved safety profiles and efficacy, influencing replacement trends in certain regions.

-

What regions are expected to offer the highest growth potential?

The Asia-Pacific region, notably China and India, due to expanding healthcare infrastructure, rising autoimmune disease diagnoses, and increasing transplant activities, holds robust growth potential.

-

What challenges could impact sales projections of IMURAN?

Regulatory restrictions, safety concerns, patent expiries leading to generic competition, and shifts toward targeted therapies may inhibit sales growth.

-

Are there opportunities for IMURAN in combination therapies?

Yes. Combining azathioprine with biologics or other immunomodulators could enhance efficacy, though approval pathways and safety profiles need careful evaluation.

References

[1] Allied Market Research. "Immunosuppressants Market Analysis," 2022.

[2] McInnes IB, et al. "The Pathogenesis of Rheumatoid Arthritis," Nat Rev Rheumatol, 2011.

[3] European Medicines Agency. "Assessment Reports for Immunosuppressive Agents," 2022.

[4] U.S. Census Bureau. "Healthcare Market Data," 2022.

[5] Global Autoimmune Disease Market Report, 2021.

[6] Industry analyst estimates based on IQVIA data and market reports, 2022.