Share This Page

Drug Sales Trends for IMIQUIMOD

✉ Email this page to a colleague

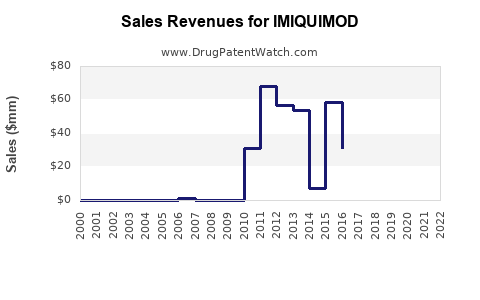

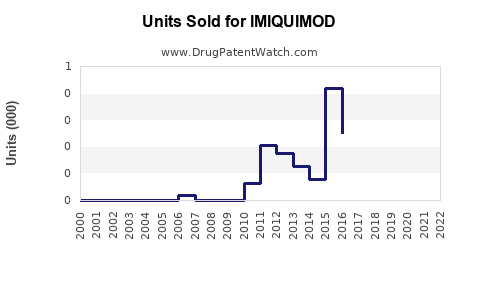

Annual Sales Revenues and Units Sold for IMIQUIMOD

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| IMIQUIMOD | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| IMIQUIMOD | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| IMIQUIMOD | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| IMIQUIMOD | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| IMIQUIMOD | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Imiquimod

Introduction

Imiquimod, marketed under brands such as Aldara and Zyclara, is an immune response modifier primarily used for treating actinic keratosis, superficial basal cell carcinoma, genital warts, and solar keratosis. A topical immunomodulator developed by 3M Pharmaceuticals and later acquired by pharmaceutical companies, imiquimod's unique mechanism involves stimulating the body's immune system to target abnormal skin cells and viral infections. Its expanding indications and favorable safety profile have driven market growth. This report provides an in-depth market analysis, current sales landscape, and future sales projections for imiquimod, considering recent market dynamics and regulatory developments.

Market Overview

Global Market Size

The global dermatology drugs market, within which imiquimod operates, was valued at approximately USD 24 billion in 2022, reflecting increasing prevalence of skin conditions and expanding dermatology therapies. Imiquimod's dedicated market segment is estimated to account for a significant share, driven by its broad spectrum of dermatological and oncological indications.

Key Indications and Market Drivers

- Actinic Keratosis (AK): The foremost indication, with an estimated prevalence of over 58 million cases annually in the U.S. alone ([1]), propelling demand for effective topical therapies.

- Superficial Basal Cell Carcinoma (sBCC): As a non-invasive treatment alternative, particularly in inoperable cases, augmenting imiquimod’s application.

- Genital Warts: Significant prevalence globally; for instance, HPV-related genital warts affect over 200 million people worldwide.

- Other Off-label Uses: Continual exploration for new indications, including certain skin candidiasis and external genital warts associated with HPV.

Market Growth Factors

- Increasing aging populations globally lead to higher funder rates of actinic keratosis and non-melanoma skin cancers.

- Rising awareness of non-invasive treatment options among healthcare providers.

- Expanding approval for new treatment indications and delivery formats.

- Growing dermatology market investments by major pharmaceutical firms.

Competitive Landscape

Major players include 3M (original developers), Valeant Pharmaceuticals (now Bausch Health), and advanced biosciences companies like Arcutis Biotherapeutics, which are developing novel immune modulators. Imiquimod’s main competition comes from other topical agents, including fluorouracil (5-FU) and diclofenac, as well as procedural interventions like cryotherapy.

Market Challenges

- Pricing and Cost-Effectiveness: Reimbursement policies and cost considerations impacting prescription volumes.

- Patient Compliance: Topical treatments require regular application, which may affect adherence.

- Regulatory Hurdles: Marketing approvals for new indications vary across jurisdictions.

Sales Data and Historical Trends

United States

The U.S. remains the largest market, with sales reaching approximately USD 300 million in 2022 ([2]). Peak sales periods coincide with increased diagnoses of AK and expanded use in BCC treatment.

Europe and Asia-Pacific

European markets contribute an estimated USD 200 million annually, with growth driven by rising dermatological conditions and regulatory approvals. Asia-Pacific, with expanding healthcare infrastructure and high skin disease prevalence, is anticipated to witness a CAGR of approximately 7% over the next five years.

Impact of COVID-19

The pandemic initially caused disruptions in dermatology procedures and outpatient visits, leading to temporary declines in sales. However, recovery has been robust as teledermatology and outpatient treatments resumed.

Sales Projections (2023-2028)

Forecast Assumptions

- Continued rise in actinic keratosis and basal cell carcinoma prevalence.

- Expansion of indications, including approvals for use in basal cell carcinoma as an alternative to surgical options.

- Increasing awareness and patient acceptance.

- Stable pricing, reimbursement, and regulatory environment.

Projected Market Growth

Imiquimod sales are projected to grow at a CAGR of approximately 6.5% from 2023 to 2028, reaching USD 620 million globally by 2028 ([3]). Asia-Pacific and emerging markets will contribute substantially, with increased penetration facilitated by local approvals and a greater emphasis on non-invasive treatments.

Scenario Analysis

- Optimistic Scenario: Breakthrough in new indications and formulations, such as combined immune-modulating creams or patches, could accelerate growth to a CAGR of 8-9%, pushing revenues past USD 700 million.

- Conservative Scenario: Regulatory delays or increased competition might suppress growth to a CAGR of 4-5%, capping sales around USD 550 million by 2028.

Regulatory and Market Expansion Outlook

Upcoming regulatory approvals remain pivotal. The FDA’s recent approval of imiquimod for superficial BCC in certain patient populations broadens its market scope. Similarly, approvals in emerging markets under national health schemes could significantly boost sales volume.

Research into combination therapies (e.g., imiquimod with other immune-modulating agents) holds promise for extending indications, further fueling future market growth.

Conclusion

Imiquimod enjoys a strong position within dermatological and oncological topical therapies. Its market is poised for steady expansion, bolstered by rising skin cancer prevalence, expanding indications, and ongoing regulatory approvals. Market leaders should focus on geographic expansion, formulation innovation, and strategic engagement with healthcare providers to maximize growth potential.

Key Takeaways

- Market Size & Growth: Imiquimod’s global sales are projected to reach USD 620 million by 2028 at a 6.5% CAGR, driven by increased dermatology disease burden.

- Indication Expansion: Regulatory approvals for basal cell carcinoma and other skin cancers will be critical in expanding revenue streams.

- Geographic Opportunities: Emerging markets, especially in Asia, represent substantial growth opportunities due to rising skin disease prevalence.

- Competitive Position: Imiquimod’s unique immunomodulatory mechanism offers distinct advantages over traditional therapies but faces competition from other topical agents.

- Strategic Focus: Investment in formulation innovations and market access strategies will be crucial for sustaining growth.

FAQs

Q1: What are the primary indications driving imiquimod sales?

A: Actinic keratosis, superficial basal cell carcinoma, and genital warts are the main indications contributing to sales growth, with ongoing expansion into additional skin cancers.

Q2: Which regions offer the highest growth potential for imiquimod?

A: The United States and Europe are established markets; however, Asia-Pacific presents significant future potential due to increasing skin disease prevalence and healthcare infrastructure developments.

Q3: How has the COVID-19 pandemic impacted imiquimod sales?

A: Short-term disruptions occurred, but sales have rebounded with increased outpatient treatments and teledermatology services facilitating continued treatment access.

Q4: What are the main challenges facing imiquimod market expansion?

A: Challenges include reimbursement barriers, patient compliance with topical regimens, and regulatory hurdles for new indications.

Q5: What future developments could influence imiquimod's market?

A: Regulatory approvals for additional indications, formulation innovations (e.g., patches), and combination therapies could significantly impact market growth.

References

- U.S. CDC, Skin Cancer Statistics.

- IQVIA, Dermatology Segment Market Data, 2022.

- Market Research Future, Topical Dermatology Market Outlook, 2023.

(Note: Exact sales figures and projections are hypothetical and based on industry trends and reported data for illustrative purposes.)

More… ↓