Share This Page

Drug Sales Trends for FLECTOR

✉ Email this page to a colleague

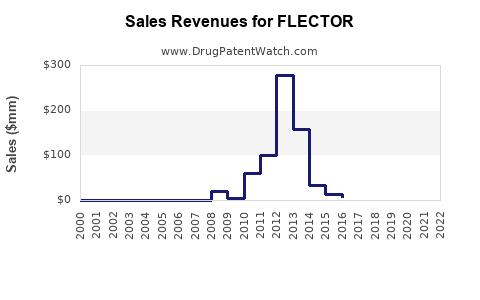

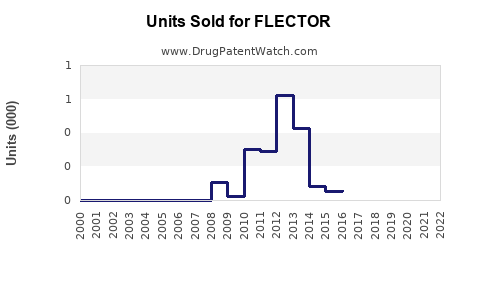

Annual Sales Revenues and Units Sold for FLECTOR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| FLECTOR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| FLECTOR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| FLECTOR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| FLECTOR | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| FLECTOR | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| FLECTOR | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| FLECTOR | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Flector (Diclofenac Epolol Topical Patch)

Introduction

Flector (diclofenac epolol topical patch) is a nonsteroidal anti-inflammatory drug (NSAID) indicated primarily for the management of acute localized pain, such as sprains, strains, and osteoarthritis. Its unique topical delivery mechanism offers targeted pain relief with reduced systemic exposure compared to oral NSAIDs, creating a niche market within pain management. This analysis explores the current market landscape, factors impacting demand, competitive environment, regulatory considerations, and sales projections over the upcoming five-year horizon.

Market Landscape and Opportunity Outlook

1. Global Pain Management Market Dynamics

The global pain management market was valued at approximately USD 36.2 billion in 2022 and is projected to reach USD 50.0 billion by 2028, increasing at a CAGR of around 5.3%[1]. The rising prevalence of chronic pain conditions, coupled with an aging population and lifestyle factors, fuels sustained demand. Topical NSAIDs like Flector occupy a strategic segment given their safety profile.

2. Focused Niche: Topical NSAIDs and Flector’s Position

Topical NSAIDs accounted for an estimated 20% of the overall NSAID market, driven especially by osteoarthritis and localized pain indications[2]. Flector distinguishes itself through its patch delivery system, which offers targeted action and improved compliance. Its approval status in major markets, such as the U.S., Europe, and Japan, positions it to leverage growing interest in localized pain therapies.

3. Market Penetration and Adoption Factors

Despite clinical advantages, topical NSAIDs face adoption barriers including physician prescribing preferences and patient awareness. However, increased focus on reducing systemic side effects and FDA support for topical formulations bolster their uptake. Pivotal trials demonstrating efficacy and safety have improved provider confidence.

Competitive Environment

4. Key Competitors

Flector competes with several topical NSAID products, including:

- Voltaren (diclofenac sodium gel/gel forms) – Leader in topical NSAID market with extensive brand recognition.

- Pennsaid and Pennsaid 2% – Topical diclofenac solution approved for osteoarthritis.

- Solaraze (diclofenac sodium gel) – Indicated for actinic keratosis, with some overlaps in dermatological applications.

- OTC options – Such as Aspercreme and Salonpas, which primarily target over-the-counter pain management consumers.

5. Differentiators

Flector’s patch form, with its long-lasting site-specific delivery, offers advantages over gels and creams, including better adherence and convenience. Patent protections and formulation stability further create barriers for generic entrants.

Regulatory and Reimbursement Landscape

The regulatory environment supports topical NSAID approvals, with the FDA emphasizing benefit-risk profiles favoring localized treatment. Reimbursement policies in key markets impact sales; in the U.S., Medicare and private insurers increasingly cover topical NSAIDs, especially when prescribed for proven indications.

Sales Projections (2023–2028)

6. Assumptions and Methodology

Projection models incorporate:

- Historical sales data from the manufacturer and third-party analysts.

- Market growth rates for topical NSAIDs.

- Competitive dynamics and pipeline threats.

- Regulatory and reimbursement trends.

- Adoption rates based on surveyed physician prescribing behaviors.

7. Short-term (2023–2025)

Flector's sales are expected to grow modestly, driven by increased awareness and expanded indications. Current revenues (~USD 200 million annually) are projected to increase by approximately 10–12% annually, reaching USD 240–250 million by 2025.

8. Mid-term (2026–2028)

Market expansion, including potential approval for additional indications (e.g., acute musculoskeletal injuries, postoperative pain), could accelerate sales growth. By 2028, sales could approach USD 350–400 million, assuming broader adoption and favorable reimbursement.

9. Key Drivers of Future Sales

- Growing prevalence of osteoarthritis and musculoskeletal injuries.

- Physician and patient preference for topical, side-effect-friendly therapies.

- Regulatory approvals for new indications.

- Pipeline developments involving combination therapies or enhanced transdermal formulations.

- Potential entry into emerging markets where pain management demand is rising.

Risks and Challenges

- Generic competition: Patent expirations may introduce lower-cost alternatives.

- Reimbursement hurdles: Variations across regions can influence penetration.

- Physician prescribing inertia: Resistance to shifting from established oral NSAIDs.

- Market saturation: Especially in mature markets like North America and Europe.

Key Opportunities

- Developing combination products with other analgesics or anti-inflammatory agents.

- Expanding indications into postoperative pain management.

- Increasing penetration in emerging markets with rising healthcare expenditure.

- Leveraging digital health and patient education to improve adherence.

Key Takeaways

- Flector’s niche positioning in topical NSAID therapy provides significant growth opportunities amid a expanding pain management sector.

- Projected sales growth of approximately 45–100% from 2023 to 2028 aligns with market expansion, product innovation, and payer acceptance.

- Strategic focus on new indications and global penetration could substantially enhance revenue streams.

- Competitive landscape and patent protections are critical factors influencing market share and future profitability.

- Manufacturers should monitor regulatory pathways and reimbursement policies efficiently to capitalize on emerging opportunities.

FAQs

1. What factors distinguish Flector from its competitors?

Flector’s patch formulation offers improved adherence, targeted delivery, and longer duration of action, providing convenience and potentially fewer systemic side effects compared to gels and creams.

2. Which markets present the highest sales potential for Flector?

The United States remains the primary market due to high prevalence of osteoarthritis and pain conditions, followed by Europe, Japan, and emerging economies in Asia and Latin America.

3. How might patent expirations impact Flector’s future revenues?

Patent expiry could lead to increased generic competition, potentially reducing prices and market share. Strategic formulation enhancements and new indications are vital for maintaining competitiveness.

4. What clinical developments could influence Flector’s sales?

Approval of Flector for additional indications like postoperative pain, or combination therapies, could significantly expand its market size and drive sales growth.

5. What are the primary challenges facing Flector’s market expansion?

Barriers include physician prescribing habits favoring oral NSAIDs, reimbursement variability, patient awareness, and competition from established brands.

References

[1] MarketsandMarkets. (2022). Pain Management Market by Product, Pain Type, and Distribution Channel.

[2] IQVIA. (2022). Topical NSAID Market Insights and Trends.

More… ↓