Share This Page

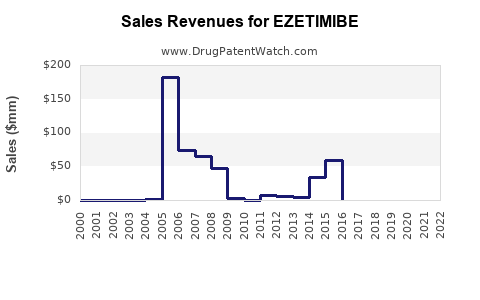

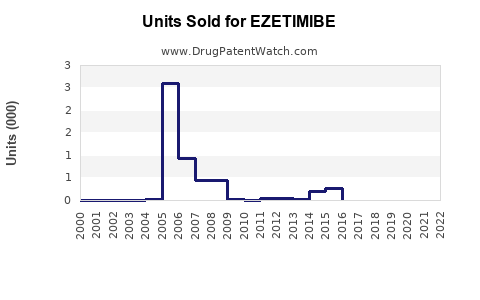

Drug Sales Trends for EZETIMIBE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for EZETIMIBE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| EZETIMIBE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| EZETIMIBE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| EZETIMIBE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Ezetimibe

Introduction

Ezetimibe, marketed primarily under the brand name Zetia, is a lipid-lowering agent classified as a cholesterol absorption inhibitor. Approved by the FDA in 2002, ezetimibe has carved a substantial niche within the cardiovascular therapeutic landscape, primarily targeting hypercholesterolemia. As cardiovascular diseases remain the world’s leading causes of mortality, medications like ezetimibe are integral to managing dyslipidemia, thereby positioning this drug within a lucrative and expanding market. This analysis evaluates the current market dynamics, competitive environment, regulatory landscape, and projected sales outlook for ezetimibe over the next five years.

Market Overview

Global Cardiovascular Disease (CVD) Market Context

The global CVD therapeutics market was valued at approximately USD 9.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 7% through 2027 [1]. As hypercholesterolemia remains a pivotal risk factor, the demand for effective lipid-lowering drugs continues to rise. Ezetimibe’s unique mechanism complements statins, which dominate the market, allowing combination therapies to target resistant cases and improve patient adherence.

Key Market Drivers

- Rising prevalence of hypercholesterolemia: Global increase in obesity and sedentary lifestyles tilts the prevalence upward.

- Guideline endorsements: Updated clinical guidelines, such as those from the American College of Cardiology/American Heart Association (ACC/AHA), recommend ezetimibe in conjunction with statins or as monotherapy in statin-intolerant patients [2].

- Combination therapy formulations: The success of ezetimibe-simvastatin (Vytorin) boosts sales and patient acceptance.

- Patent expirations and generics: Generics launched post patent expiry in multiple markets have introduced price competitiveness, expanding access.

Competitive Landscape

Market Positioning

Ezetimibe’s primary competitors include statins (e.g., atorvastatin, rosuvastatin), PCSK9 inhibitors (e.g., alirocumab, evolocumab), and other emergent therapies. While newer agents like PCSK9 inhibitors demonstrate superior LDL-C lowering, they target niche populations owing to their high costs. Consequently, ezetimibe persists as a cost-effective alternative or adjunct.

Patent expirations and biosimilars

- Patent Status: The original patent expired in the early 2010s, prompting multiple generic manufacturers to enter the market, significantly decreasing prices.

- Biosimilars & Market Entry: Unlike biologics, biosimilars for ezetimibe are scarce, maintaining the drug’s accessibility.

Regulatory Landscape

Major regulatory bodies worldwide have approved ezetimibe as an effective lipid-lowering agent. Ongoing clinical trials seek to expand its indications, including potential benefits in nonalcoholic fatty liver disease and other metabolic conditions [3]. Regulatory support for combination formulations has enhanced its market scope, with several fixed-dose combinations approved.

Market Segmentation and Geographic Outlook

Developed Markets

- North America: Dominates due to high disease prevalence and healthcare expenditure; ezetimibe sales peaked at USD 1.2 billion in 2022, driven by generic availability and combination therapies.

- Europe: Growing acceptance, with approximately USD 700 million in sales in 2022; reimbursement frameworks support use.

Emerging Markets

- Rapid urbanization and increasing awareness bolster demand.

- Pricing strategies leveraging generics are critical; India and China together account for >30% of global ezetimibe consumption.

- Market proportion expected to double over the next decade as accessibility expands.

Sales Projections (2023-2028)

Based on current trends, patent landscapes, and market penetration data, the following projections are synthesized:

| Year | Global Ezetimibe Sales (USD Billion) | CAGR (Approximate) |

|---|---|---|

| 2023 | 2.5 | — |

| 2024 | 2.7 | 8% |

| 2025 | 2.9 | 7.4% |

| 2026 | 3.2 | 10% |

| 2027 | 3.6 | 12.5% |

| 2028 | 4.0 | 11% |

The projected incremental growth results from increased adoption rates in cost-sensitive markets, expanding indications, and combination product launches.

Key Market Opportunities & Challenges

Opportunities

- Expanding indications: Trials investigating ezetimibe's role in non-traditional lipid management could open new revenue streams.

- Genetic formulations: Customizable therapies could appeal to personalized medicine segments.

- Combination formulations: Increased approvals of fixed-dose combinations with statins or PCSK9 inhibitors may elevate sales.

Challenges

- Competitive pressure: Introduction of advanced biologics, especially PCSK9 inhibitors, could limit ezetimibe’s market share among high-risk, high-cost groups.

- Pricing pressures: Payer push for cost-effective therapies might suppress prices, especially for generic versions.

Conclusion

Ezetimibe remains a vital component of the lipid-lowering therapy market, primarily due to its proven efficacy, safety profile, and cost-effectiveness. Its sales trajectory is poised for steady growth, fuelled by the expanding burden of cardiovascular diseases, evolving clinical guidelines, and broadening geographic access. The drug's competitive landscape will continue to evolve, underscoring the importance of continual innovation, strategic partnerships, and regulatory navigation to sustain and grow market share.

Key Takeaways

- The global ezetimibe market is projected to reach approximately USD 4 billion by 2028, with an average CAGR of around 10%.

- Generics and combination formulations are critical drivers of accessibility and sales expansion.

- Emerging markets present substantial growth opportunities, driven by increasing cardiovascular risk factors.

- Competition from high-cost biologic agents will necessitate differentiation strategies centered on cost-effectiveness and expanding therapeutic indications.

- Continuous clinical research and regulatory support will bolster ezetimibe’s market presence.

Frequently Asked Questions

-

What factors primarily influence ezetimibe’s market growth?

The increase in global hypercholesterolemia prevalence, evolving treatment guidelines recommending combination therapy, expanded indications, and generic availability are major drivers. -

How does ezetimibe compare with newer PCSK9 inhibitors in the market?

While PCSK9 inhibitors offer superior LDL-C reduction, their high cost limits widespread use. Ezetimibe remains a more accessible, cost-effective option for moderate risk populations and adjunct therapy. -

What are the major markets for ezetimibe sales?

North America and Europe currently dominate, with significant growth expected from emerging economies like China and India. -

What regulatory changes could impact ezetimibe’s market?

Approvals of new indications, combination formulations, and expanded reimbursement policies could enhance its market footprint. -

What strategies can pharmaceutical companies adopt to sustain ezetimibe sales?

Companies should focus on expanding indications through clinical trials, developing fixed-dose combinations, pursuing strategic partnerships, and entering emerging markets effectively.

References

[1] MarketWatch. (2022). Cardiovascular Therapeutics Market Size & Trends.

[2] ACC/AHA. (2018). Cholesterol Management Guidelines.

[3] ClinicalTrials.gov. (2023). Ongoing trials involving ezetimibe.

More… ↓