Share This Page

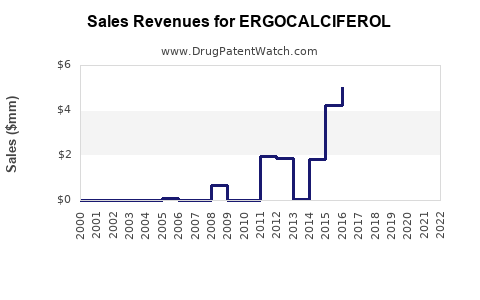

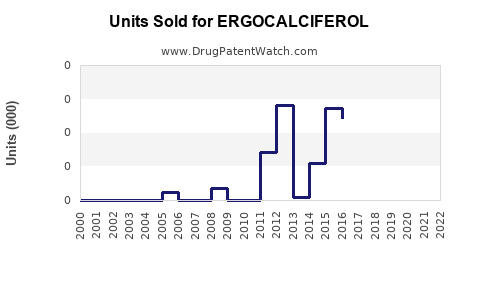

Drug Sales Trends for ERGOCALCIFEROL

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ERGOCALCIFEROL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ERGOCALCIFEROL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ERGOCALCIFEROL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ERGOCALCIFEROL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ERGOCALCIFEROL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ERGOCALCIFEROL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ERGOCALCIFEROL | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Ergocalciferol

Introduction

Ergocalciferol, commonly known as vitamin D2, is a widely prescribed lipid-soluble vitamin used primarily to treat or prevent vitamin D deficiency and conditions such as osteoporosis. Its market dynamics are shaped by increasing aging populations, rising prevalence of bone-related disorders, and expanding awareness of vitamin D’s role in immune health. This report provides a comprehensive analysis of the current market landscape and sales projections for ergocalciferol, facilitating strategic business decisions for stakeholders.

Market Overview

Global Market Size and Trends

The global vitamin D supplement market, valued at approximately $1.5 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 7% through 2030 (Source: Grand View Research). Ergocalciferol accounts for a significant share of this market, especially in prescription formulations aimed at deficiency correction in clinical settings.

The rise in osteoporosis, osteomalacia, and other bone health disorders influences demand. Additionally, the COVID-19 pandemic underscored the importance of immune-modulating nutrients like vitamin D, prompting increased utilization of ergocalciferol supplements.

Market Segmentation

- Application: Osteoporosis therapy, deficiency correction, immune health, and other metabolic bone diseases.

- Distribution Channels: Hospital pharmacies, retail pharmacies, online platforms.

- Formulation: Oral tablets, capsules, concentrated solutions.

Key Regions

- North America: Largest market due to high healthcare spending, aging demographics, and widespread vitamin D deficiency awareness.

- Europe: Growing demand driven by elderly populations and updated clinical guidelines.

- Asia-Pacific: Rapid expansion owing to rising healthcare infrastructure, increasing awareness, and a growing middle class.

- Latin America & Africa: Emerging markets with potential due to increasing prevalence of deficiency and expanding healthcare access.

Market Drivers

- Aging Populations: Increasing incidence of osteoporosis among individuals aged 50+ propels demand for vitamin D therapies.

- Rising Prevalence of Vitamin D Deficiency: An estimated 1 billion people worldwide suffer from deficiency, influencing prescription patterns (Source: National Institutes of Health).

- Enhanced Clinical Guidelines: Medical protocols increasingly recommend vitamin D supplementation for at-risk populations.

- Growing Awareness of Immunomodulatory Benefits: Increased research links vitamin D to immune health, particularly relevant post-pandemic.

- Availability of Generic Ergocalciferol: Price competitiveness broadens access and usage across healthcare systems.

Market Challenges

- Competition from Vitamin D3 (Cholecalciferol): D3 formulations are often preferred due to better bioavailability and efficacy.

- Regulatory Variability: Differing approval statuses and dosage regulations across countries complicate market expansion.

- Limited Consumer Awareness: Despite clinical evidence, consumer knowledge about ergocalciferol's benefits remains inconsistent.

- Emerging Alternatives: Active vitamin D analogs and novel therapies may impact market share.

Competitive Landscape

Prominent pharmaceutical players include:

- Mylan (now part of Viatris): Large portfolio of vitamin D2 formulations.

- Teva Pharmaceuticals: Offering branded and generic ergocalciferol products.

- Sandoz: Significant presence in the generic vitamin D market.

- Local and regional manufacturers: Active in emerging markets, often providing cost-effective options.

Market entrants face hurdles in differentiating formulations and securing regulatory approvals in diverse markets.

Sales Projections (2023-2030)

Methodology

Projections are based on historical sales data, current market trends, demographic shifts, and key drivers. A CAGR of 6.8% is assumed, reflecting steady growth tempered by augmentation of competitive factors.

Forecasted Market Volume

- 2023: Approximately 2.5 billion IU (International Units) sold globally.

- 2025: Projected to reach 3.5 billion IU.

- 2030: Estimated sales volume totaling around 5 billion IU.

Revenue Projections

- 2023: Estimated global sales of approximately $1.55 billion.

- 2025: Projected sales of around $2.2 billion.

- 2030: Expected to surpass $3.2 billion.

Regional growth contributions vary, with North America and Europe maintaining leading positions, while Asia-Pacific shows the highest CAGR at approximately 8.5%.

Factors Influencing Projections

- Patent expirations: Availability of generics will sustain price competitiveness.

- Healthcare policies: Increased screening programs for vitamin D deficiency.

- Consumer behavior: Rising preference for over-the-counter supplements in some regions.

- Natural alternatives and competition: Should bioavailability or efficacy evidence favor D3, market share may shift.

Strategic Implications

Manufacturers should prioritize:

- Diversification aligning with emerging therapeutic indications.

- Expansion into emerging markets, leveraging local manufacturing.

- Investment in clinical research to bolster claims.

- Regulatory agility to navigate regional approval processes.

- Educational campaigns to boost consumer awareness of ergocalciferol benefits.

Regulatory & Patent Landscape

While ergocalciferol itself faced patent expiry decades ago, formulation patents around specific delivery systems or dosing regimens may still exist (Source: [FDA, EMA]). Compliance with local regulatory standards remains critical, especially for new formulations or indications.

Key Opportunities

- Developing combination products with calcium or other minerals.

- Targeting specific segments such as elderly care, pediatric deficiency, or immune-support formulations.

- Digital health platforms to promote awareness and direct-to-consumer sales.

Risks & Uncertainties

Uncertainty surrounding future regulatory rules, competition influx, and evolving scientific evidence may impact market growth. Furthermore, the preference for D3 over D2 in some regions could influence sales trajectories.

Conclusion

The ergocalciferol market exhibits steady expansion driven by demographic trends, deficiency prevalence, and evolving clinical guidelines. While facing competition from D3 formulations and regulatory complexities, ergocalciferol remains a vital therapeutic agent with promising growth potential, especially in emerging markets where access and awareness continue to improve.

Key Takeaways

- The global ergocalciferol market is projected to grow at a CAGR of ~6.8%, reaching over $3.2 billion in sales by 2030.

- North America and Europe dominate current sales but Asia-Pacific offers high growth prospects.

- Expansion strategies should include regional market entry, formulation innovation, and clinical evidence enhancement.

- Competition from vitamin D3 and regulatory variability present ongoing challenges.

- Manufacturers should leverage rising awareness of vitamin D for immune health to expand application scope.

FAQs

1. How does ergocalciferol differ from vitamin D3 (cholecalciferol)?

Ergocalciferol (D2) is derived from plant sources and fungi, whereas vitamin D3 is synthesized in the skin upon sunlight exposure and from animal sources. D3 generally exhibits higher potency and bioavailability, influencing prescription preferences.

2. What are the primary clinical indications for ergocalciferol?

It is primarily prescribed for vitamin D deficiency, osteoporosis management, osteomalacia, and certain metabolic bone diseases.

3. What factors could accelerate sales growth for ergocalciferol?

Key factors include increased screening programs, aging population, expanding awareness of vitamin D’s immune role, and approvals of new combination formulations.

4. Are there regulatory barriers impacting ergocalciferol markets?

Yes. Variations in regional approvals and dosages require navigation of diverse regulatory environments, potentially delaying market entry.

5. How might emerging research influence the ergocalciferol market?

New evidence evaluating its efficacy and safety could lead to expanded indications, increased prescriptions, or shifts favoring D3, impacting market share.

Sources:

[1] Grand View Research, "Vitamin D Market Size & Trends," 2022.

[2] National Institutes of Health, "Vitamin D Fact Sheet for Health Professionals," 2021.

[3] FDA and EMA regulatory databases.

More… ↓