Last updated: July 29, 2025

Introduction

DIABETA, a prominent oral hypoglycemic agent containing the active ingredient gliclazide, occupies a significant position in the management of type 2 diabetes mellitus. As a second-generation sulfonylurea, DIABETA's efficacy, safety profile, and market dynamics influence its sales trajectory. This comprehensive analysis evaluates current market conditions, competitive landscape, demand drivers, and future sales projections to inform strategic decisions for stakeholders.

Market Overview

Global Diabetes Landscape

Diabetes mellitus affects over 537 million adults worldwide, with projections estimating an increase to 643 million by 2030 and 783 million by 2045, according to the International Diabetes Federation (IDF)[1]. The rising prevalence directly amplifies demand for effective therapeutic options like DIABETA.

Diabetes Treatment Paradigms

Management strategies for type 2 diabetes involve lifestyle modification and pharmacotherapy. Oral agents, especially sulfonylureas, remain cornerstone treatments due to their cost-effectiveness and long-standing clinical use. Despite advents of novel agents such as SGLT2 inhibitors and GLP-1 receptor agonists, sulfonylureas continue to be prescribed, particularly in low-to-middle-income regions.

Position of DIABETA

As a well-established gliclazide formulation, DIABETA benefits from proven efficacy, favorable safety data, and penetrated key markets including Europe, Asia, and Latin America. Its pharmacological profile offers advantages over older sulfonylureas by reducing hypoglycemia risk, making it preferable in certain patient populations.

Market Size and Segmentation

Current Market Valuation

The global oral antidiabetic drugs market was valued at approximately USD 46 billion in 2022 and is projected to grow at a CAGR of 7-8% over the next five years[2]. DIABETA's segment primarily resides within the sulfonylurea subset, which, despite declining relative share, remains substantial due to cost considerations.

Regional Dynamics

- Europe: High adoption rate driven by established healthcare infrastructure; DIABETA’s availability and regulatory approvals support steady sales.

- Asia-Pacific: Region exhibiting the highest growth owing to escalating diabetes prevalence, increasing healthcare spending, and cost-sensitive treatment approaches favoring older agents like gliclazide.

- Latin America and Africa: Markets with significant growth potential due to expanding access to affordable diabetes management medications.

Competitive Landscape

Key Competitors

- Glimepiride (Amaryl): Popular second-generation sulfonylurea with broad global use.

- Glyburide (Diabeta): Older sulfonylurea with declining usage due to hypoglycemia concerns.

- Repaglinide and Nateglinide: Meglitinides offering alternative mechanisms.

- Emerging Generic Brands: Increased competition from generic gliclazide formulations.

Differentiators and Barriers

DIABETA’s differentiators include reduced hypoglycemia risk compared to first-generation sulfonylureas, favorable tolerability profile, and cost advantage. Barriers involve preferences for newer agents in certain markets, patent expirations affecting pricing, and regulatory challenges.

Demand Drivers

- Growing Diabetes Prevalence: The primary driver, expanding patient bases globally.

- Cost-Effectiveness: Particularly in emerging markets, affordability sustains demand for gliclazide-based therapies.

- Physician Preference: Long-standing clinical evidence supports sulfonylurea use; physician familiarity sustains prescriptions.

- Regulatory Approvals and Formulations: Expanded indications and fixed-dose combinations enhance market reach.

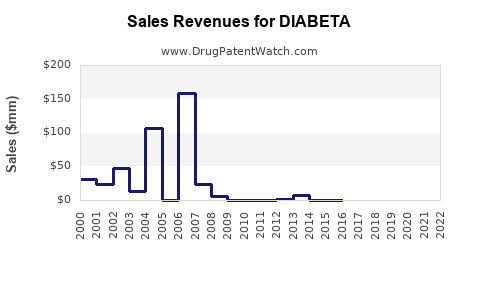

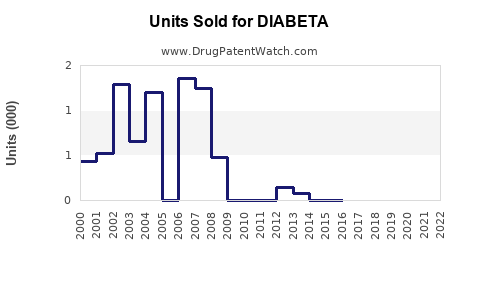

Sales Projections (2023-2028)

Methodology

Projections integrate epidemiological data, market growth rates, competitive shifts, and regulatory trends using a CAGR-driven model aligned with regional economic and healthcare developments. Assumptions include steady adoption of DIABETA where approved and maintained market share within the sulfonylurea segment.

Projection Highlights

- 2023: USD 350 million globally, reflecting mature markets and increasing prevalence.

- 2024-2025: CAGR of approximately 5%, driven by emerging markets' rapid expansion.

- 2026-2028: Stabilization around USD 450–500 million, accounting for market saturation in mature regions and acceleration in emerging markets.

Regional Growth Estimates

- Asia-Pacific: Highest CAGR (~8%), driven by rising affordability and healthcare infrastructure.

- Europe: Moderate CAGR (~3–4%), with sales plateauing as newer agents gain prominence.

- Latin America/Africa: Significant growth (~6–7%) due to market penetration and rising diabetes burden.

Strategic Factors Impacting Future Sales

- Regulatory Environment: Approvals or restrictions influence availability.

- Innovation and Formulation Improvements: Fixed-dose combinations with metformin and other agents can capture share.

- Pricing Strategies: Generics and biosimilars may competitively lower prices, expanding access.

- Healthcare Policy and Reimbursement: Government initiatives promoting affordable diabetes treatment enhance sales.

Risks and Challenges

- Market Shift toward Newer Agents: SGLT2 inhibitors and GLP-1 receptor agonists gaining favor for cardiovascular benefits.

- Generic Competition: Price erosion from generics, impacting margins.

- Regulatory Hurdles: Delays or denials can hinder market expansion.

- Patient Preference and Physician Prescribing Habits: Resistance to shift from traditional treatments.

Conclusion

DIABETA's enduring market presence hinges on its cost-effectiveness, established efficacy, and favorable safety profile amidst evolving diabetes management practices. While the trajectory indicates steady growth—particularly in cost-sensitive and emerging markets—competition from innovative therapies necessitates strategic positioning. Continuous innovation, localized pricing, and expanding indications are vital to sustain and enhance DIABETA's sales.

Key Takeaways

- The global diabetic population surges underpin ongoing demand for long-standing oral therapies like DIABETA.

- Emerging markets present significant growth opportunities due to increasing prevalence and affordability.

- Competition from newer agents remains a challenge; differentiation relies on cost, safety, and proven efficacy.

- Sales are projected to grow at a CAGR of approximately 5-8% over the next five years, reaching USD 450–500 million globally.

- Strategic initiatives should include formulary expansion, combination therapies, and market-specific price strategies to maximize revenue.

FAQs

1. What factors contribute to DIABETA’s competitive advantage over other sulfonylureas?

DIABETA (gliclazide) offers a reduced risk of hypoglycemia and better tolerability compared to first-generation sulfonylureas. Its established clinical profile and favorable safety underscore its appeal, especially in populations prone to hypoglycemia.

2. How will emerging therapies impact DIABETA’s market share?

Newer agents like SGLT2 inhibitors and GLP-1 receptor agonists are gaining popularity due to additional benefits such as cardiovascular protection. While these may limit DIABETA’s growth in some markets, its affordability and familiarity support continued demand, particularly in cost-sensitive regions.

3. Which regions will drive the highest sales growth for DIABETA?

Asia-Pacific and Latin America are poised for the highest growth, driven by rising diabetes prevalence, expanding healthcare access, and the cost-effectiveness of gliclazide formulations.

4. How might patent expirations influence DIABETA sales?

Patent expirations often lead to increased generic competition, exerting downward pressure on prices but potentially increasing volume sales. Strategic positioning and cost leadership are essential to maintain margins.

5. What strategic actions can manufacturers take to sustain DIABETA’s market position?

Developing fixed-dose combinations, expanding indications, tailoring formulations for specific populations, implementing pricing strategies, and strengthening regulatory approvals can help sustain and augment sales.

References

[1] International Diabetes Federation. (2022). IDF Diabetes Atlas, 10th Edition.

[2] MarketWatch. (2023). "Oral Antidiabetic Drugs Market Size, Share & Trends."