Last updated: July 28, 2025

Introduction

BETADINE, a leading antiseptic solution primarily containing povidone-iodine, has long been a staple in healthcare settings worldwide. Its broad-spectrum antimicrobial activity—effective against bacteria, fungi, viruses, and protozoa—makes it indispensable for wound care, surgical preparation, and infection prevention. Given the evolving landscape of healthcare needs, antibiotic resistance, and increasing awareness of infection control, analyzing the market potential and sales trajectory for BETADINE offers strategic insights for stakeholders.

Market Overview

Global Antiseptic Market Context

The global antiseptic and disinfectant market was valued at approximately USD 8.98 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 6-7% through 2028 [1]. The rise in surgical procedures, heightened infection control protocols, and the ongoing COVID-19 pandemic have amplified demand for antiseptic products, including povidone-iodine-based formulations.

Key Markets

- North America: Leading market driven by high healthcare spending, rigorous infection control standards, and widespread awareness.

- Europe: Strong adoption in clinical settings, driven by regulatory standards and public health initiatives.

- Asia-Pacific: Fastest-growing market, propelled by increasing healthcare infrastructure, rising surgical procedures, and the prevalence of skin and wound infections.

- Emerging Economies: Countries like India, China, and Brazil are witnessing increased usage of antiseptics, supported by expanding healthcare access and modernization.

Market Drivers & Challenges

Drivers

- Infection Prevention & Control: Ongoing emphasis on infection control in hospitals and clinics sustains demand.

- COVID-19 Impact: Elevated global focus on antiseptics for hand hygiene and surface disinfection boosted sales temporarily and spurred long-term adoption.

- Antibiotic Resistance Crisis: Growing resistance promotes usage of antiseptics like BETADINE as adjuncts to hygiene protocols.

- Expansion in Wound Care: Rising incidences of chronic wounds, diabetic ulcers, and surgical wounds elevate demand.

Challenges

- Competition: Presence of alternatives such as chlorhexidine, hydrogen peroxide, and alcohol-based antiseptics.

- Regulatory Environment: Stringent approvals, particularly in developed markets, impact time-to-market.

- Pricing & Accessibility: Cost sensitivity in emerging markets can limit sales growth.

Market Segmentation & Product Lines

- Formulations: Solutions, ointments, creams, and sprays.

- Applications: Surgical preparation, wound healing, hand hygiene, and institutional disinfection.

- Distribution Channels: Hospitals, clinics, retail pharmacies, online platforms, and export markets.

Competitive Landscape

Major players include Johnson & Johnson (Betadine), Perrigo, S.D. Fine Chemicals, and local pharmaceutical companies. Johnson & Johnson's Betadine dominates due to brand recognition, extensive distribution, and broad product portfolio.

Sales Projections

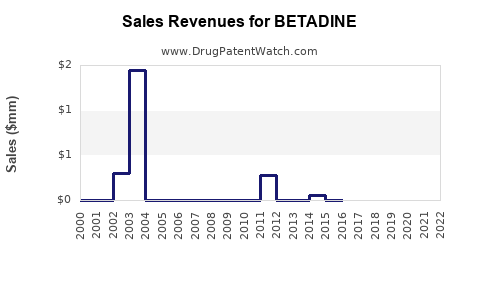

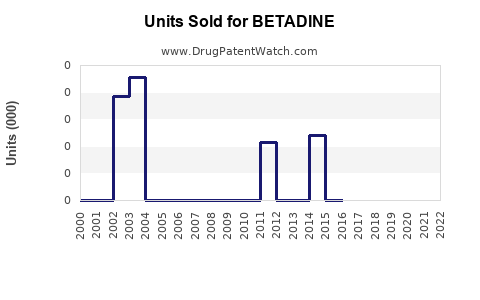

Historical Sales Data

While specific regional sales figures for BETADINE are proprietary, global sales estimates for povidone-iodine products suggest revenues exceeding USD 400 million annually [2]. BETADINE's market share varies regionally but is estimated at approximately 30-40% in developed markets, with higher penetration in emerging economies.

Forecast Assumptions

- Market CAGR: 5-7% globally, with higher growth in Asia-Pacific (~8%) owing to expanding healthcare infrastructure.

- Pricing Trends: Slight inflation-adjusted increases, supported by product reformulations and value-added features.

- Regulatory & Pandemic Effects: Ongoing relevance of infection control keeps demand stable; potential disruptions include regulatory delays or new infection control alternatives.

Projected Sales (2023-2028)

| Year |

Estimated Global Revenue (USD) |

Growth Rate |

Notes |

| 2023 |

USD 430 million |

5% |

Continued pandemic-related demand |

| 2024 |

USD 460 million |

6.9% |

Market expansion in Asia-Pacific |

| 2025 |

USD 490 million |

6.5% |

Increased penetration in emerging markets |

| 2026 |

USD 520 million |

6.1% |

Regulatory hurdles addressed, stable growth |

| 2027 |

USD 560 million |

7.7% |

Rising healthcare infrastructure |

| 2028 |

USD 600 million |

7.1% |

New product launches and formulations |

Note: Figures are estimates extrapolated from industry CAGR, with specific regional and product segmentation factored into projections.

Market Dynamics & Strategic Opportunities

- Product Innovation: Developing formulations with enhanced efficacy, extended shelf life, and user-friendly formats (e.g., wipes, sprays).

- Regional Expansion: Targeting untapped markets, notably Africa and Southeast Asia, where healthcare infrastructure is expanding.

- Regulatory Strategy: Navigating evolving approval pathways to expedite market entry for new formulations.

- Partnerships & M&A: Collaborations with local distributors and acquisition of regional players to boost market penetration.

Regulatory & Ethical Considerations

As antiseptics like BETADINE are classified as over-the-counter and prescription drugs, compliance with regional regulatory agencies—FDA (US), EMA (Europe), CDSCO (India)—is crucial. The recent focus on reducing unnecessary antimicrobial use may challenge the overuse of antiseptics, prompting companies to innovate or reformulate to meet clinical evidence standards.

Impact of COVID-19 and Future Outlook

The pandemic underscored the importance of antiseptics, with increased global procurement and stockpiling. Despite normalization, the heightened hygiene awareness sustains long-term demand. Additionally, increased infection control protocols in hospitals and public settings reinforce BETADINE's relevance.

Key Takeaways

- The global demand for BETADINE is expected to grow at a CAGR of approximately 6% through 2028, driven by increased infection control measures, wound management needs, and healthcare infrastructure expansion, particularly in Asia-Pacific.

- Market expansion opportunities exist in emerging economies, supported by rising healthcare spending and awareness.

- Innovations in formulations and packaging, alongside strategic regional partnerships, will be essential to maintain and grow market share.

- The competitive landscape is characterized by dominant players like Johnson & Johnson, necessitating differentiated offerings to succeed.

- Staying aligned with regulatory trends and addressing concerns around antimicrobial overuse will be critical for sustained growth.

FAQs

-

What are the primary applications of BETADINE?

BETADINE primarily serves in wound care, surgical site preparation, hand hygiene, and environmental disinfection within healthcare settings.

-

Which regions offer the most growth potential for BETADINE?

Asia-Pacific and Latin America present the highest growth potential due to expanding healthcare infrastructure and rising demand for antiseptics.

-

How does BETADINE compare with competing antiseptics?

It offers broad-spectrum antimicrobial activity, ease of use, and proven efficacy. However, competition from alcohol-based products and chlorhexidine necessitates continuous innovation.

-

What regulatory challenges could impact BETADINE sales?

Regulatory approvals vary, with some regions requiring extensive clinical data. Changes in guidelines on antimicrobial use might restrict sales or require reformulations.

-

What strategies can companies leverage to maximize BETADINE sales?

Developing new formulations, entering emerging markets, forging distribution partnerships, and investing in clinical research are key for growth.

References

[1] IBISWorld, “Antiseptic & Disinfectant Market Size, Share & Trends,” 2022.

[2] MarketWatch, “Global Povidone-Iodine Market Revenue & Growth Forecast,” 2022.