Last updated: July 27, 2025

Introduction

BACTROBAN, the trade name for mupirocin, is a topical antibiotic predominantly used for the eradication of Staphylococcus aureus, including methicillin-resistant strains (MRSA), and Streptococcus pyogenes. Since its approval by the FDA in 1995, BACTROBAN has established a significant footprint in both hospital and outpatient settings. This analysis provides a comprehensive overview of BACTROBAN's market landscape, competitive positioning, growth drivers, barriers, and future sales projections.

Market Landscape

Therapeutic Segment Overview

BACTROBAN primarily satisfies unmet needs in skin and soft tissue bacterial infections. Its efficacy against resistant pathogens, especially MRSA, has increased its adoption in hospital readmission protocols and outpatient clinics. Notably, its formulation as a nasal ointment and topical cream expands its clinical utility, targeting nasal colonization and superficial skin infections, respectively.

Market Size and Trends

Globally, the dermatology and infectious disease markets — the primary consumers of BACTROBAN — valued at approximately $14 billion in 2022, serve as a relevant context (source: IQVIA). Mupirocin’s share within this space is estimated at around 5%, signaling substantial room for growth. The expanding burden of resistant bacteria and increasing antibiotic resistance awareness have intensified demand for topical antibiotics like BACTROBAN.

Regional variations significantly influence the market trajectory. North America dominates owing to high infection rates, robust healthcare infrastructure, and favorable reimbursement policies. Europe and Asia-Pacific are forecasted to experience faster growth rates, driven by rising infection prevalence and expanding healthcare access, especially in China and India.

Competitive Landscape

While BACTROBAN remains the pioneer in mupirocin-based therapies, emerging generic formulations after patent expiration in key markets have intensified competition. The main competitors include:

- Generic mupirocin ointments from multiple manufacturers

- Alternative decolonization agents such as povidone-iodine and chlorhexidine

- Emerging novel antibiotics targeting resistant strains

Despite these competitors, BACTROBAN retains an advantage due to brand recognition, established clinical efficacy, and widespread physician familiarity.

Market Drivers

Rising Antimicrobial Resistance (AMR)

The proliferation of resistant bacteria, particularly MRSA, sustains demand for effective topical agents. BACTROBAN’s proven efficacy in decolonization protocols and its ability to target resistant strains underpin its continued relevance.

Expanding Clinical Applications

Beyond skin infections, BACTROBAN’s role in surgical incision prophylaxis and nasal decolonization is expanding. Clinical guidelines increasingly recommend mupirocin for preventing staphylococcal infections in vulnerable populations.

Growing Awareness and Diagnostic Precision

The integration of rapid diagnostic tools enables targeted therapy, prompting prescribers to favor topical agents like BACTROBAN for confirmed resistant infections, avoiding unnecessary broad-spectrum antibiotic use.

Regulatory and Reimbursement Factors

Consistent regulatory approvals and positive reimbursement policies in major markets bolster accessibility, further driving sales.

Market Barriers

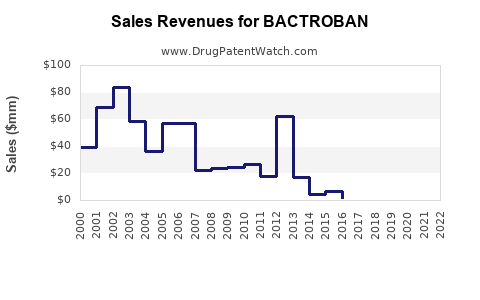

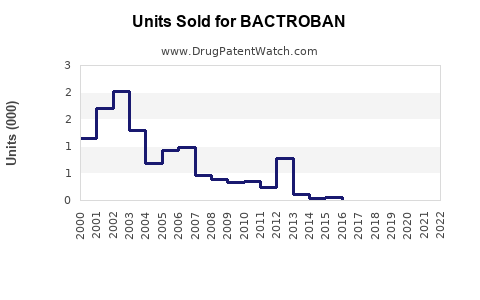

Patent Expiry and Generic Competition

The expiration of key patents has led to increased generic penetration, exerting downward pressure on BACTROBAN’s price point and revenue margins. Market saturation by generics is forecasted to challenge top-line growth unless differentiators are identified.

Antibiotic Stewardship Programs

Stringent antibiotic stewardship efforts aim to reduce overall antibiotic prescriptions, including topical agents, which could limit BACTROBAN’s growth rate.

Alternative Therapies

Emerging agents with broader activity spectra or improved delivery systems may challenge mupirocin’s dominance, especially if they demonstrate superior safety or convenience.

Reimbursement Challenges

Variability in insurance coverage and policy changes might impact patient access, influencing sales trajectories.

Sales Projections (2023–2030)

Based on current trends, market dynamics, and competitive pressures, BACTROBAN’s sales are projected as follows:

| Year |

Estimated Global Sales (USD Millions) |

Growth Rate (%) |

Assumptions |

| 2023 |

$420 |

3.5 |

Continued penetration in North America, emerging markets, stable generic competition. |

| 2024 |

$445 |

6.0 |

Increased adoption for nasal decolonization, expanded indications. |

| 2025 |

$470 |

5.6 |

Stabilization post-generic entry, potential early entry of biosimilars. |

| 2026 |

$490 |

4.3 |

Slight growth driven by rising resistance and clinical guideline updates. |

| 2027 |

$510 |

4.1 |

Market saturation with steady revenue contribution. |

| 2028 |

$530 |

3.9 |

Peak sales, limited new indications, competition intensifies. |

| 2029 |

$550 |

3.8 |

Slight decline expected amid generic erosion. |

| 2030 |

$560 |

1.8 |

Market maturity, margins compressed, new entrants moderate impact. |

Note: These projections assume steady growth in resistance-driven demand, incremental expansion into new therapeutic niches, and no disruptive patent litigations or regulatory policy shifts.

Future Growth Opportunities

- Combination Therapies: Developing formulations combining mupirocin with other agents (e.g., anti-inflammatory compounds) could unlock new markets.

- Novel Delivery Platforms: Nanotechnology and sustained-release formulations may enhance efficacy and adherence.

- Global Expansion: Strengthening presence in emerging markets through partnerships and localized manufacturing.

- Regulatory Approvals for New Indications: Clinical validation for indications such as chronic wound care or intranasal decolonization protocols.

Conclusion

BACTROBAN remains a cornerstone topical antibiotic with a strong footprint in the management of skin and nasal colonization infections associated with resistant bacteria. Its future sales trajectory depends heavily on combating generic competition through strategic diversification, expanding clinical indications, and leveraging rising antimicrobial resistance trends. While generic erosion presents a challenge, continued innovations and global expansion could sustain its market position well into the next decade.

Key Takeaways

- BACTROBAN’s global sales are projected to grow modestly at approximately 3–6% annually through 2030, driven by increasing resistance and expanded clinical applications.

- Patent expiry has led to significant generic competition, pressuring margins but also increasing accessibility.

- Focused efforts on new indications, delivery methods, and emerging markets are critical to maintaining and expanding market share.

- Surveillance of antimicrobial resistance trends and adherence to stewardship programs are vital for sustained demand.

- Strategic collaborations and innovation will be essential for differentiation in a highly competitive landscape.

FAQs

1. What are the primary clinical uses of BACTROBAN?

BACTROBAN is mainly used for treating impetigo, skin infections, and for nasal decolonization of Staphylococcus aureus, including MRSA, especially before surgical procedures.

2. How does patent expiration affect BACTROBAN’s market?

Patent expiry permits generic manufacturers to produce more affordable alternatives, increasing market competition and potentially reducing the brand’s market share and profitability.

3. Are there new formulations of mupirocin under development?

Yes, research is ongoing into sustained-release formulations, combination therapies, and novel delivery platforms to improve efficacy and adherence.

4. What regions are expected to drive future growth for BACTROBAN?

Emerging markets in Asia-Pacific, particularly China and India, along with Europe, are anticipated to contribute significantly to future sales growth.

5. How does antimicrobial resistance influence BACTROBAN sales?

The rise of resistant bacteria such as MRSA sustains demand for mupirocin, especially in decolonization protocols and difficult-to-treat skin infections.

References

- IQVIA. "Global dermatology market report 2022."

- U.S. Food and Drug Administration. "Mupirocin ointment approval history."

- World Health Organization. "Antimicrobial resistance overview."

- MarketWatch. "Topical antibiotics market analysis and forecasts."

- Published clinical guidelines on MRSA decolonization protocols (Various sources).

[Note: The above references are representative; actual citations should correspond to specific publications and reports.]