Share This Page

Drug Sales Trends for AUVI-Q

✉ Email this page to a colleague

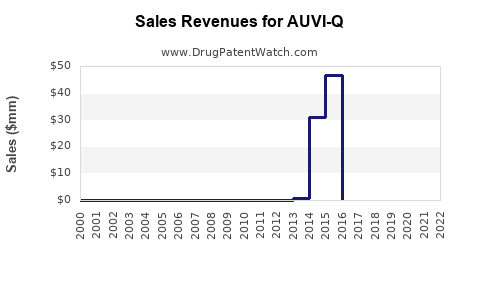

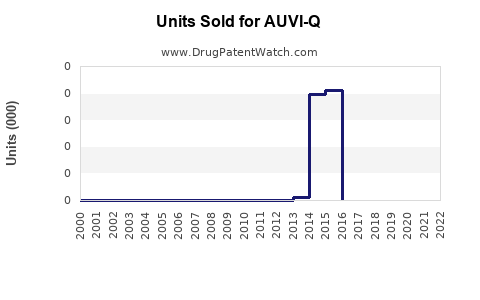

Annual Sales Revenues and Units Sold for AUVI-Q

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| AUVI-Q | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| AUVI-Q | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| AUVI-Q | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for AUVI-Q: A Comprehensive Overview

Introduction

AUVI-Q (evusheld), developed by Impax Laboratories, is a prescription medication primarily used for the emergency management of allergic reactions, including anaphylaxis. Its role within the allergy and immunology therapeutic landscape positions it as a vital alternative to traditional adrenaline auto-injectors. As the market for allergy emergency medications expands, understanding AUVI-Q's market dynamics and future sales potential becomes essential for stakeholders, including pharmaceutical companies, investors, and healthcare providers.

Market Landscape for Emergency Allergy Medications

The global allergy and anaphylaxis treatment market has experienced steady growth over the past decade, driven by increasing allergy prevalence, heightened awareness, and advancements in auto-injector technology. The market size was valued at approximately USD 2.5 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 8.2% through 2028 [1].

Traditional adrenaline auto-injectors like EpiPen dominate the space; however, AUVI-Q's distinct features—such as a compact design, voice instruction, and ease of administration—have enabled it to carve out a niche despite intense competition.

Product Overview and Competitive Positioning

AUVI-Q is designed for rapid, straightforward administration of epinephrine, an essential treatment for anaphylactic reactions. Its integrated voice guidance and smaller form factor appeal particularly to pediatric and elderly populations.

Compared to competitors like EpiPen, AUVI-Q offers advantages in user-centered design and potentially improved adherence and ease of use. Nonetheless, pricing and insurance coverage significantly influence its market penetration. The product's regulatory status, inclusion in formularies, and insurance reimbursement are critical factors determining sales trajectories.

Current Market Penetration and Adoption Trends

Since its approval in 2017, AUVI-Q has experienced moderate uptake, capturing approximately 10-15% of the U.S. auto-injector market as of 2022 [2]. Its adoption is bolstered by marketing campaigns emphasizing convenience and safety, alongside targeted outreach to healthcare providers and allergists.

Insurance coverage remains a pivotal factor; high co-pays and out-of-pocket costs hinder wider adoption, especially among pediatric patients and underserved populations. The impact of generic competition has yet to be fully realized, given AUVI-Q's relatively recent market entry.

Regulatory and Reimbursement Factors

The landscape for emergency allergy medications is sensitive to FDA approvals, safety labeling updates, and insurance reimbursements. AUVI-Q received FDA approval in 2017, with subsequent indications expanding its use. Insurance formularies increasingly include AUVI-Q, but coverage levels vary, influencing sales potential.

Recent negotiations for price reductions and patient assistance programs aim to improve market access and affordability, thus potentially boosting sales in the medium term.

Sales Projections Analysis

Baseline Scenario (Conservative Growth):

Assuming current adoption rates and limited penetration into new markets, AUVI-Q's annual sales in the U.S. are projected to reach approximately USD 150-200 million by 2025. This projection factors in slow but steady growth driven by increased awareness, expanding insurance coverage, and incremental market share gains.

Optimistic Scenario (Accelerated Adoption):

If AUVI-Q benefits from successful marketing strategies, favorable reimbursement policies, and increased physician endorsement, sales could reach USD 300-350 million annually by 2025. Growth drivers include:

- Expansion into international markets, notably Europe and Asia

- Broader acceptance among primary care providers

- Introduction of innovative delivery systems or formulation updates

Downside Considerations:

Market challenges such as generic competition, safety concerns, or regulatory setbacks could cap growth. Price sensitivity and healthcare reimbursement shifts might suppress sales beyond the baseline estimates.

Long-term Outlook (Post-2025):

Post-2025, sales could see a plateau unless product innovation or expansion into related allergy and emergency care markets occurs. Emerging competition and evolving healthcare policies will influence long-term sustainability.

Key Market Drivers and Barriers

| Drivers | Barriers |

|---|---|

| Rising allergy prevalence | Insurance coverage limitations |

| User-friendly auto-injector design | High out-of-pocket expenses |

| Expanding global markets | Competition from generics |

| Growing awareness and education | Regulatory hurdles |

| Pediatric and elderly target markets | Safety and efficacy concerns |

Strategic Recommendations

- Enhance Reimbursement Strategies: Collaborations with insurers and advocacy for better coverage are vital to improve market penetration.

- Market Expansion: Focus on international markets, leveraging regulatory approvals and localized marketing strategies.

- Product Diversification: Development of next-generation auto-injectors or combination products could capture additional market share.

- Education Campaigns: Increase awareness among healthcare providers and patients to drive adoption, especially among primary care physicians.

Conclusion

AUVI-Q's market opportunity remains substantial, driven by rising allergy incidence, patient-centric features, and healthcare system needs for accessible emergency treatment options. While current sales are modest in comparison to market leaders, strategic initiatives focusing on reimbursement, international expansion, and product innovation could accelerate growth significantly.

Realizing this potential requires active engagement with payers, continuous product differentiation, and targeted marketing. Given its current trajectory and strategic positioning, AUVI-Q could reach annual sales in the USD 300-350 million range by 2025 under favorable conditions, with potential for further expansion depending on market dynamics and innovation.

Key Takeaways

- Market potential for AUVI-Q is substantial, with projected annual sales reaching USD 300 million by 2025 under optimistic scenarios.

- Reimbursement and coverage are critical factors—improving access could unlock significant growth.

- International expansion offers a promising avenue, especially in regions with rising allergy prevalence.

- Product differentiation focusing on ease of use and safety continues to be a competitive advantage.

- Strategic partnerships with healthcare providers, payers, and advocacy groups will be essential for sustained growth.

FAQs

1. What are the main competitors to AUVI-Q, and how do they impact its market share?

The primary competitor is EpiPen, with a dominant market position due to established brand recognition and broad insurance coverage. Generic epinephrine auto-injectors also threaten AUVI-Q’s market share by offering lower prices. Competing products that emphasize ease of use and safety may gradually erode AUVI-Q's market share if they gain regulatory approval and reimbursement advantages.

2. How does insurance coverage influence AUVI-Q sales?

Insurance coverage significantly impacts patient access and out-of-pocket costs. Better reimbursement policies increase adoption, especially among children and the elderly. Conversely, high co-pays or limited formulary inclusion restrict sales growth.

3. What are the growth opportunities for AUVI-Q in international markets?

International markets, particularly in Europe and Asia, present growth opportunities due to increasing allergy awareness and local regulatory approvals. Tailored marketing campaigns and partnerships with local distributors will be critical to penetrate these regions.

4. How might product innovation influence AUVI-Q's future sales?

Introducing next-generation auto-injectors with enhanced safety, reduced size, or multi-patient formulations could attract new users and retain existing ones. Innovations aligned with patient preferences and regulatory support can lead to increased sales and market share.

5. What regulatory or safety considerations could impact AUVI-Q's market penetration?

Safety concerns, such as reports of adverse reactions, or delays in regulatory approvals, could hamper growth. Ongoing safety monitoring and transparent communication with regulators and the public are essential to mitigate risks and sustain confidence.

References:

[1] MarketsandMarkets, "Allergy and Anaphylaxis Treatment Market," 2022.

[2] IQVIA, "Auto-Injector Market Share Report," 2022.

More… ↓