Last updated: July 28, 2025

Introduction

Oxycodone, a potent opioid analgesic, is widely prescribed for the management of moderate to severe pain. Initially developed in the 1910s and introduced into clinical use in the 1930s, it has since become one of the most prescribed opioids globally. Its efficacy in pain relief has driven extensive medical adoption; however, the drug’s potential for misuse, dependence, and regulatory scrutiny has significantly shaped its market landscape. This report provides a comprehensive analysis of the current market environment for oxycodone and offers projections for its sales trajectory over the next five years.

Current Market Landscape

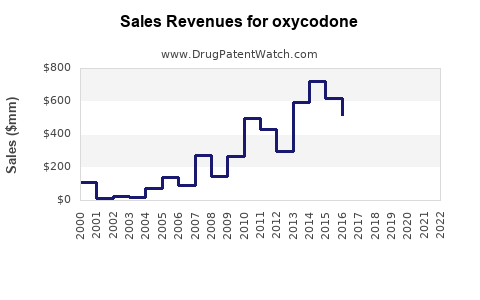

1. Market Size and Revenue

The global opioid analgesics market, including oxycodone, was valued at approximately USD 8.4 billion in 2022, with oxycodone accounting for a significant share due to its widespread prescription use. North America dominates this market, with the U.S. representing over 80% of global oxycodone sales owing to high prescription rates and prevalent pain management practices.[1]

2. Prescription Trends

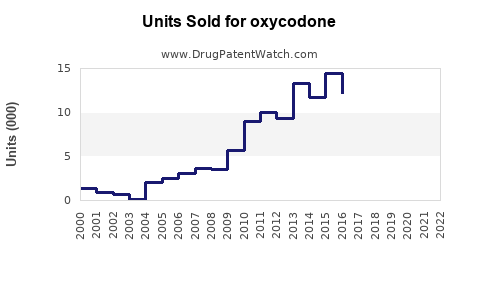

Prescription volumes for oxycodone surged during the 2000s, driven by an emphasis on pain management. However, the opioid epidemic prompted stricter prescribing guidelines, led by the CDC’s 2016 guidelines, which aimed to curb over-prescription. Consequently, prescription rates declined marginally post-2016 but remain substantial, especially in specialized pain clinics and certain chronic pain patient populations.[2]

3. Key Players and Supply Chain Dynamics

Major pharmaceutical manufacturers include Purdue Pharma (notably its brand OxyContin), Teva Pharmaceuticals, and Mylan. Purdue Pharma’s bankruptcy and restructuring amid lawsuits have influenced supply and marketing practices. The supply chain maintains stability but faces pressure from regulatory agencies, law enforcement, and alternative pain management strategies.

Regulatory and Legal Environment

The regulatory landscape significantly impacts oxycodone sales. Post-2010, US authorities intensified oversight, fostering a decline in prescription volumes. Lawsuits targeting manufacturers have led to penalties and restructuring strategies encompassing marketing restrictions. Several countries, including Canada and parts of Europe, adhere to stricter opioid prescribing protocols, influencing local markets.[3]

The increasing focus on combating the opioid crisis has led to legislative measures that restrict opioid distribution, including prescription monitoring programs (PMPs) and prescription limits, which constrains market growth prospects.

Emerging Trends and Challenges

-

Shift Toward Abuse-Deterrent Formulations: The development and adoption of abuse-deterrent oxycodone formulations aim to minimize misuse and diversion. While these innovations may command premium pricing, their uptake may also reflect shifting reimbursement policies.

-

Alternative Pain Management Modalities: Non-opioid pain therapies, including gabapentinoids, nerve blocks, and non-pharmacological interventions, threaten oxycodone’s market share, especially in chronic pain management.

-

Regulatory Restrictions and Public Health Initiatives: Increasing restrictions and public health campaigns further dampen volume growth, emphasizing the importance of considering these factors in sales projections.

Market Segmentation and Geographic Analysis

-

By Application

- Acute Pain Management: Hospitals and emergency departments still utilize oxycodone extensively.

- Chronic Pain Management: Represents the larger market share, though growth is hampered by regulatory restrictions.

- Cancer Pain & Palliative Care: Continued reliance on oxycodone due to its efficacy.

-

By Formulation

- Immediate-Release (IR): Used for short-term or breakthrough pain.

- Controlled-Release (CR/OxyContin): Preferred for long-term management but under scrutiny.

-

Geographical Outlook

- North America: Largest market, with sales driven by high prescription rates but facing regulatory headwinds.

- Europe: Slower growth post-2010 due to strict prescribing policies.

- Asia-Pacific: Emerging market with increasing demand attributed to expanding healthcare infrastructure.

Sales Projections (2023-2028)

Assumptions:

- The global opioid market will witness modest growth driven by a focus on balanced pain management, despite regulatory challenges.

- Revenue growth rates will be influenced by the degree of regulatory stringency, innovation adoption, and public health policies.

- The decline in volume growth initially observed post-2016 will stabilize with new formulations and policy adaptations.

Forecasts:

| Year |

Estimated Market Revenue (USD billion) |

Growth Rate (%) |

Notes |

| 2023 |

USD 7.2 |

-2.5 |

Slight decline, stabilization post-2020s |

| 2024 |

USD 7.4 |

2.8 |

Slow recovery with increased abuse-deterrent formulations |

| 2025 |

USD 7.8 |

5.4 |

Market stabilization; innovation influence |

| 2026 |

USD 8.2 |

5.1 |

Continued growth in emerging markets |

| 2027 |

USD 8.6 |

4.9 |

Regulatory environment remains pivotal |

| 2028 |

USD 9.0 |

4.7 |

Maturation phase; shifts toward non-opioid alternatives |

Note: The projections assume that measures to address opioid misuse will keep prescription growth restrained but will gradually open opportunities for specialized formulations and safer delivery systems.

Key Drivers and Risks Affecting Sales

-

Drivers:

- Persistent demand for effective pain relief.

- Innovations in abuse-resistant formulations.

- Expansion into emerging markets with increasing healthcare access.

- Chronic pain prevalence epidemiology.

-

Risks:

- Regulatory restrictions leading to decreased prescriptions.

- Legal liabilities affecting manufacturers.

- Alternative pain therapies under development.

- Public health initiatives reducing opioid utilization.

Impact of COVID-19 Pandemic

The pandemic initially disrupted supply chains, labor availability, and healthcare access, resulting in short-term declines in prescriptions. However, telemedicine expansion and increased focus on pain management are likely to sustain demand levels in post-pandemic recovery phases.

Conclusion

Oxycodone’s market remains sizable but increasingly constrained by regulatory reforms, societal concerns, and the advent of alternative therapies. While current prescription volumes are stabilizing or declining in some jurisdictions, there remains a sustained, though cautious, demand, especially for formulations designed to mitigate abuse.

Key Takeaways

- Market trajectory indicates modest growth over the next five years, with revenues projected to reach approximately USD 9 billion by 2028.

- Regulatory landscape is the primary influence, with tightening controls tempering volume growth.

- Innovation in formulations, particularly abuse-deterrent products, presents growth opportunities but may face reimbursement challenges.

- Competitive dynamics shift as manufacturers adapt to legal and societal pressures, with emerging markets offering potential expansion.

- Alternative therapies and public health initiatives pose long-term threats to traditional oxycodone sales, underscoring the importance of diversification strategies.

FAQs

1. How will regulatory changes impact oxycodone sales in the coming years?

Regulatory efforts, including stricter prescribing guidelines and monitoring programs, are likely to suppress prescription volumes initially but may foster innovation in abuse-resistant formulations, potentially offsetting declines to some extent.

2. Are there opportunities in emerging markets for oxycodone?

Yes, increasing healthcare infrastructure and rising prevalence of chronic pain conditions in Asia-Pacific and Latin America present growth opportunities, contingent upon local regulatory approvals and market penetration strategies.

3. How does the development of abuse-deterrent formulations influence sales?

Abuse-deterrent formulations may command premium prices and support continued market presence by addressing safety concerns, although their adoption depends on reimbursement policies and prescriber acceptance.

4. What role do alternative pain management strategies play?

Growing adoption of non-opioid modalities, such as nerve blocks, non-pharmacologic therapies, and new analgesics, can reduce reliance on oxycodone, potentially constraining future sales.

5. Will the opioid epidemic lead to the complete decline of oxycodone?

While the epidemic has led to significant regulatory and societal backlash, oxycodone remains vital for specific medical contexts like cancer pain and palliative care. It is unlikely to disappear entirely but will likely see a reshaped, more regulated market landscape.

References

[1] MarketWatch. "Global Opioid Analgesics Market." 2022.

[2] CDC. "Guideline for Prescribing Opioids for Chronic Pain." 2016.

[3] Drug Policy Alliance. "The Impact of Regulation on Opioid Market Dynamics." 2021.