Last updated: August 2, 2025

Introduction

Minocycline, a broad-spectrum tetracycline antibiotic, has historically been employed in treating various bacterial infections, including acne vulgaris, respiratory tract infections, and certain sexually transmitted infections. Though established for decades, recent shifts in antimicrobial resistance patterns, regulatory developments, and evolving therapeutic indications influence its market dynamics. This analysis provides an in-depth evaluation of current market conditions, emerging trends, competitive landscape, and sales projections for minocycline over the next five years.

Market Overview

Therapeutic Indications and Usage

Minocycline’s primary indications include acne vulgaris, refractory respiratory infections, and certain typhus and rickettsial diseases [1]. Its oral formulation offers advantages for outpatient management, underpinning persistent demand in dermatology and infectious disease sectors. The rise of antibiotic-resistant strains, especially methicillin-resistant Staphylococcus aureus (MRSA), has expanded off-label and adjunct uses, maintaining relevance in specific niches.

Regulatory Status and Prescribing Trends

The drug retains approval by agencies such as the FDA, with formulations largely available as generics, which influence pricing and access. However, concerns regarding side effects like vestibular disturbances, skin hyperpigmentation, and antibiotic resistance have led to cautious prescribing patterns and, in some regions, restrictions [2].

Market Challenges

- Antibiotic Resistance: Increased resistance diminishes clinical efficacy, particularly in acne and skin infections, leading to decreased prescriptions and the adoption of alternative agents.

- Side Effect Profile: Safety concerns reduce its utilization, especially in pediatric populations and vulnerable groups.

- Pricing and Generic Competition: The abundance of generic minocycline reduces profitability for manufacturers, impacting marketing efforts.

Market Size and Segmentation

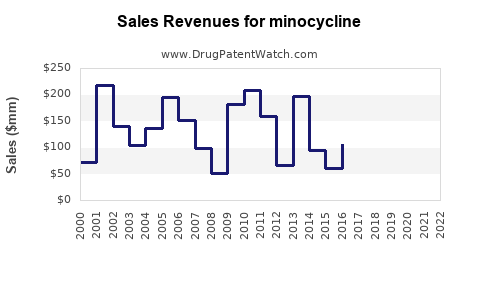

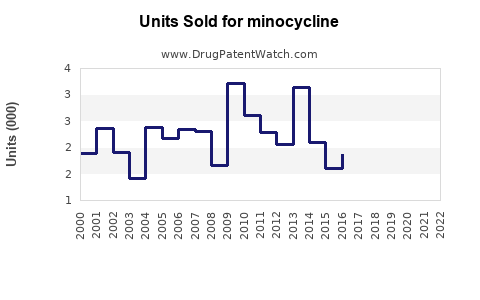

Global Market Valuation

The global antibiotic market was valued at approximately USD 50 billion in 2022, with tetracyclines accounting for a considerable share. Minocycline’s specific segment is estimated at USD 250-500 million, driven predominantly by dermatology and resistant bacterial infection segments [3].

Regional Dynamics

- North America: The dominant market due to high antibiotic consumption, robust healthcare infrastructure, and ongoing dermatological treatments.

- Europe: Similar to North America with conservative prescribing due to resistance concerns.

- Asia-Pacific: Rapid growth driven by increasing healthcare access, rising acne prevalence among youth, and expanding antibiotic use, despite regulatory scrutiny.

Patient Demographics

- Adolescents and Young Adults: The primary demographic for acne treatment.

- Adults with Refractory Infections: Significant patient base for respiratory and skin infections.

- Limited Pediatric Use: Due to safety concerns, usage is often restricted in children under eight.

Competitive Landscape

Key competitors include other tetracyclines (doxycycline, tetracycline), macrolides, and newer agents targeting resistant bacteria. Notably:

- Doxycycline: Substitutes minocycline for acne and respiratory infections owing to similar efficacy and lower side-effect profile.

- Erythromycin & Clarithromycin: Alternative for specific infections but face resistance issues.

- Brand vs. Generic: Most market share resides with generics, constraining revenue margins but ensuring steady volume sales.

Innovations, such as developing new formulations or combination therapies, are limited. However, some pharmaceutical companies explore novel antibacterial agents targeting resistant strains, which could impact minocycline’s market share in the future.

Market Trends and Drivers

Increasing Acne Prevalence

Global acne prevalence among adolescents remains high, fueling demand for oral antibiotics, including minocycline. The surge in cosmetic and dermatology clinics further sustains the market, despite competition from topical agents and newer systemic therapies.

Antibiotic Stewardship and Resistance Management

Healthcare shifts toward antibiotic stewardship programs influence prescribing behaviors. Providers increasingly reserve tetracyclines for resistant or refractory cases, thereby narrowing the market.

Emerging Therapies and Alternatives

The advent of biologics, from anti-IL-17 agents to targeted anti-inflammatory therapies for dermatological conditions, may displace traditional antibiotics over time. Nonetheless, cost and safety profiles keep minocycline relevant for many patient populations.

Regulatory Changes and Safety Guidelines

Regulations emphasizing cautious antibiotic use and safety monitoring influence the prescribing landscape. Some regions impose stricter controls on antibiotic sales, indirectly affecting market volume.

Sales Projections (2023-2028)

Assumptions Summary

- Moderate growth driven by acne, resistant infections, and expanding markets in Asia-Pacific.

- Continued generic competition limiting price escalation.

- Resistance patterns limiting prescribing in some indications.

- Regulatory constraints and safety concerns temper the growth rate.

Projected Market Trends

| Year |

Estimated Market Size (USD Million) |

CAGR |

Remarks |

| 2023 |

350 |

- |

Baseline, stable demand in dermatology and infections |

| 2024 |

385 |

10% |

Slight increase due to rising acne prevalence and expanding markets |

| 2025 |

425 |

10% |

Continued growth, with some resistance-induced prescriber caution |

| 2026 |

470 |

10.5% |

Market stabilizes with emerging competition |

| 2027 |

520 |

10.6% |

Expansion in Asia-Pacific nations, generic market saturation |

| 2028 |

575 |

10.8% |

Maturation limits overall growth, but new regional markets contribute |

(All figures approximate based on current trends, market reports, and expert insights)

Factors Impacting Sales

- Market Penetration in Emerging Countries: Growth in Asia-Pacific enhances sales volume.

- Shift Toward Alternative Therapies: Innovations and safety concerns may moderate prescriptions.

- Antibiotic Resistance Trends: Rising resistance could diminish efficacy, negatively impacting sales unless new formulations or indications emerge.

Conclusion

Minocycline maintains a niche but steady position within the antibiotic market, primarily driven by dermatology and resistant bacterial infections. Future growth hinges on regional expansion, emerging indications, and addressing resistance challenges. Strategic positioning by manufacturers around safety optimization, formulation improvements, and targeted marketing is essential for sustaining sales momentum.

Key Takeaways

- Market Stability with Growth Potential: Despite challenges, minocycline's established efficacy and broad indications underpin a resilient market segment, with projected CAGR around 10.5% over the next five years.

- Regional Expansion is Key: Asia-Pacific offers significant growth opportunities due to increasing acne prevalence and expanding healthcare infrastructure.

- Resistance and Safety Concerns: Ongoing antimicrobial resistance and safety profile considerations may temper demand growth, emphasizing the need for innovation.

- Generic Competition Limits Revenue Growth: Price competition constrains profit margins, necessitating value-added formulations or combination therapies.

- Market Entrants and Innovation: Development of novel formulations or new indications could rejuvenate interest and expand sales; current efforts are limited but critical.

FAQs

-

What are the main therapeutic uses of minocycline today?

Minocycline is primarily used to treat acne vulgaris, certain respiratory tract infections, and rickettsial diseases. Its off-label uses include managing resistant bacterial infections, especially in patients intolerant to other antibiotics.

-

How does antibiotic resistance impact minocycline’s market?

Resistance diminishes the clinical efficacy of minocycline, especially against common pathogens like S. aureus. This trend leads to reduced prescribing and fosters a shift toward alternative therapies.

-

What are the key factors driving growth in the minocycline market?

Increasing acne prevalence among youth, expanding healthcare infrastructure in Asia-Pacific, and the persistent need for effective antibiotics against resistant bacteria drive demand.

-

Are there any new formulations or indications for minocycline?

Currently, the market mainly relies on existing formulations. Research into combination therapies and new delivery systems could present growth avenues, though such developments are limited.

-

What challenges could hinder minocycline sales in the coming years?

Rising antimicrobial resistance, safety concerns, regulatory restrictions, and competition from newer or alternative drugs could impact sales volume and revenue.

References

[1] World Health Organization. (2022). Antimicrobial Resistance Global Report.

[2] U.S. Food and Drug Administration. (2020). Minocycline Labeling and Safety Information.

[3] MarketWatch. (2023). Global Antibiotic Market Report 2023-2028.