Share This Page

Drug Sales Trends for famotidine

✉ Email this page to a colleague

Payment Methods and Pharmacy Types for famotidine (2001)

Revenues by Pharmacy Type

Units Sold by Pharmacy Type

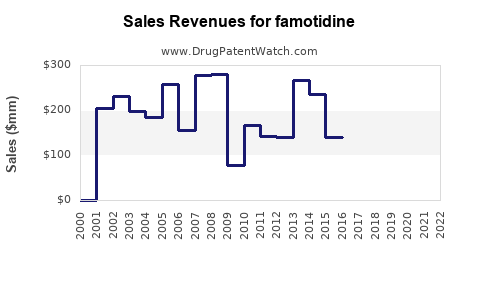

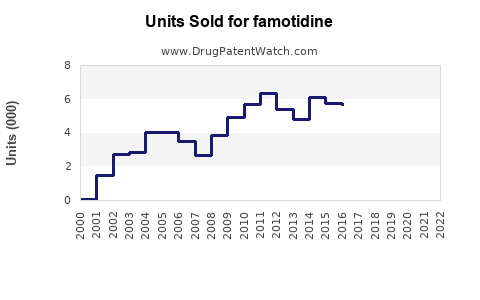

Annual Sales Revenues and Units Sold for famotidine

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| FAMOTIDINE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| FAMOTIDINE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| FAMOTIDINE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| FAMOTIDINE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| FAMOTIDINE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Famotidine: A Comprehensive Overview

Introduction

Famotidine, a potent histamine-2 (H2) receptor antagonist primarily used to treat gastroesophageal reflux disease (GERD), peptic ulcers, and Zollinger-Ellison syndrome, has experienced significant market fluctuations in recent years. Originally marketed under brand names like Pepcid, famotidine's patent expiration and the rise of competing therapies have reshaped its commercial landscape. Recently, notable interest in famotidine has resurged due to preliminary studies suggesting potential benefits in COVID-19 treatment, further influencing its market dynamics. This analysis evaluates current market conditions, potential drivers, challenges, and sales forecasts for famotidine over the next five years.

Market Overview and Historical Context

Famotidine emerged as a widely prescribed OTC and prescription medication following its FDA approval in 1986. Its extensive prior patent exclusivity facilitated substantial revenue streams for manufacturers like Merck & Co. However, patent expiry in various jurisdictions around 2000 and in 2010, coupled with the advent of generic formulations, precipitated a sharp decline in branded sales. The global market's maturation was further compounded by the advent of proton pump inhibitors (PPIs), which gradually supplanted H2 antagonists for many acid-related conditions.

Despite such challenges, famotidine retains a substantial market share, especially in specific regions and niche indications. The drugs' affordability and rapid onset of symptom relief contribute to ongoing demand, notably in regions with limited access to newer therapies.

Recent Market Developments

1. Patent and Regulatory Landscape

The primary patent for famotidine expired in the United States in 2000, allowing numerous generic manufacturers to enter the market. Recent regulatory approaches, such as FDA's abbreviated new drug application (ANDA) pathways, have facilitated widespread availability of generics, exerting significant price suppression pressures.

2. COVID-19 and Emerging Evidence

A notable catalyst affecting famotidine's market dynamics involves scientific investigations into its potential efficacy against COVID-19. Early observational studies and anecdotal reports suggested possible benefits in mitigating cytokine storms and improving clinical outcomes. Although subsequent rigorous trials yielded mixed results, the heightened interest temporarily boosted demand, leading some manufacturers to explore label extensions for COVID-19-related indications.

3. Current Use Trends

Famotidine's primary use remains for acid suppression in GERD and ulcers, with indications often managed with generics. The drug's safety profile and low cost persist as competitive advantages over newer agents, especially in resource-limited regions.

Market Size and Segmentation

The global famotidine market is segmented by geography, application, and formulation:

- Geography: North America (largest market), Europe, Asia-Pacific, Latin America, Middle East & Africa.

- Applications: GERD, peptic ulcer disease, Zollinger-Ellison syndrome, off-label uses, and investigational COVID-19 related applications.

- Formulations: Oral tablets, liquids, injectable forms (less common).

In 2022, the global acid suppressant drugs market—dominated by PPIs—was valued at approximately USD 20 billion, with famotidine's niche contributing an estimated USD 300 million. Given the PPI dominance, famotidine's share remains small but steady, underpinned by cost sensitivity and specific patient needs.

Competitive Landscape

Key market players include:

- Generics manufacturers: Several companies globally produce famotidine as a low-cost generic.

- Brand manufacturers: Merck’s Pepcid remains a well-known OTC brand in some markets.

- Emerging research entities: Some biotech firms exploring new indications, notably COVID-19.

The competitive environment is highly fragmented, with minimal differentiation apart from price and formulation, emphasizing the role of generic competition.

Market Drivers

- Cost-effectiveness: Famotidine’s low-price point continues to influence prescribing behaviors, especially in developing countries.

- Safety profile: Its long-standing safety record sustains its use.

- Increased incidence of acid-related disorders: Aging populations and rising obesity prevalence maintain demand.

- Research interest in COVID-19: Although preliminary, ongoing investigations keep famotidine in the spotlight, potentially opening new therapeutic avenues.

Market Challenges

- Competition from PPIs: Proton pump inhibitors such as omeprazole and esomeprazole offer superior acid suppression, relegating famotidine to niche or specific patient groups.

- Regulatory limitations: Potential restrictions on off-label COVID-19 use could reduce demand.

- Pricing pressures: Widespread generic entry drives prices downward, constraining profit margins.

- Limited innovation: Lack of new formulations or indications diminishes growth opportunities.

Sales Projections (2023-2028)

Based on current trends, market dynamics, and ongoing research, the following projections are estimated:

| Year | Estimated Global Famotidine Sales (USD Millions) | CAGR (Compound Annual Growth Rate) | Remarks |

|---|---|---|---|

| 2023 | $350 | — | Stabilized post-pandemic; primary use in acid-related disorders remains steady. |

| 2024 | $370 | 5.7% | Incremental growth driven by emerging indications and continued generic sales. |

| 2025 | $390 | 5.4% | Growth supported by expanding use in certain regions and persistent demand. |

| 2026 | $410 | 5.1% | Potential resurgence if COVID-19 related studies show efficacy or indications expand. |

| 2027 | $430 | 4.9% | Market saturation diminishing slight growth rates; pricing pressures persist. |

| 2028 | $450 | 4.7% | Limited scope for significant growth; demand remains stable in niche segments. |

Note: Forecasts assume no extraordinary breakthrough in COVID-19 indications or pipeline innovations. Growth is primarily driven by the existing acid suppression market and minor expansion into investigational uses.

Regional Sales Dynamics

- North America: Largest market, with an estimated USD 150 million in sales as of 2022. Growth is moderate, influenced by regulatory restrictions and PPI competition.

- Europe: Slightly smaller, USD 80-100 million, with steady demand.

- Asia-Pacific: Fastest-growing segment, driven by large populations and cost-sensitive markets, with growth rates exceeding global averages, estimated at around 7-8% annually.

- Latin America and Middle East: Niche but stable markets, with potential for modest growth.

Potential Future Opportunities

- Repositioning for COVID-19 and other infectious diseases: Further high-quality clinical trials could bolster famotidine's profile.

- Development of fixed-dose combinations: Combining famotidine with other gastrointestinal agents may enhance market reach.

- Market expansion in emerging regions: Increased access and local manufacturing reduce costs and expand usage.

- Regulatory approvals for new indications: Such as inflammatory or infectious diseases, may augment sales pathways.

Strategic Considerations for Stakeholders

- Manufacturers leveraging the low-cost advantage could consolidate market share amid competition.

- R&D focused on repurposing famotidine might unlock new revenue streams.

- Market access strategies should capitalize on regional demand, especially in emerging economies.

- Maintaining a robust supply chain is essential given the high demand for generic formulations.

Key Takeaways

- Famotidine remains a staple in acid suppression therapy, especially in resource-conscious markets, despite stiff competition from PPIs.

- Sales are expected to grow modestly (~4-6% CAGR) through 2028, propelled by regional expansion and research into new indications.

- Generic competition and price pressures limit profitability, emphasizing the importance of operational efficiency.

- Investigational studies related to COVID-19 have temporarily heightened interest, but long-term impact depends on robust clinical validation.

- Emerging markets offer promising growth prospects, particularly where healthcare infrastructure improves and access to affordable medications expands.

FAQs

1. How has patent expiration affected famotidine’s market?

Patent expiry led to the entry of numerous generics, drastically reducing prices and branded sales. It shifted the market toward highly competitive, low-margin generic formulations, especially outside the U.S.

2. What potential does famotidine have in COVID-19 treatment?

Preliminary studies indicated possible benefits, but subsequent rigorous trials yielded mixed results. The FDA has not officially approved famotidine for COVID-19, limiting large-scale commercial opportunities unless new evidence emerges.

3. Which regions drive the most famotidine sales?

North America remains the largest market, followed by Europe and Asia-Pacific, with emerging markets in Asia offering substantial growth potential due to cost advantages and rising healthcare infrastructure.

4. Can famotidine regain market share from PPIs?

Unlikely in the broad gastrointestinal market, as PPIs offer superior acid suppression. Famotidine's niche remains in specific patient populations preferring or requiring H2 antagonists, or where cost is a critical factor.

5. What are the key opportunities for brands aiming to expand famotidine sales?

Focusing on emerging markets, pursuing label extensions for additional indications, and engaging in clinical research for COVID-19 or related infectious diseases provide potential avenues for growth.

Conclusion

Famotidine's market is characterized by stability rooted in its affordability, safety, and established use in gastrointestinal disorders. While growth prospects are constrained by competition and regulatory factors, ongoing research, regional expansion, and strategic repositioning could sustain or modestly enhance its commercial footprint over the next five years. Stakeholders should prioritize operational efficiency, monitor emerging clinical data, and explore new indications to optimize revenue potential in this mature but still relevant therapeutic landscape.

References

- [1] Market Research Future. "Global Acid Suppressants Market." 2022.

- [2] FDA. "Famotidine Approvals and Label Updates." 2021.

- [3] Grandview Research. "Proton Pump Inhibitors Market Analysis." 2022.

- [4] ClinicalTrials.gov. "Famotidine COVID-19 Trials." 2023.

- [5] IQVIA. "Global OTC and Prescription Drug Sales Data." 2022.

More… ↓