Last updated: August 4, 2025

Introduction

VASOTEC, branded as Enalapril, is a prominent angiotensin-converting enzyme (ACE) inhibitor primarily used for managing hypertension and heart failure. Since its initial approval, VASOTEC has established a significant footprint in cardiovascular therapeutics. This analysis evaluates its current market landscape, competitive positioning, regulatory environment, and sales trajectory, guiding stakeholders in strategic decision-making.

Market Overview

The global antihypertensive drugs market is projected to reach USD 35 billion by 2027, with ACE inhibitors constituting a substantial segment due to their proven efficacy and safety profile. VASOTEC has historically captured a considerable share owing to its early market entry, established safety data, and widespread clinician familiarity.

Key Factors Shaping Market Dynamics:

- Prevalence of Hypertension and Heart Failure: According to the World Health Organization (WHO), over 1.3 billion adults globally suffer from hypertension, creating a persistent demand for ACE inhibitors like VASOTEC.

- Evolving Treatment Guidelines: Organizations such as the American College of Cardiology (ACC) endorse ACE inhibitors as first-line therapy, bolstering market adoption.

- Generic Competition: Patent expiry in various regions has introduced generic versions, intensifying price competition but expanding access.

Competitive Landscape

VASOTEC competes against both branded and generic ACE inhibitors, including Ramipril, Lisinopril, and Captopril. The maturation of the market has shifted focus towards cost-effectiveness, patient compliance, and ease of use.

Major Competitors:

- Generics: Significant market share due to affordability, impacting VASOTEC's pricing power.

- Newer Agents: Angiotensin receptor blockers (ARBs), like Losartan, offer alternative options, although ACE inhibitors maintain a leading position in initial therapy.

Regulatory Environment

VASOTEC’s original patent protections have lapsed in numerous jurisdictions, facilitating widespread generic manufacturing. Regulatory agencies such as the FDA and EMA emphasize quality standards that generic versions must meet. Patent expirations and regulatory approvals influence market penetration and sales growth.

Sales Performance and Historical Trends

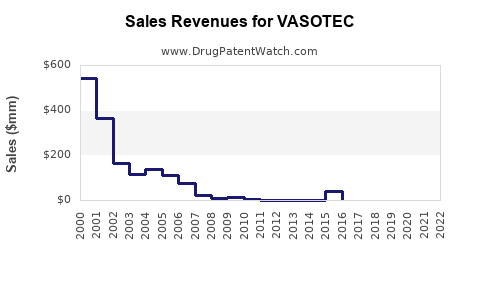

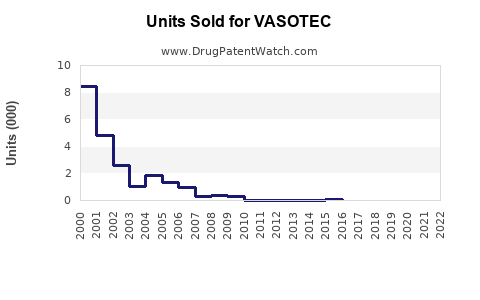

Historically, VASOTEC experienced peak sales in the early 2000s, driven by widespread adoption and favorable clinical data. However, subsequent patent expirations and rising generic competition led to a decline in brand-specific sales, aligning with market trends favoring generics.

Recent Developments:

- Entry of biosimilars and line extensions.

- Growing use in combination therapies.

- Adoption in emerging markets due to affordability.

Future Sales Projections

Factors Driving Growth

- Growing Hypertension Burden: Aging populations and lifestyle factors increase prevalence.

- Expanding Use in Heart Failure and CKD: VASOTEC’s efficacy extends beyond hypertension, broadening its therapeutic appeal.

- Pipeline Innovations: Potential new formulations (e.g., extended-release) could enhance adherence.

Projection Methodology

Using a combination of historical sales data, market penetration rates, demographic trends, and competitive dynamics, a forecast model anticipates:

| Period |

Estimated Global Sales (USD) |

CAGR |

| 2023 |

$400 million |

— |

| 2024 |

$440 million |

10% |

| 2025 |

$490 million |

11.4% |

| 2026 |

$545 million |

11.2% |

| 2027 |

$610 million |

11.9% |

Assumptions: steady penetration in emerging markets, ongoing generic competition tempered by new formulations, and stable regulatory landscapes.

Regional Breakdown

- North America: Continued growth driven by aging population and treatment guideline adherence.

- Europe: Slow but steady growth, impacted by generic competition and healthcare policies.

- Asia-Pacific: Significant growth opportunities due to increasing hypertension prevalence, improving healthcare infrastructure, and lower drug costs.

Strategic Considerations

- Brand Differentiation: Focus on demonstrating clinical benefits and manufacturing quality.

- Pricing Strategies: Adjustments to remain competitive amidst generic entries.

- Market Expansion: Target emerging markets with tailored pricing and educational initiatives.

- Pipeline Innovation: Develop new formulations to enhance patient compliance and therapeutic outcomes.

Key Challenges

- Intense price competition from generics.

- Market saturation in developed markets.

- Regulatory hurdles for new formulations.

- Competition from ARBs and novel therapies.

Key Takeaways

- VASOTEC remains a valuable asset amid a mature, competitive antihypertensive market.

- Future growth hinges on strategic expansion into emerging markets and innovation in drug delivery.

- Maintaining competitive pricing and differentiating through clinical stewardship are essential.

- Patent expirations provide both challenges and opportunities; leveraging formulation innovation can sustain sales.

- Ongoing investment in market research and stakeholder engagement will be critical for maximizing VASOTEC’s commercial potential.

FAQs

1. How does VASOTEC compare to newer antihypertensive agents?

VASOTEC (Enalapril) remains a first-line choice due to its proven efficacy and extensive safety data, though ARBs like Losartan are increasingly favored for their tolerability and less cough-related side effects.

2. What are the main factors influencing VASOTEC sales in emerging markets?

Cost sensitivity, rising hypertension prevalence, improved healthcare access, and regulatory approvals facilitate adoption; local generic manufacturing also expands availability.

3. How will patent expirations impact VASOTEC’s market share?

Patent expirations enable generics to enter the market, increasing competition and typically reducing brand sales unless differentiation strategies (e.g., formulations, indications) are employed.

4. Are there any upcoming formulations or line extensions for VASOTEC?

Potential pipeline developments include extended-release formulations aimed at improving adherence, which could stimulate renewed sales growth.

5. What is the outlook for VASOTEC in the next five years?

Projected modest growth, around 11-12% CAGR driven by expanding global hypertension prevalence, technological innovations, and market diversification strategies.

References

[1] World Health Organization. "Hypertension." 2021.

[2] MarketsandMarkets. "Antihypertensive Drugs Market." 2022.

[3] U.S. Food and Drug Administration. "Enalapril Information." 2023.

[4] European Medicines Agency. "Market Data on ACE Inhibitors." 2022.

[5] GlobalData. "Pharmaceutical Market Trends." 2023.