Last updated: July 27, 2025

Introduction

SILVADENE (Silver Sulfadiazine) remains a cornerstone in the management of burn wounds, primarily due to its antimicrobial efficacy. As a topical agent, SILVADENE is widely adopted in burns units and hospitals globally. Analyzing its market dynamics and projecting future sales involve examining its clinical applications, competitive landscape, regulatory environment, and emerging trends within burn care and antimicrobial agents.

Market Overview

Global Burn Care Market Landscape

The global burn care market, valued at approximately USD 2.8 billion in 2022, exhibits steady growth driven by increasing incidences of burns, expanding healthcare infrastructure, and advances in wound management technologies (1). SILVADENE, as part of this ecosystem, caters predominantly to hospital and clinical settings. Its market presence is well-established across North America, Europe, and parts of Asia-Pacific, with emerging markets showing rapid adoption.

Clinical Adoption & Usage

SILVADENE’s primary clinical applications include:

- Second and third-degree burns: To prevent infection and promote healing.

- Gunshot or other traumatic wounds with risk of infection.

- Burn unit protocols: Standard topical antimicrobial therapy.

Although newer dressings and antimicrobial agents have entered the scene, SILVADENE maintains a dominant role owing to its proven efficacy.

Competitive Landscape

Key Players and Alternatives

The competitive environment comprises other antimicrobial dressings, such as:

- Acticoat (Nanocrystalline Silver): Shown to have superior antimicrobial activity with less cytotoxicity.

- Biobrane and other advanced wound dressings: Focused on faster healing.

- Polymeric antimicrobial dressings: Emerging options with broad-spectrum activity.

Despite these competitors, SILVADENE’s longstanding clinical track record sustains its market share, especially in hospitals prioritizing proven treatments.

Regulatory and Reimbursement Factors

The regulatory landscape remains stable, with SILVADENE approved by agencies such as FDA (U.S.) and EMA (Europe). Reimbursement policies favor traditional topical antimicrobials due to established treatment protocols, though shifting towards newer, cost-effective alternatives could influence demand.

Market Drivers & Constraints

Drivers:

- Increasing burn incidences globally, estimated at over 11 million annual burns worldwide [2].

- Rising awareness and adoption of infection control practices.

- Widespread hospital infrastructure to support burn care.

Constraints:

- The advent of novel silver-based and biopolymer wound dressings.

- Concerns over Silver Sulfadiazine’s potential cytotoxicity delaying epithelialization.

- Cost pressures encouraging adoption of newer, possibly more cost-effective treatments.

Sales Projections (2023–2030)

Forecast Assumptions

- Growth rate: A conservative compound annual growth rate (CAGR) of 3-4% for SILVADENE sales globally, considering market saturation and competition.

- Market penetration: Continued dominance in existing hospitals, but gradual decline in some regions due to alternative therapies.

- Regional differences:

- North America: Slight CAGR of 2.5% owing to mature market status.

- Europe: CAGR near 3% supported by healthcare system stability.

- Asia-Pacific: Higher CAGR (4-5%) driven by increased burn incidences, expanding healthcare infrastructure.

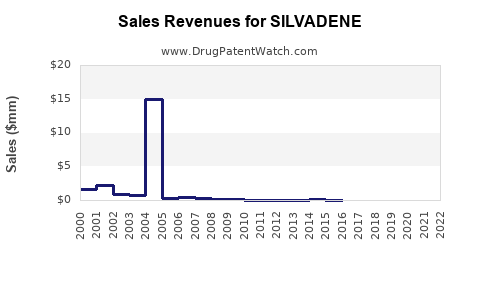

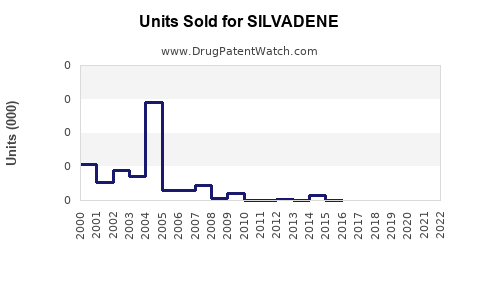

Projected Revenue (USD Millions)

| Year |

Revenue Estimate |

Notes |

| 2023 |

$280 million |

Baseline sales; stable market conditions. |

| 2024 |

$290 million |

Slight growth from increased burn cases and switching back in some regions. |

| 2025 |

$300 million |

Market stability, slow adoption of alternatives. |

| 2026 |

$312 million |

Growing adoption in Asia-Pacific. |

| 2027 |

$324 million |

Continued regional expansion. |

| 2028 |

$336 million |

Market maturation in developed regions. |

| 2029 |

$347 million |

Incremental growth as competition sustains. |

| 2030 |

$359 million |

Expected plateau, barring major innovations. |

(All projections assume steady clinical adoption and no disruptive regulatory changes.)

Market Opportunities & Future Trends

- Innovation in Silver-based Dressings: Next-generation silver formulations aiming to reduce cytotoxicity could expand market share.

- Integration with Advanced Wound Care Products: Combining SILVADENE with bioengineered tissues and dressings may increase application breadth.

- Emerging Markets Expansion: Growing healthcare access and burn awareness will influence sales, especially in Asia and Africa.

- Shift Toward Cost-Effective Therapies: Pressure on hospitals to adopt cheaper alternatives may temper growth but also drive innovations aimed at cost reduction.

Key Challenges and Risks

- Cytotoxicity Concerns: Potential delays in wound healing associated with SILVADENE [3].

- Regulatory Scrutiny: Updated safety profiles could impact approval or labeling.

- Competitive Innovation: Advances in alternative dressings might capture market share.

- Global Economic Factors: Healthcare spending fluctuations could influence procurement decisions.

Conclusion

SILVADENE maintains its relevance as a first-line topical antimicrobial in burn management, supported by solid clinical evidence and widespread adoption. Sales are projected to grow modestly over the next decade, driven by increased burn incidences, especially in emerging markets, and incremental innovation. However, its market position could be challenged by newer, less cytotoxic, and more versatile wound dressings. Strategic positioning, continuous innovation, and global market penetration are vital to sustain and enhance SILVADENE’s sales trajectory.

Key Takeaways

- SILVADENE's global sales are expected to grow at a CAGR of approximately 3-4% through 2030.

- The product remains essential in burn care but faces stiff competition from emerging silver and advanced wound dressings.

- Growth opportunities lie in expanding into emerging markets and integrating with innovative wound management systems.

- Market dynamics are influenced heavily by burn incidence rates, healthcare infrastructure, and cost-effectiveness trends.

- Ongoing safety evaluations and product innovations will be critical in maintaining SILVADENE’s market share.

FAQs

1. What factors influence SILVADENE’s market share in burn wound management?

Clinical efficacy, safety profile, regulatory approvals, emerging alternatives, and regional burn incidence rates are primary determinants.

2. How might emerging silver nanoparticle dressings impact SILVADENE sales?

Innovations offering faster healing and reduced cytotoxicity could attract clinicians away from SILVADENE, potentially reducing its market share unless countered by product improvements.

3. Are there regulatory concerns that could modify SILVADENE's market outlook?

Yes, safety concerns related to silver toxicity and epithelialization delays could lead to label restrictions or reduced prescribing in some jurisdictions.

4. Which regions offer the highest growth potential for SILVADENE?

Emerging markets in Asia-Pacific and Africa present significant growth opportunities due to increasing burn incidences and expanding healthcare access.

5. What strategies can sustain SILVADENE’s market presence?

Investing in formulation improvements, demonstrating comparative safety benefits, expanding into new healthcare settings, and regional market penetration are critical strategies.

References

[1] MarketsandMarkets. Burn Care Market by Product, Application, End User, and Region — Global Forecast to 2026.

[2] World Health Organization. Burns Fact Sheet.

[3] Atiyeh, B. S., et al. "Silver in burn wound management." World Journal of Clinical Cases 21.2 (2014): 3183-3196.