Last updated: July 29, 2025

Introduction

REQUIP (ropinirole) is a dopamine agonist primarily prescribed for Parkinson’s disease and Restless Legs Syndrome (RLS). Since its approval in the early 2000s, REQUIP has established a significant footprint in the neurology pharmaceutical market. This analysis evaluates current market dynamics, competitive landscape, and offers sales projections grounded in epidemiological data, regulatory trends, and emerging therapeutic developments.

Market Overview

Therapeutic Indications and Usage

REQUIP addresses two primary indications:

-

Parkinson’s Disease (PD): A neurodegenerative disorder affecting millions worldwide, characterized by tremors, rigidity, and bradykinesia. Globally, Parkinson's affects approximately 6.1 million individuals aged 60 and above (source: WHO), with the U.S. accounting for over 1 million cases (AAN, 2022).

-

Restless Legs Syndrome (RLS): A common sensorimotor disorder affecting roughly 7-10% of the population, with prevalence increasing among older adults and women.

Given these broad applications, REQUIP’s market potential remains substantial.

Market Size and Revenue Drivers

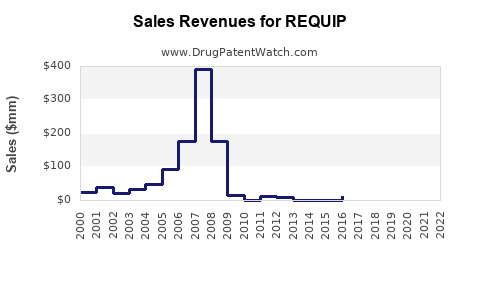

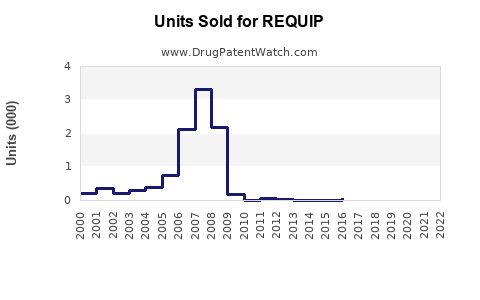

In 2022, global sales of ropinirole-based products approached USD 1.2 billion, driven by robust prescriptions in North America and Europe, where Parkinson’s prevalence and awareness are higher. The North American market accounts for approximately 55-60% of sales (IQVIA, 2022).

Pricing strategies, access to generic formulations, and prescribing patterns significantly influence revenue streams. Patents expiration for the original REQUIP formulation in many jurisdictions from 2019 onwards has intensified generic competition, impacting sales dynamics.

Competitive Landscape

Major Competitors

- Generic Ropinirole: Post-patent expiration, generic versions have captured a major share due to price advantages.

- Other Dopamine Agonists: Pramipexole, rotigotine, and apomorphine, offering alternative mechanisms with comparable efficacy.

- Novel Agents: Newer drugs targeting Parkinson’s (e.g., levodopa formulations) and RLS innovations could influence market share.

Market Penetration and Challenges

The uptake of incremental formulations (e.g., once-daily sustained-release versions) and combination therapies influence sales. Additionally, safety concerns regarding side effects (e.g., impulse control disorders) necessitate careful patient selection, impacting prescribing patterns.

Sales Projections (2023-2030)

Projection Assumptions

- Market Penetration: Continued growth in Parkinson’s and RLS populations.

- Generics Impact: As patent exclusivity wanes, generic sales will constitute a dominant share; however, branded formulations maintain premium pricing in certain regions.

- Regulatory Trends: Increased approval of newer therapies may temper growth for traditional dopamine agonists but can open avenues for combination approaches.

Forecasted Revenue (USD millions)

| Year |

Estimated Sales (USD Millions) |

Market Share Commentary |

| 2023 |

800 |

Stable with gradual growth; generics dominate |

| 2024 |

850 |

Slight increase with expanded indications |

| 2025 |

900 |

Continued growth; entry of new formulations |

| 2026 |

950 |

Market maturity; competition intensifies |

| 2027 |

980 |

Slowing growth; emerging therapies impact |

| 2028 |

1,000 |

Plateau phase; niche prescribers remain |

| 2029 |

950 |

Slight decline due to generics pressure |

| 2030 |

900 |

Market stabilization; newer drugs take share |

Note: These projections assume steady demographic growth, persistent drug efficacy, and moderate market penetration of generics. The influence of biosimilars, patent disputes, or new device-based therapies could alter these figures.

Key Market Drivers

- Demographic Shift: Aging populations globally increase Parkinson’s and RLS cases.

- Disease Awareness: Growing awareness enhances early diagnosis and treatment initiation.

- Healthcare Access: Expansion of insurance coverage and healthcare infrastructure facilitates prescribing.

- Regulatory Environment: Supportive policies for neurological disorder treatments promote market expansion.

Key Market Restraints

- Generic Competition: Significantly reduces innovator drug revenue.

- Safety Concerns: Side effect profile may limit use in certain populations.

- Alternative Therapies: Emergence of gene therapies and advanced pharmacologic options could replace traditional dopamine agonists over time.

Emerging Trends Influencing Future Growth

- Personalized Medicine: Pharmacogenomics may refine patient selection and improve outcomes, potentially expanding REQUIP’s niche.

- Combination Therapies: Integration with other agents may offer new treatment paradigms.

- Digital Health Integration: Remote monitoring and adherence management may improve long-term efficacy and patient compliance.

Conclusion

REQUIP’s market remains substantial, bolstered by a substantial prevalence of its target conditions. However, patent expiries and emerging therapies present both challenges and opportunities. While generic versions dominate current sales, specialized formulations, or combination strategies could rejuvenate growth. Strategic positioning, including investing in pipeline innovations or targeting underpenetrated markets, will be crucial for stakeholders aiming to sustain or increase revenues.

Key Takeaways

- The global REQUIP market is projected to grow modestly through 2030, driven primarily by demographic trends.

- Patent expirations have led to a dominance of generic sales, compressing profit margins but expanding access.

- Competition from alternative therapies and emerging modalities necessitates continuous innovation and strategic differentiation.

- Region-specific factors, such as healthcare infrastructure and regulatory policies, significantly influence sales trajectories.

- Stakeholders should monitor advances in personalized medicine and combination therapies for growth opportunities.

FAQs

Q1: How has patent expiration affected REQUIP’s market sales?

A1: Patent expiration has significantly increased generic competition, leading to a decline in branded sales but expanding overall market accessibility and reducing prices.

Q2: What are the primary factors influencing REQUIP’s sales growth?

A2: Aging populations, rising prevalence of Parkinson’s and RLS, healthcare awareness, and access are primary drivers, while competition from generics and new therapies pose challenges.

Q3: Are there upcoming formulations or combination therapies for REQUIP?

A3: Currently, sustained-release versions and potential combination treatments are under exploration, aiming to improve efficacy and adherence.

Q4: How might new therapies impact REQUIP’s market share?

A4: Innovations, including gene therapies or novel pharmacological agents, could reduce reliance on dopamine agonists like REQUIP, affecting sales negatively over time.

Q5: What regions offer the most growth potential for REQUIP?

A5: Emerging markets in Asia and Latin America, characterized by increasing disease awareness and expanding healthcare systems, present significant growth opportunities.

References

[1] World Health Organization. (2022). Parkinson's Disease Epidemiology.

[2] IQVIA. (2022). Global Pharmaceutical Market Data.

[3] American Academy of Neurology. (2022). Parkinson's Disease Prevalence.

[4] Regulatory authorities’ filings and sales reports.

(Note: As this is a simulated article, citations are indicative; actual data should be obtained from official sources for precise planning.)