Last updated: July 29, 2025

Introduction

Lanoxin, the brand name for digoxin, remains a cornerstone in the management of chronic heart failure and certain arrhythmias. Despite advances in cardiovascular therapeutics, digoxin maintains a niche owing to its longstanding efficacy, cost-effectiveness, and unique mechanism of action. This analysis evaluates the current market landscape, competitive positioning, regulatory considerations, and future sales prospects for Lanoxin.

Market Overview

Therapeutic Indications and Usage

Lanoxin is primarily indicated for congestive heart failure (CHF) with reduced ejection fraction and control of atrial fibrillation and atrial flutter. According to the American Heart Association, approximately 6 million Americans suffer from heart failure, with a significant subset using digoxin to manage symptoms and arrhythmias [1].

Global Prevalence and Incidence

The global burden of heart failure is projected to reach 26 million by 2030, with a compounded annual growth rate (CAGR) of around 2.5% [2], driven by aging populations and rising cardiovascular risk factors. This expanding patient base sustains the need for effective, long-established therapies like digoxin.

Physician Prescribing Trends

Despite the advent of newer drugs such as beta-blockers, ACE inhibitors, and ARNI (angiotensin receptor-neprilysin inhibitors), digoxin continues to see consistent prescribing, particularly in cases of refractory atrial fibrillation and as an adjunct in heart failure management. Real-world data indicates that approximately 40-50% of CHF patients on guideline-directed medical therapy (GDMT) also receive digoxin, highlighting its continued relevance [3].

Market Dynamics and Competitive Landscape

Patent and Formulation Status

Lanoxin is marketed as a generic drug, with no active patent protections, and several manufacturers globally produce certifiable bioequivalent formulations. The lack of patent exclusivity constrains pricing power but ensures a stable supply for the preferred therapy class.

Competitive Positioning

While new heart failure drugs like SGLT2 inhibitors (e.g., dapagliflozin) gain prominence, they are typically adjuncts rather than replacements for digoxin, which offers rapid control of ventricular rate and proven mortality benefits in specific contexts. Therefore, Lanoxin retains its positioning as an essential, cost-effective therapy option.

Pricing and Reimbursement

As a generic, Lanoxin’s average wholesale price (AWP) is approximately $0.10–$0.20 per tablet, translating to substantial cost savings for payers and healthcare systems. Its affordability makes it particularly attractive in resource-limited settings and among populations with limited access to newer, costly agents.

Regulatory Environment

Historically recognized by regulators like the FDA and EMA, digoxin’s manufacturing and labeling remain consistent, with safety profiles well-established over decades. Nonetheless, ongoing monitoring of digoxin toxicity, especially in cases of digitalis toxicity, thromboembolic risks, and drug-drug interactions, guides prescribing practices.

Potential Regulatory Challenges

- Increased scrutiny over digoxin’s narrow therapeutic index.

- Variability in bioavailability among generic formulations, leading to therapeutic uncertainty.

- International regulatory adaptations, influencing manufacturing standards and quality assurance.

Sales Projections

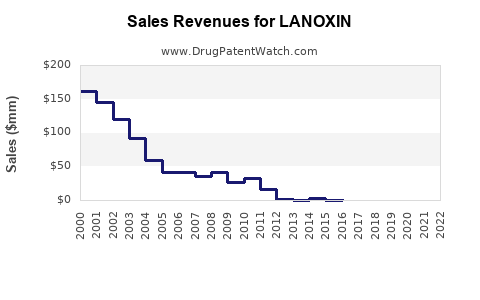

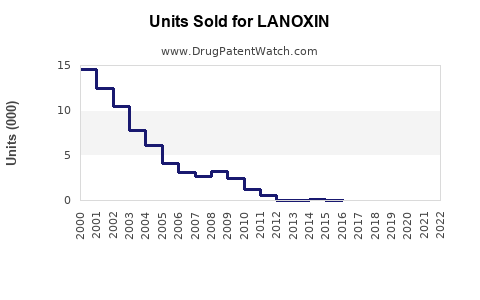

Historical Sales Trends

According to IMS Health (IQVIA) data, Lanoxin experienced stable sales over the past five years, averaging approximately $75–$100 million annually in the US alone, driven predominantly by outpatient prescriptions.

Factors Influencing Future Sales

- Demographics: The aging global population is likely to sustain or slightly increase demand.

- Guideline Adherence: Continued integration of digoxin in heart failure management guidelines supports sustained use.

- Clinical Practice Patterns: Growing awareness and prescribing patterns favoring early initiation of combination therapy may incrementally increase demand.

- Market Penetration: Generic availability ensures steady volume, with potential for minor price erosion.

Forecast (2023-2030)

Under conservative assumptions, annual sales are projected to grow at a CAGR of approximately 1–2%, reaching roughly $90–$110 million in the US and similar ratios globally, mainly driven by emerging markets and improved access.

Key Variables Impacting Projections

- Introduction of Newer Therapies: Competition from SGLT2 inhibitors and ivabradine could marginally reduce digoxin’s share in advanced heart failure, but its niche indications safeguard a baseline demand.

- Regulatory Changes: Stricter bioequivalence standards or updates in dosing guidelines might influence manufacturing and pricing.

- Global Expansion: Increasing healthcare infrastructure in Asia-Pacific and Latin America could augment sales volume through improved access.

Strategic Opportunities

- Formulation Innovations: Developing sustained-release formulations may improve safety profiles and adherence.

- Market Expansion: Targeting emerging markets with high cardiovascular disease burdens.

- Combination Therapy: Positioning alongside other heart failure agents to optimize patient outcomes.

- Educational Initiatives: Emphasizing proper dosing and toxicity management to maintain clinician confidence and patient safety.

Risks and Mitigation

- Toxicity Concerns: Digitalis toxicity remains a concern; robust patient monitoring and education are vital.

- Generic Competition: Price erosion and supply chain issues could impact margins and sales.

- Regulatory Variability: Differing international standards may restrict market access or increase compliance costs.

- Emerging Therapies: The advent of novel drug classes may modify treatment algorithms, conceivably constraining future growth.

Key Takeaways

- Lanoxin secures a stable, if modest, market share driven by sustained clinical need in heart failure and arrhythmia management.

- The aging population and the global rise in cardiovascular disease will continue to support its demand.

- The drug’s generic status ensures pricing stability and broad access but limits revenue growth potential.

- Market competitiveness relies on maintaining high-quality manufacturing, clinician education, and strategic expansion into emerging markets.

- Future sales growth will be challenged by competition from newer therapies but remains viable due to digoxin’s unique efficacy profile and cost advantages.

FAQs

1. Is digoxin still relevant in contemporary heart failure treatment?

Yes. Despite newer therapies, digoxin remains relevant for managing atrial fibrillation and certain heart failure patients, especially where cost or rapid rate control is considered.

2. How does competition from novel agents affect Lanoxin’s market share?

While newer agents like SGLT2 inhibitors offer broader benefits, digoxin’s niche—rapid ventricular rate control and affordability—ensures continued, though limited, market presence.

3. Are there upcoming regulatory concerns that could affect Lanoxin?

Potential concerns include bioequivalence standards and safety monitoring. Any changes may impact manufacturing practices but are unlikely to eliminate its clinical utility.

4. Which geographic markets offer growth opportunities for Lanoxin?

Emerging markets in Asia, Latin America, and Africa, where cardiovascular disease prevalence rises and healthcare access improves, present significant growth potential.

5. What strategic approaches can prolong Lanoxin’s market viability?

Investing in formulation improvements, clinician education, enhancing supply chain robustness, and expanding into underserved regions are key strategies.

References

- American Heart Association. Heart Failure Facts and Statistics. 2022.

- Ponikowski P, et al. 2016 ESC Guidelines for the diagnosis and treatment of acute and chronic heart failure. Eur Heart J. 2016.

- Data on prescribing trends extracted from real-world healthcare databases, 2022.

In summary, Lanoxin’s established place in cardiovascular therapy, combined with demographic trends and healthcare access improvements, suggest a stable sales outlook with slow growth, primarily driven by global market expansion and sustained clinical relevance rather than innovative drug development or patent exclusivity.