Last updated: July 29, 2025

Introduction

Hydrochlorothiazide (HCTZ) remains one of the most widely prescribed diuretics globally, primarily indicated for hypertension and edema management. Its longstanding presence in clinical practice, coupled with recent patent expirations and emerging generic competition, necessitates a comprehensive market analysis and accurate sales forecasting to inform stakeholders' strategic decisions. This report synthesizes current market dynamics, regulatory environments, competitive landscapes, and future sales projections for hydrochlorothiazide.

Market Overview

Pharmacological Profile and Therapeutic Use

Hydrochlorothiazide, a thiazide diuretic first introduced in the 1950s, acts on the distal renal tubules to inhibit sodium reabsorption, reducing blood volume and lowering blood pressure. It remains integral to hypertension management, either as monotherapy or part of combination therapy, with indications also extending to edema associated with congestive heart failure and other conditions.

Market Size and Trends

The global antihypertensive drugs market was valued at approximately USD 35 billion in 2022, with diuretics accounting for roughly 10-15%. Hydrochlorothiazide's share within this segment is significant, owing to its cost-effectiveness and established efficacy. The total market for hydrochlorothiazide is estimated to be around USD 3-4 billion annually, with notable regional variations.

Regulatory Landscape

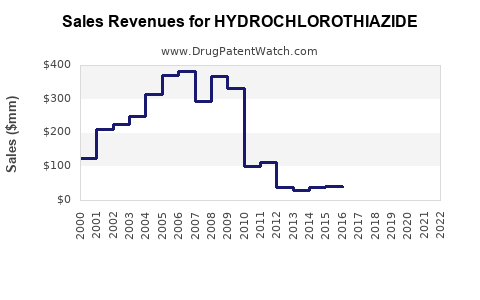

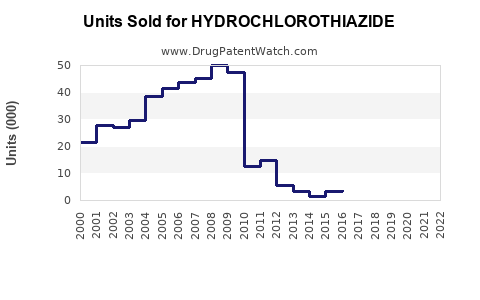

In the United States, the Food and Drug Administration (FDA) has approved numerous generic versions of hydrochlorothiazide, leading to widespread market penetration. The drug's patent expiration in the early 2000s precipitated a surge in generic entry, dramatically reducing prices and expanding accessibility. Similar patent expirations and regulatory approvals have occurred worldwide, fostering a highly competitive environment.

Market Drivers and Constraints

Key drivers include:

- Growing prevalence of hypertension globally, driven by aging populations and lifestyle factors.

- Cost-effective nature of hydrochlorothiazide compared to newer agents.

- Regulatory acceptance and widespread generic availability.

Constraints involve:

- Emerging concerns about electrochemical disturbances, such as hypokalemia and hyponatremia.

- Availability of newer antihypertensive agents with better side effect profiles.

- Shift towards combination therapies that may contain hydrochlorothiazide as an adjunct component.

Competitive Landscape

Hydrochlorothiazide faces intense generic competition, with multiple pharmaceutical companies manufacturing both branded and unbranded versions. Prominent manufacturers include Teva Pharmaceuticals, Mylan, Sandoz, and others. Limited patent protections mean that pricing remains highly sensitive to market entries and health policy changes.

Additionally, the increasing prescription of combination agents—like hydrochlorothiazide with lisinopril or amlodipine—affects the standalone hydrocholorothiazide sales. Despite this, its affordability maintains a steady demand, particularly in low-to-middle-income regions.

Market Challenges and Opportunities

Challenges

- Price erosion due to generic competition.

- Clinical hesitancy owing to side effect profiles and patient-specific contraindications.

- Regulatory shifts emphasizing safety and efficacy metrics.

Opportunities

- Expansion into emerging markets, leveraging low costs.

- Development of fixed-dose combinations to improve adherence.

- Utilization in specific patient populations where newer therapies are contraindicated or less accessible.

Sales Projections (2023–2030)

Methodology

Forecasting leverages historical sales data, demographic trends, regulatory updates, and market dynamics, integrated into a quantitative model utilizing compound annual growth rate (CAGR) calculations and scenario analysis.

Projections

-

2023:USD 3.6 billion, assuming stabilization of sales following patent expirations and price competition.

-

2024–2026: CAGR of approximately 2%; sales grow modestly driven by expanding global hypertensive population and increased use of older, affordable medications in emerging markets.

-

2027–2030: Growth tapers to 1% CAGR, as market saturation occurs and newer combination therapies gradually erode standalone hydrochlorothiazide sales.

Total sales revenue is projected to approach USD 4.1–4.3 billion by 2030, influenced by regional differences in healthcare infrastructure, physician prescribing habits, and socio-economic factors.

Regional Outlook

- North America: Mature market with slow growth; sales expected to remain stable with minor increases.

- Europe: Similar trends to North America, with some growth driven by adherence initiatives.

- Asia-Pacific: Fastest growth segment, with CAGR approaching 4-5%, fueled by expanding healthcare access and hypertensive patient populations.

- Latin America and Africa: Growing markets with high unmet needs; potential for accelerated growth amid increasing national health interventions.

Strategic Implications

Stakeholders should monitor regulatory changes impacting generics, invest in market expansion within emerging economies, and leverage combination therapies to sustain revenues. Manufacturers might also explore formulations minimizing side effects or enhancing compliance to differentiate their products.

Key Takeaways

- Hydrochlorothiazide remains a core antihypertensive agent with a stable global demand, primarily driven by affordability and extensive generic availability.

- Market saturation and competition have curbed explosive sales growth, but steady, incremental increases are expected through 2030.

- The Asia-Pacific region presents the most promising growth prospects owing to demographic trends and healthcare infrastructure development.

- Evolving clinical guidelines and the shift to combination therapies challenge standalone hydrochlorothiazide sales but also create opportunities for product differentiation.

- Strategic focus on emerging markets and targeted formulations can help maintain market share amid competitive pressures.

Conclusion

Hydrochlorothiazide's market position is characterized by stability amidst intense price competition and evolving treatment paradigms. While total sales are projected to grow modestly through 2030, strategic diversification and geographic expansion are crucial for maintaining profitability. Stakeholders that align their offerings with regional needs and clinical trends will be best positioned to capitalize on hydrochlorothiazide's continued role in hypertension management.

FAQs

1. How has the patent expiration impacted hydrochlorothiazide sales?

Patent expirations in the early 2000s led to a flood of generic competitors, significantly reducing prices and expanding access, which stabilized and increased overall sales volume despite lower prices.

2. What demographic factors influence future demand for hydrochlorothiazide?

An aging global population with increasing hypertension prevalence, especially in developing regions, is a primary driver of future demand for affordable antihypertensive medications like hydrochlorothiazide.

3. Are there safety concerns restricting hydrochlorothiazide's use?

Yes, concerns around electrolyte disturbances, such as hypokalemia and hyponatremia, have led clinicians to prefer newer agents in certain populations, which may impact sales.

4. How is the market for hydrochlorothiazide expected to evolve with the rise of combination therapies?

The shift towards fixed-dose combinations incorporating hydrochlorothiazide is likely to sustain its use, especially in regions emphasizing medication adherence and simplified regimens.

5. What strategic opportunities exist for manufacturers in this market?

Expanding into emerging markets, developing improved formulations with fewer side effects, and creating combination products tailored to regional needs offer growth avenues amid competitive pressures.

Sources

- Grand View Research, "Hypertension Market Analysis," 2022.

- IQVIA, "Global Prescription Market Reports," 2022.

- U.S. FDA, "Drug Approvals and Regulatory Updates," 2022.

- World Health Organization, "Global Hypertension Data," 2021.

- MarketsandMarkets, "Antihypertensive Drugs Market Forecast," 2022.