Share This Page

Drug Sales Trends for FINASTERIDE

✉ Email this page to a colleague

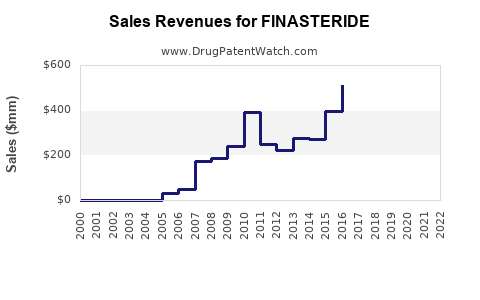

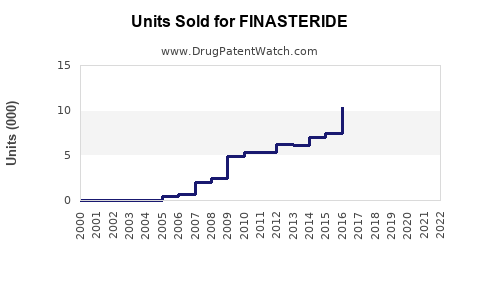

Annual Sales Revenues and Units Sold for FINASTERIDE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| FINASTERIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| FINASTERIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| FINASTERIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| FINASTERIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| FINASTERIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| FINASTERIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| FINASTERIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Finasteride

Introduction

Finasteride, a 5-alpha-reductase inhibitor, is widely prescribed for male androgenetic alopecia (pattern baldness) and benign prostatic hyperplasia (BPH). Developed initially as a treatment for BPH, finasteride has gained substantial traction in the cosmetic dermatology market due to its efficacy in hair loss management. Understanding the market dynamics, competitive landscape, and future sales projections is crucial for pharmaceutical stakeholders seeking strategic investment and operational planning. This report delivers a comprehensive market analysis of finasteride, with an emphasis on sales forecasts and growth drivers over the next five years, grounded in current trends, regulatory developments, and patent landscape reviews.

Market Overview

Global Market Size and Trends

The global finasteride market was valued at approximately USD 1.1 billion in 2022, with projections reaching USD 1.6 billion by 2030, representing a compound annual growth rate (CAGR) of around 4.5% from 2023 to 2030 (1). The growth is driven by increasing prevalence of hair loss, expanding aging populations, and rising awareness of treatment options.

The drug's primary indications—BPH and male pattern baldness—are prevalent among men over 50, and demographic shifts are amplifying the demand. Additionally, off-label use and the evolving landscape of personalized medicine further influence market expansion.

Regional Market Dynamics

- North America: Regains dominance owing to high awareness, established healthcare infrastructure, and widespread prescribing habits. The U.S. accounts for nearly 50% of the global value (2).

- Europe: Steady growth fueled by aging populations and expanding dermatology markets.

- Asia-Pacific: Fastest-growing region driven by increasing income levels, urbanization, and awareness—market CAGR estimated at 6% (3).

- Rest of the World: Moderate growth with emerging markets exploring hair loss management and BPH treatments.

Key Market Drivers

- Rising Prevalence of Androgenetic Alopecia: By 2022, approximately 50 million men in the U.S. suffer from androgenetic alopecia; similar trends are evident globally, propelling demand for finasteride (4).

- Aging Population: Age-related BPH and hair loss increase the prescription rate among older males.

- Brand and Patent Expirations: The patent expiry of Propecia (finasteride 1 mg) in major markets has led to increased generic availability, lowering costs and expanding access.

- Product Accessibility & Off-label Use: Growing acceptance of finasteride for off-label indications, such as transgender hormone therapy, broadens market scope.

Competitive Landscape

The market is segmented into branded and generic segments. Notably:

- Brand Leaders: Merck's Propecia and Proscar are established brands, although patent expiry catalyzed generic proliferation.

- Generics Manufacturers: Multiple pharmaceutical companies produce generic finasteride, leading to intense price competition.

- Emerging Players & Biosimilars: Entry barriers are low post-patent expiry, but quality assurance remains critical.

Regulatory Challenges: Concerns over adverse effects—such as sexual dysfunction and potential links to depression—impact market growth and marketing strategies.

Sales Projections

Forecast Assumptions

- Continued patent expiries will sustain price competition.

- Growing awareness and acceptance of finasteride for hair loss will sustain demand.

- Regulatory developments, particularly concerning safety profiles, may influence prescribing trends.

- Emerging markets will account for a significant proportion of incremental sales.

Projected Sales (2023–2027)

| Year | Estimated Market Size (USD billions) | Key Factors Impacting Sales |

|---|---|---|

| 2023 | $1.2 | Regulatory reviews, market stabilization |

| 2024 | $1.3 | Increased adoption in Asia-Pacific, generics penetration |

| 2025 | $1.4 | Broadening off-label use, demographic shifts |

| 2026 | $1.5 | Innovation in delivery methods, increasing awareness |

| 2027 | $1.6 | Mature markets stabilizing, emerging markets expanding |

The projected CAGR of approximately 4.5% aligns with current market trends, with the most significant growth anticipated in Asia-Pacific due to urbanization and healthcare expansion.

Impact of Patent Expiry and Generic Competition

Patent expiration of Propecia in key markets (e.g., US in 2017, EU in 2018) has led to a surge in generic finasteride sales, decreasing prices by roughly 50%, thus increasing volume but reducing average selling price (ASP). The net effect has been stabilization or slight growth driven by volume expansion.

Emerging Opportunities

- Topical Finasteride: Early-stage clinical trials suggest potential for topical formulations, potentially expanding patient base.

- Combination Therapies: Co-formulations with other hair growth agents or BPH medications could augment sales.

- Cancer Research: Investigations into finasteride's role in prostate cancer prevention may open new indications.

Regulatory and Safety Considerations

While safety concerns persist, especially regarding sexual side-effects and potential depression links, regulatory agencies such as the FDA and EMA continue to endorse finasteride for approved indications. Market access remains secure with clear labeling; however, adverse effect management and patient education are imperative for sustained market growth.

Market Challenges

- Adverse Effect Profile: Negative publicity and side effect apprehension can deter prescriptions.

- Patent and Regulatory Uncertainty: Potential patent litigations and regulatory modifications pose risks.

- Market Saturation: Mature markets exhibit slower growth, requiring innovation and targeted marketing strategies.

Strategic Outlook

To capitalize on growth opportunities, companies should focus on:

- Expanding availability in emerging markets.

- Developing novel delivery systems (e.g., patches, topical solutions).

- Monitoring regulatory trends for off-label indications.

- Investing in patient education to enhance adherence and acceptance.

Key Takeaways

- The global finasteride market is projected to grow at a CAGR of approximately 4.5%, driven by demographic shifts and increasing awareness.

- Patent expiries have catalyzed generic entry, leading to price competition but volume-driven growth.

- Asia-Pacific constitutes a key growth region, due to rising income levels and expanding healthcare infrastructure.

- Innovations in formulation and evolving indications present future revenue streams.

- Safety concerns and regulatory dynamics necessitate proactive risk management and patient education.

FAQs

1. How does patent expiration influence finasteride sales?

Patent expiry facilitates generic entry, reducing prices and expanding accessibility, which shifts revenue from branded to generic sales but can increase overall volume.

2. What are the main safety concerns affecting finasteride's market?

Potential side effects include sexual dysfunction, decreased libido, and reports of depression, leading to cautious prescribing and black-box warnings in some markets.

3. Which regions offer the greatest growth opportunities for finasteride?

The Asia-Pacific region presents rapid growth prospects due to increasing healthcare expenditure, awareness, and urbanization.

4. Are there emerging formulations or new indications for finasteride?

Yes, topical formulations are under clinical evaluation, and research into finasteride's role in prostate cancer prevention may widen its therapeutic scope.

5. How do off-label uses impact market dynamics?

Off-label applications, such as use in transgender hormone therapy, can expand demand but also pose regulatory and safety monitoring challenges.

References

- MarketsandMarkets. Finasteride Market Forecast, 2023-2030.

- IQVIA. Pharmaceutical Market Data, 2022.

- Research and Markets. Asia-Pacific Finasteride Industry Analysis, 2022.

- American Academy of Dermatology Association. Hair Loss Statistics, 2022.

More… ↓