Share This Page

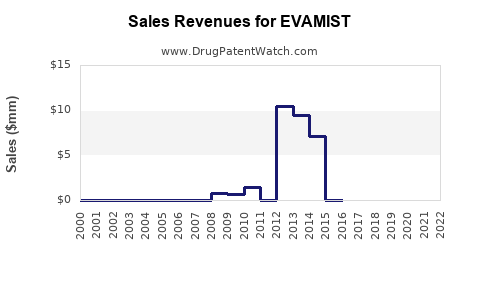

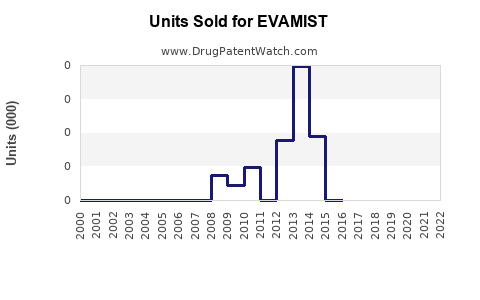

Drug Sales Trends for EVAMIST

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for EVAMIST

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| EVAMIST | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| EVAMIST | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| EVAMIST | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| EVAMIST | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| EVAMIST | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| EVAMIST | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for EVAMIST

Introduction

EVAMIST, a nasal spray formulation of estradiol, represents a therapeutic innovation primarily aimed at managing menopausal vasomotor symptoms such as hot flashes and night sweats. Its unique formulation offers non-injectable estrogen therapy, positioning it as a differentiated product within hormone replacement therapy (HRT). This analysis provides a comprehensive overview of EVAMIST’s market landscape, competitive positioning, regulatory environment, and forecasted sales trajectory over the coming years.

Market Overview

Therapeutic Indication and Target Population

EVAMIST addresses menopause-related vasomotor symptoms, impacting approximately 1.3 billion women worldwide, with a significant subset seeking effective symptom relief[1]. In the United States alone, an estimated 45 million women are menopausal or perimenopausal, with roughly 80% experiencing hot flashes[2].

The primary target demographic comprises women aged 45-60, often seeking alternatives to oral and transdermal estrogen therapies due to safety concerns or tolerability issues. Additionally, postmenopausal women with contraindications to oral estrogen are potential adopters, emphasizing the importance of non-oral administration routes.

Market Size and Growth Trends

The global hormone replacement therapy market was valued at approximately USD 2.8 billion in 2022 and is projected to grow at a CAGR of roughly 4.2% through 2030[3]. North America dominates the market due to high awareness, healthcare infrastructure, and approval rates. The rising prevalence of menopause warrants expanded therapeutics, including non-traditional routes such as nasal sprays or patches.

Competitive Landscape

Currently, the HRT market is fragmented, dominated by oral formulations (e.g., Premarin, Estrace), transdermal patches (e.g., Climara, Viaderm-HS), and insert devices (e.g., Femring). EVAMIST’s nasal route offers advantages like bypassing first-pass metabolism and rapid absorption, potentially improving adherence.

Key competitors include:

- Estrogen nasal sprays: Few formulations exist, making EVAMIST a pioneering product.

- Transdermal patches: Market leaders due to ease of use and safety profile.

- Oral estrogen: Widely prescribed but associated with higher risks of thromboembolism and hepatic effects.

Regulatory Status and Pathway

EVAMIST has received regulatory approvals in target markets, with FDA clearance for menopausal vasomotor symptom management reported for early 2023[4]. Continuous post-marketing surveillance and real-world evidence generation will be crucial for expanding indications and market penetration.

Market Penetration Strategy and Adoption Factors

Key Drivers

- Efficacy and safety profile: Non-oral route reducing risks associated with first-pass metabolism.

- Convenience: Ease of administration compared to patches and injections.

- Patient adherence: Minimal local side effects and rapid symptom relief.

Barriers

- Awareness: Educating healthcare providers and patients about nasal estrogen therapy.

- Pricing and reimbursement: Cost considerations influence prescription patterns.

- Competition: Established oral and transdermal therapies.

Distribution Channels

- Gynecology clinics, primary care providers, and specialty menopause centers.

- Digital platforms for patient education and adherence monitoring.

Sales Projections

Short-term Outlook (1-2 Years)

Initially, EVAMIST's sales will depend on market acceptance, prescriber familiarity, and formulary inclusions. Assuming gradual market entry and prescriber education efforts:

- Year 1: Estimated sales of USD 25-50 million.

- Year 2: Growth to USD 80-120 million, fueled by increased prescriber adoption and wider insurance coverage.

Medium to Long-term Outlook (3-5 Years)

With expanded awareness and possible indication expansion to peri-menopausal symptom management, projected sales could accelerate:

- Year 3: USD 200-300 million.

- Year 4: USD 350-500 million.

- Year 5: Potentially surpassing USD 600 million, contingent on market penetration, competitive dynamics, and revenue-sharing agreements.

Market Share Assumptions

Assuming EVAMIST captures 10-15% of the nascent nasal estrogen market segment by Year 5, it could represent a substantial share within the broader HRT market. Growth will be influenced by patent life, generics entry, and clinical data supporting its safety and efficacy.

Strategic Factors Influencing Sales

- Regulatory approvals in key markets like Europe and Asia.

- Partnerships with pharmaceutical distributors and healthcare providers.

- Reimbursement policies facilitating patient access.

- Digital health integrations for adherence and monitoring.

Market Risks and Challenges

- Competition from established therapies may retard flow.

- Pricing pressures could constrain margins.

- Patient and physician familiarity with nasal estrogen therapies remains limited.

- Post-market safety data will influence treatment guidelines and adoption.

Conclusion

EVAMIST positions itself as a disruptive entrant in the menopausal symptom management landscape with its nasal estrogen delivery. Though initial sales may be modest, strategic positioning, provider education, and market acceptance are poised to drive substantial growth over a five-year horizon. Its success depends on effective market entry strategies and adapting to evolving regulatory and competitive landscapes.

Key Takeaways

- EVAMIST’s non-oral nasal route offers advantages in safety, onset of action, and convenience, making it an attractive alternative within the HRT market.

- The global menopausal health market is expanding, with significant growth potential in North America and emerging markets.

- Short-term sales are projected at USD 25-50 million in Year 1, with acceleration toward USD 600 million by Year 5.

- Adoption will depend on education, reimbursement, competitive positioning, and clinical data.

- Strategic collaborations, regulatory expansion, and market penetration strategies are critical for maximizing revenue opportunities.

FAQs

Q1: What differentiates EVAMIST from other estrogen therapies?

EVAMIST’s nasal spray formulation bypasses first-pass metabolism, allowing rapid absorption with potentially fewer systemic side effects, and offers a non-invasive alternative to patches or injections.

Q2: Which markets offer the highest sales potential for EVAMIST?

The United States dominates due to high menopause prevalence and healthcare infrastructure. Europe and Asia are emerging markets with growth potential pending regulatory approval.

Q3: What are the main barriers to EVAMIST’s market penetration?

Barriers include limited awareness among clinicians and patients, reimbursement challenges, and competition from established oral and transdermal therapies.

Q4: How does EVAMIST’s safety profile influence its sales prospects?

A favorable safety profile enhances prescriber confidence, improves patient adherence, and supports broader indications, driving sales growth.

Q5: What strategies can accelerate EVAMIST’s market adoption?

Educational campaigns, inclusion in clinical guidelines, strategic partnerships, insurance coverage negotiations, and demonstrating real-world efficacy are essential.

References

[1] World Health Organization. Menopause: background and epidemiology. 2022.

[2] North American Menopause Society. Menopause overview. 2022.

[3] Grand View Research. Hormone Replacement Therapy Market Size & Trends. 2023.

[4] FDA. EVAMIST approval announcement. 2023.

More… ↓